Latest Dividend Hikes in Europe: Week 4/2025

Ericsson, Investor AB, Essity and EQT raise their dividend

As the new year gets underway, the European markets are buzzing with activity as numerous companies announce notable increases in their dividend payouts.

This has been a particularly eventful week, with a steady stream of announcements about annual dividend payments. And it’s just the beginning—the next few weeks promise even more activity, as major European companies, including the Netherlands-based semiconductor giant ASML, gear up to release their annual results and dividend plans.

Summary of Dividend Hikes week 4, 2025

Ericsson: Dividend hike of 5.6%; Yield: 3.4%

EQT AB: Dividend hike of 19.4%; Yield: 1.2%.

Signify: Dividend hike of 0.6%; Yield: 6.8%.

Essity: Dividend hike of 6.5%; Yield: 3%.

Sandvik: Dividend hike of 4.5%; Yield: 2.5%.

Swedbank: Dividend hike of 43.2%; Yield: 8.8%.

Tryg A/S: Dividend hike of 5.4%; Yield: 5.3%.

Investor AB: Dividend hike of 8.3%; Yield: 1.7%.

ALM Brand A/S: Dividend hike of 9.1%; Yield: 4.1%.

For now, Sweden is leading the charge, with several key players already unveiling substantial dividend hikes for 2025. These announcements set a strong tone for the year and underline Sweden’s leadership in rewarding shareholders with consistent growth.

Ericsson (Sweden)

Ericsson, the Swedish provider of infrastructure, services and software to the telecommunication industry, announced its first dividend hike in two years with a new annual payment of SEK 2.85 per share, up from SEK 2.70 paid in both 2024 and 2023.

Ericsson stock dropped 12.7% this Friday following disappointing Q4/annual results, leaving shareholders with a 3.4% yield at a stock price of SEK 85.20. Ericsson will pay two semi-annual dividends: a SEK 1.43 per share interim dividend with ex-date March 26, 2025 and a SEK 1.42 final dividend with ex-date September 26, 2025.

EQT AB (Sweden)

EQT AB announced a 19.4% dividend hike, bringing the annual payout to SEK 4.30 per share. This will be distributed in two semi-annual payments of SEK 2.15 each. At a stock price of SEK 365, the dividend yield stands at 1.2%. This marks the fifth consecutive year of dividend increases for EQT, highlighting the private equity firm’s steady performance and commitment to rewarding shareholders.

Signify (Netherlands)

Formerly known as Philips Lighting, Signify revealed a dividend increase to €1.56 per share, up 0.6% year-over-year. The company’s progressive dividend policy reflects its focus on consistent growth.

At a stock price of €23.66, the dividend yield is an impressive 6.8%. As a leader in lighting systems and services, Signify’s steady dividend growth underlines its resilience in a competitive market. The company did cancel its €1.35 per share dividend for FY 2019 because of the covid pandemic, but repaid this one year later together with the FY 2020 dividend, resulting in a total payment of €2.75 per share for that year.

Essity (Sweden)

Essity, a global leader in tissue, toilet paper, and personal care products, will increase its dividend by 6.5% to SEK 8.25 per share. This marks a record high for the company, yielding 3% at a stock price of SEK 278.50. The ex-dividend date is March 28, 2025. With six consecutive years of dividend increases, Essity continues to strengthen its position as a peer to industry giants like Procter & Gamble and Kimberly-Clark.

Sandvik (Sweden)

Sandvik, an engineering firm specializing in mining, rock excavation, metal-cutting, and materials technology, announced a 4.5% increase in its dividend to SEK 5.75 per share for 2025. At a stock price of SEK 230, the dividend yield is 2.5%. The ex-dividend date is April 30, 2025. Sandvik’s modest yet consistent growth reflects its strong presence in industrial and mining sectors.

Swedbank (Sweden)

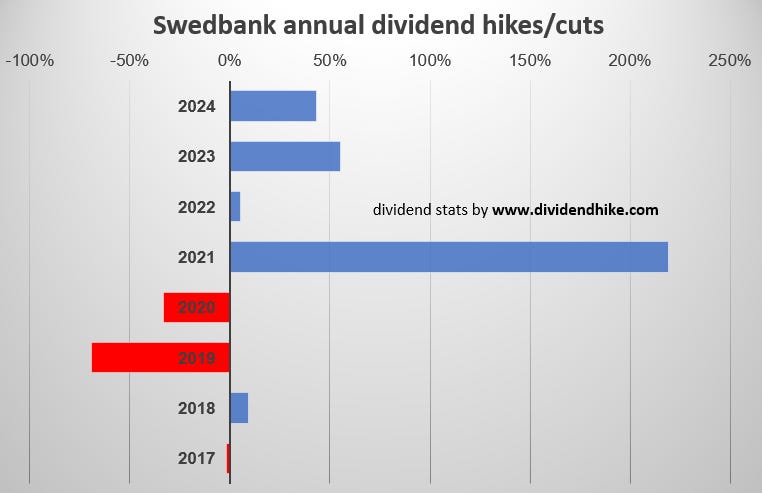

Swedbank reported a substantial 43.2% hike in its dividend, raising the payout to a record SEK 21.70 per share. With a stock price of SEK 245, this results in a remarkable dividend yield of 8.8%. The ex-dividend date is March 27, 2025.

This significant increase underscores Swedbank’s robust financial health and its commitment to delivering value to shareholders. However we don’t forget that Swedbank did cut its dividend big time for both FY 2020 and FY 2019.

Tryg A/S (Denmark)

Danish property and casualty insurer Tryg A/S announced a 5.4% increase in its full-year 2024 dividend, amounting to DKK 7.80 per share. Notably, Tryg pays dividends quarterly, with the next payment of DKK 1.95 per share scheduled for January 28, 2025 (ex-date January 24). At a stock price of DKK 147, the dividend yield is 5.3%, marking the highest payout in the company’s history.

Investor AB (Sweden)

Investment holding company Investor AB raised its dividend by 8.3% to SEK 5.20 per share for 2025. This will be paid in two installments: SEK 3.75 (ex-date May 8) and SEK 1.45 (ex-date November 7).

At a stock price of SEK 320, the yield is 1.7%. This marks the fifth consecutive year of increases, with a 10-year compound annual growth rate (CAGR) of 8.7%. Investor AB’s consistent growth highlights its role as a reliable income generator for shareholders.

ALM Brand A/S (Denmark)

ALM Brand A/S, another Danish property and casualty insurer, will raise its dividend by 9.1% to DKK 0.60 per share in 2025. At a stock price of DKK 15, the dividend yield is 4.1%. This increase reflects ALM Brand’s solid operational performance and its strategy to deliver steady returns to investors.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

Swiss fragrance and flavor co #Givaudan hikes the dividend by 2.9% to CHF 70 per share in 2025. This means Givaudan will most likely be a Dividend Aristocrat next year! #europe #dividends

What is your favorite European stock? Share it right here with us!