5 Australian Dividend Growth Stocks with Strong Long-Term Potential

Discover five ASX-listed companies combining business strength with consistently rising dividends.

For income-focused investors looking beyond the typical blue-chip names, Australia offers a compelling set of lesser-known but high-quality companies delivering steady dividend growth. In this article, we explore five ASX-listed businesses—Supply Network, Northern Star Resources, Tasmea, TechnologyOne, and CAR Group—each with a proven track record of performance and shareholder returns.

These companies operate in essential sectors ranging from gold mining and vehicle marketplaces to enterprise software and industrial maintenance, and they share a commitment to distributing a meaningful and growing portion of profits as dividends. Backed by sound fundamentals and resilient market positions, these dividend payers deserve a closer look from anyone seeking sustainable yield with growth potential.

All five of our stocks from Australia rank high based on EBIT-margin (double digits), Return on Invested Capital (ROIC) and revenue growth and dividend growth.

Supply Network Ltd (ASX: SNL)

Supply Network Ltd, operating under the Multispares brand, imports and distributes aftermarket parts for commercial vehicles—primarily trucks and buses—across Australia and New Zealand. In addition to parts, the company offers services such as parts interpretation, procurement support, and supply‑management solutions. Its branch and delivery‑van network enables timely fulfilment across ANZ. The company was incorporated in 1986 and has steadily expanded its physical presence over decades. Supply Network focuses on organic growth in the commercial‑vehicle aftermarket, with strategic investment in warehousing and transactional IT systems, and maintains a policy targeting consistent dividend payouts (typically 60–70 % of post‑tax profits).

The stock has been one of the star performers in Australia in the last couple of years with double digit gains in each of the past 6 years including a 101% gain in 2024.

Dividend and Fundamentals

Supply Network Ltd hiked its dividend by 16.7% last year and did a double digit hike in each of the last four years. If you are interested in more dividend stats, please send us an email.

The valuation for Supply Network Ltd is high with a forward p/e of 42 for FY 2025 (ending in June). Revenues are expected to grow by 16.3% in FY 2025, reaching a record high of A$352 million.

The current dividend yield is 2.3% at a stock price of A$39.75.

Northern Star Resources Ltd (ASX: NST)

Northern Star Resources Ltd presents itself as a global‑scale gold producer, operating three production centres located in world‑class jurisdictions—Western Australia and Alaska. The company’s portfolio comprises high‑quality, high‑margin underground and open‑pit gold mines. Northern Star was listed on the ASX in 2003, and its strategy centres on organic growth via targeted exploration, extending mine life, and disciplined asset management. Sustainability forms a core pillar: in FY24 the company commissioned solar arrays and a wind farm at Jundee, and committed over A$6.1 million to community support—progressing toward its net‑zero ambition by 2050. Northern Star’s financial framework emphasises maintaining strong liquidity, low leverage, and high returns on capital.

Dividend and Fundamentals

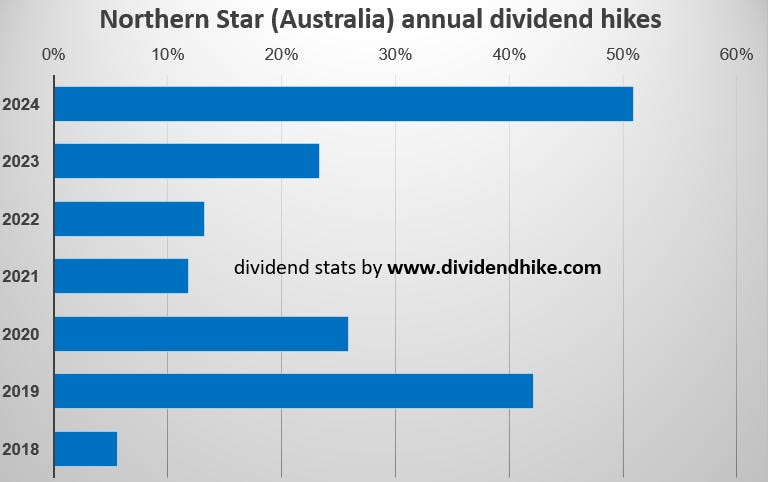

Northern Star has been a dividend growth monster in the past five years and has super strong dividend stats with a 5 year CAGR well over 20%.

The current yield is 3% at a stock price of A$16.28 for Northern Star Resources. Revenue is expected to grow by a whopping 30% in 2024 (June) to a record of A$6.4 billion. This company is expected to be debt free by the end of this fiscal year. The current estimated p/e of 15.7 is not as high as many of the other stocks in this article.

Tasmea Limited (ASX: TEA)

Tasmea Limited is a specialist maintenance services group comprising 23 operating businesses, including the 49 %-owned Yura Yarta (in support of Supply Nation certification). The Tasmea Group provides programmed maintenance, emergency breakdown support, shutdown services, and sustaining‑capital upgrades across four technical areas: electrical, mechanical, civil, and water & fluid. The firm is headquartered in Perth and operates offices in each mainland Australian State plus a number of regional centres. Its strategic focus is on servicing remote and essential‑industry fixed‑plant assets such as those in mining, infrastructure and utilities, where specialised maintenance capabilities are critical.

Dividend and Fundamentals

Tasmea Limited had its stock price almost doubling in 2024. The current dividend yield is 3.7% at a stock price of A$3.47. This company is not yet a Dividend Aristocrat with the first dividend being paid just last year in 2024. But we like the company and will follow it in the next couple of years with additional dividend growth very likely.

Currently Tasmea has a forward p/e of 15 with revenues growing by 30%+ both this year and next year based on analyst estimates.

TechnologyOne Ltd (ASX: TNE)

TechnologyOne Ltd is Australia’s leading enterprise software company, providing a global SaaS ERP platform that serves government, education, healthcare, and commercial sectors across Australia, New Zealand, the UK, and Asia‑Pacific. Founded in 1987 in Brisbane and listed on the ASX in December 1999, the company has been continually profitable since 1992 and has delivered 12 consecutive years of record profit, revenues, and SaaS fee growth. Since 2012, TechnologyOne has transitioned from on‑premise software to cloud (SaaS) delivery, reallocating approximately 20 % of revenue annually into R&D. Its dividend policy targets a payout ratio of 55–65 % of net profit after tax.

Dividend and Fundamentals

TechnologyOne also saw its stock price double in 2024. Revenues are growing by double digits every year with a record A$593 million in sales expected for FY 2025 (September). This comes with a debt free balance sheet and also a high forward p/e of 94.

The dividend was raised by a record high 35.9% last year with a current dividend yield of 0.8% at a stock price of A$40.10. TechnologyOne has one of the better dividend track records in Australia.

CAR Group Ltd (ASX: CAR)

CAR Group Ltd, better known as carsales.com in Australia, operates leading digital marketplaces for buying and selling vehicles across multiple international markets—including Australia, South Korea (Encar), the United States (Trader Interactive), Chile (chileautos), and Brazil (via Webmotors). The group is an ASX50 business that combines technology, data, and advertising solutions to deliver a superior platform experience. Founded in the 1990s and listed later, CAR Group has evolved into a diversified global portfolio of wholly‑owned and majority‑owned digital marketplace brands. Its ambition is to be the global leader in online vehicle marketplaces by leveraging scale, user data, and cross‑regional synergy.

Dividend and Fundamentals

Car Group from Australia now has a 2.5% dividend yield with double digit increases in both 2024 and 2023. The track record is strong with 10+ consecutive years of increases for the carsales.com owner.

The five best dividend growth stocks from Canada

Forget Constellation Software (sorry, guys) and skip Couche-Tard for once — we're going off the beaten path.

With a forward p/e of 38 at a stock price of A$37.05 Car Group stock is not cheap especially with revenue growth expected to be single digits for FY 2025, following a sales growth of 40+ percent in the previous two years.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.