5 European Dividend Champions for Reliable Income and Growth

Aristocrats from Europe with a 5%+ yield AND annual dividend hikes

In this post, we highlight five European dividend stocks that combine high dividend yields with a proven track record of stability and growth. What sets these stocks apart? Each one has maintained or increased its dividend for at least ten consecutive years, showcasing their resilience and strong commitment to shareholders.

Europe stands out as a region with significantly more high-yield dividend stocks compared to the United States. For income-focused investors, this presents a unique opportunity to discover reliable and attractive dividend-paying companies. In this selection, we feature top dividend stocks from Norway, Italy, Belgium, the Netherlands, and France. The Dutch stock is insurer NN Group. Subscribe to dividendhike to find our about the other four stocks from Europe.

Our focus is on companies offering a minimum dividend yield of 5%, achieved through regular payouts or a mix of ordinary and special dividends. These stocks provide not only steady income but also the potential for further dividend growth in the years ahead.

From industrial leaders to financial powerhouses, these five European dividend stocks stand out as excellent choices for investors seeking reliable income and long-term capital appreciation. Dive into their potential and see why they deserve a place in your portfolio.

From industrial leaders to financial powerhouses, these five European dividend stocks stand out as excellent choices for investors seeking income and long-term capital appreciation. Explore their potential and find out why they deserve a place in your portfolio.

1. Orkla (Norway)

2. Rubis (France)

3. Retail Estates (Belgium)

4. NN Group (The Netherlands)

5. Enel (Italy)

Orkla

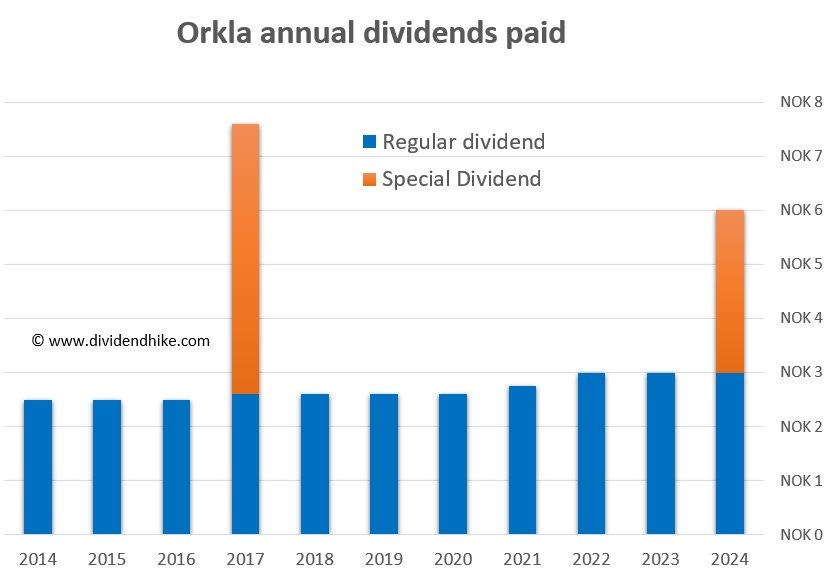

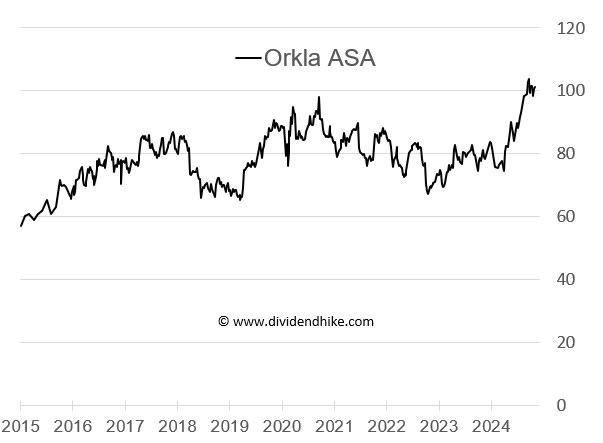

Our first dividend champion from Europe is Consumer Staples giant Orkla, known for its high regular dividends and special dividend payments. Orkla is a leading Norwegian company specializing in branded consumer goods, with operations across the Nordic region, Europe, and beyond. The company produces a wide range of products, including food, snacks, beverages, personal care items, and cleaning products. Orkla's brands are household names in many markets, catering to both retail and professional customers. Additionally, the company has interests in ingredients and materials, supplying businesses in various industries. Known for its focus on sustainability and innovation, Orkla is a key player in the consumer goods sector.

Orkla is known for its super strong dividend history with decades of steady and increasing payments with as a big bonus special dividend payments once every couple of years. There are not many companies in Europe with a dividend track records like Orkla. Think about decades without a dividend cut, a 3% regular dividend yield and a total dividend yield of almost 6% if we include special dividends. In 2024 Orkla paid a record high regular dividend of 3 Norwegian Kroner (NOK) per share together with a special dividend of also 3 Norwegian Kroner. The total dividend of 6 Norwegian Kroner results in a 6% dividend yield at a stock price of 101 Norwegian Kroner. We expect Orkla to increase its regular dividend in 2025. Also we expect Orkla to announce more special dividends down the road. The stock has gained 29% in 2024 so far which is no surprise to us because of the amazing dividend history and prospects.

Previously we already highlighted Orkla in a post about special dividends.

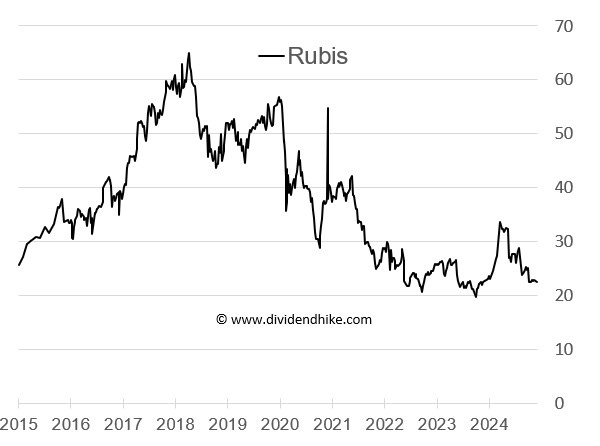

Rubis

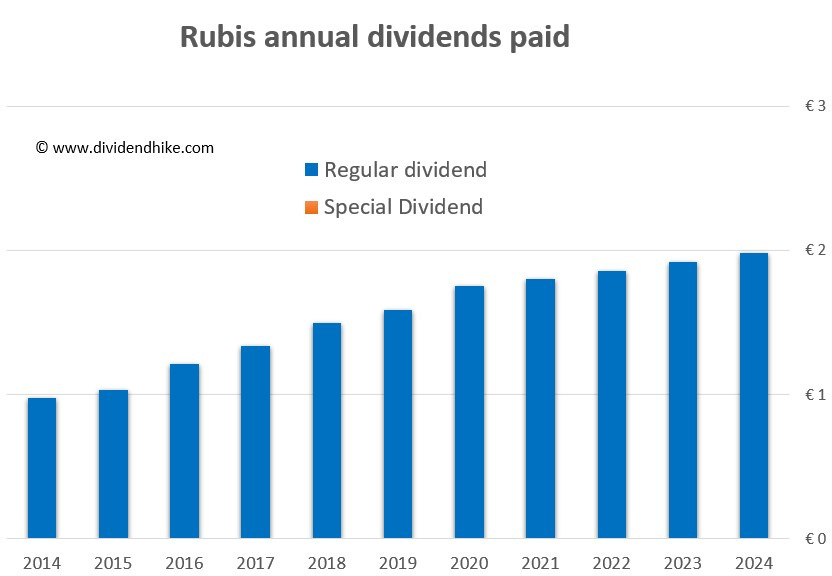

Little known Rubis is actually one of just a few real Dividend Aristocrats in Europa with more than 25 consecutive years of increased dividends. Rubis boasts a super high dividend yield with annual dividend growth.

Rubis is a French company specializing in the storage, distribution, and trading of energy products such as liquefied petroleum gas (LPG), fuels, and bitumen. Operating across Europe, the Caribbean, and Africa, Rubis provides essential energy solutions for both industrial and domestic markets. The company is also involved in terminal operations, offering storage facilities for petroleum and chemical products. Known for its resilience and diversification, Rubis plays a critical role in ensuring energy supply in various regions.

In 2024 Rubis hiked its dividend by 3.1%, marking almost 30 consecutive years of increased dividends. Dividend growth has slowed in the last couple of years and with Rubis’ stock price moving down this results in a super high dividend yield of 8.7% at a current stock price of €22.86. Rubis has expressed several times that is plans to at least maintain the current dividend, but free cash flow needs to go up in the next couple of years to stay in line with the annual dividend payment of more than €200 million.

The good thing about Rubis is that analysts stay confident with 4 buy ratings, 1 hold recommendation and no experts telling you to sell the stock. This makes dividend champion Rubis a stock to watch in 2025 and beyond!

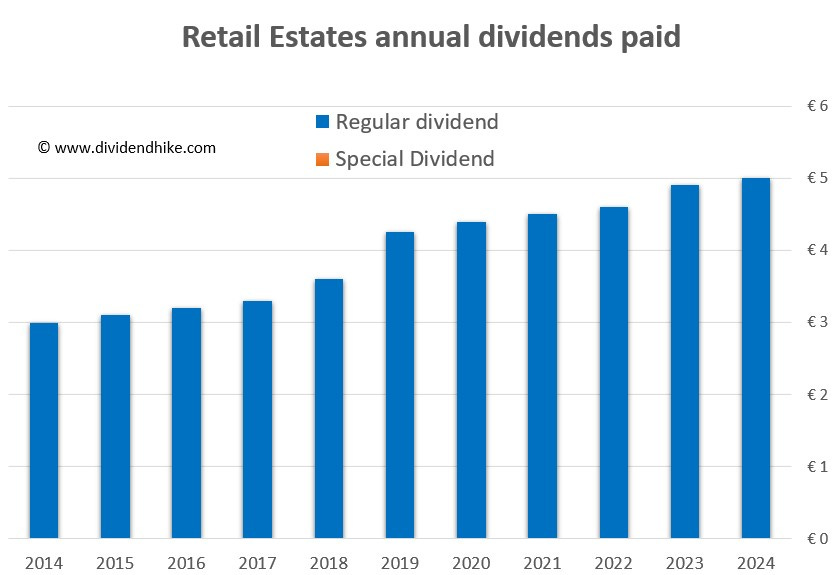

Retail Estates

Also unknown to many investors is real estate company Retail Estates from Belgium. The company has a strong dividend track record with decades of annual increases.

Retail Estates is a Belgian real estate investment trust (REIT) specializing in retail properties. The company focuses on the acquisition, development, and management of retail parks and standalone stores located in suburban areas and along major roads. Its portfolio includes a wide range of commercial properties leased to well-known retail chains, ensuring stable rental income. Retail Estates is a key player in the Belgian and Dutch retail property markets, offering investors exposure to a resilient and income-generating asset class.

Retail Estates paid a record high dividend of €5.00 per share in 2024, up 2% from 2023. On top of this the company has already announced its intention to raise the dividend to €5.10 next year. With a dividend yield of 8.5% and a buy rating from all analysts covering the stock this one actually looks to good to be true. No other real estate company from Europe currently combines the strong dividend track record of Retail Estates with such a high dividend yield AND a new hike already announced for next year.

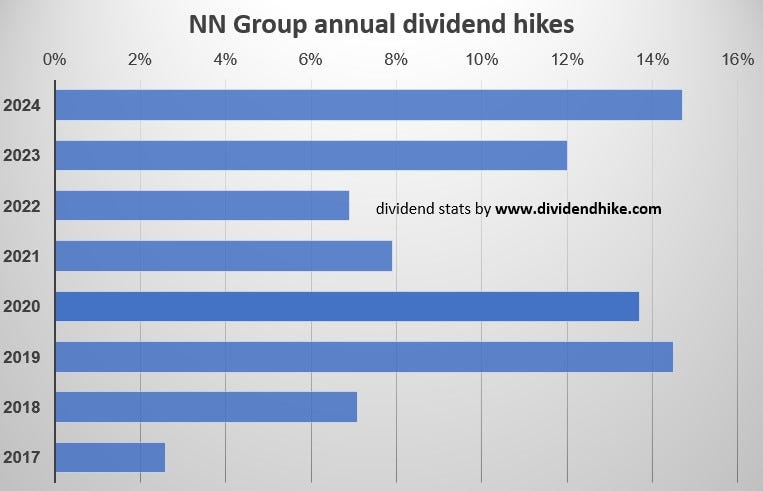

NN Group

Insurer NN Group combines a high dividend yield with strong annual dividend growth.

NN Group is a Dutch financial services company providing insurance, pensions, and investment solutions. Headquartered in the Netherlands, NN Group operates in multiple countries across Europe and Japan, serving both individual and corporate clients. The company offers a range of products, including life and non-life insurance, retirement planning, and asset management services. With a focus on sustainability and innovation, NN Group aims to support customers in securing their financial futures while contributing to a better society.

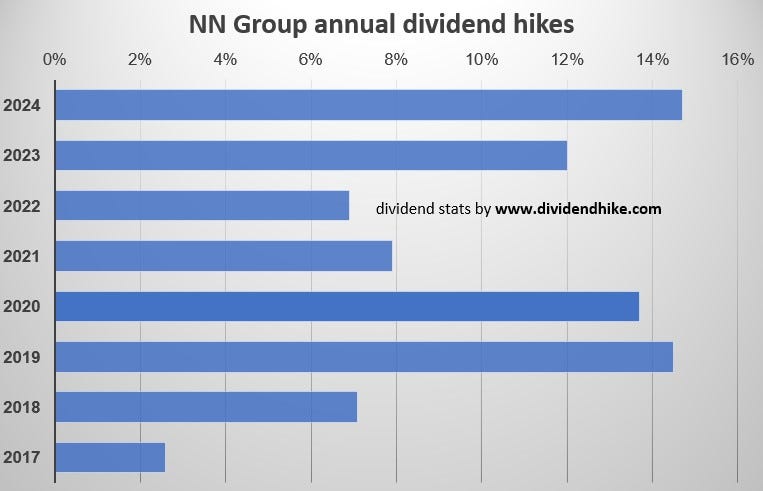

NN Group initiated a dividend in 2015 and has since hiked its dividend by double digits on average every single year with the five year CAGR standing at a whopping 11%, which is not bad for a company with a dividend yield of 7.8%. So imagine this: A super high dividend yield with double digit annual increases. You will not find a company with these statistics in the United States. NN Group hiked its dividend by 14.7% to a record high of €3.20 for 2023 and already announced a 14.2% increase for the interim dividend for 2024. It is expected that NN group will also announce a higher final dividend early 2025. This would mark the 10th consecutive year of dividend increases, with double digit hikes in the last couple of years and a current yield of almost 8%. That is unbelievable!

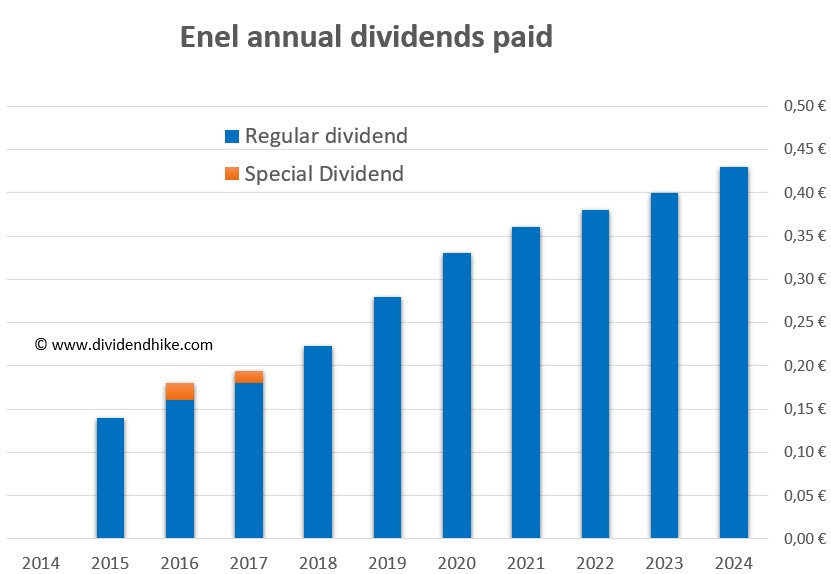

Enel

Another company from Europe known for its high yield and annual dividend increases is utility Enel from Italy. Enel has a dividend yield of 6.2% with now 10 consecutive years of increases.

Enel is an Italian multinational energy company that operates in the fields of electricity generation, distribution, and renewable energy. The company is one of the largest energy providers in Europe and Latin America, with a strong focus on sustainability and the transition to green energy. Enel is actively involved in renewable energy projects such as wind, solar, and geothermal power, and it aims to reduce its carbon footprint while providing reliable energy solutions to millions of customers worldwide.

Enel paid a record high dividend of €0.43 per share for 2023, up 7.5% from the 2022 year. This November Enel also declared a new unchanged interim dividend of €0.215 per share for 2024. Enel's dividend policy focuses on providing stable and sustainable dividend growth. The company aims for a payout ratio of around 70% of net income, depending on its financial performance. Enel has consistently increased dividends in recent years, balancing shareholder rewards with reinvestment for growth and sustainability. Dividends are typically paid annually and may include both regular and special dividends.

These five stock from Europe stand out based on the combination of a high dividend yield and annual dividend increases.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.