A Future Dividend Aristocrat with strong fundamentals

Market Leader in Connectivity Solutions with accelerating dividend growth

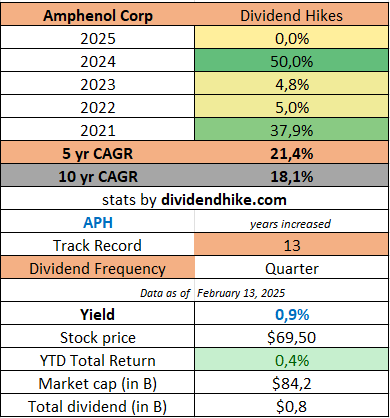

Our new Focus Stock comes from the USA and happens to be one of the Dividend Heroes in 2025. This dividend growth stock seems to be doing everything right with strong free cash flow generation used for big annual dividend hikes together with buybacks and multiple acquisitions.

And yes, they also have a strong balance sheet, generate 20+% margins, have strong organic growth and a strong and also a steady 20%+ ROIC every single year.

Annual dividend hikes:

2024: +50.0%

2023: +4.8%

2022: +5.0%

2021: +37.9%

2020: +16.0%

The dividend will most likely be hiked by double digits again this year, resulting in 14 consecutive years of increases for this new Focus Stock. Let’s take a look at this next dividend growth beauty from the USA!

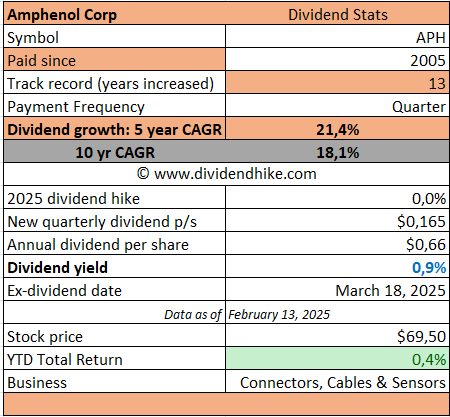

The stock is Amphenol Corporation (ticker APH), one of the Dividend Heroes in 2025 because of its massive 50% dividend hike in 2024.

From Radio Tube Sockets to a Global Tech Powerhouse

Amphenol Corporation has established itself as a global leader in interconnect, sensor, and antenna solutions, benefiting from the rapid acceleration of digitalization and connectivity. Founded in 1932 as the American Phenolic Corporation, the company initially produced radio tube sockets—critical components in early electronics—before expanding into military interconnect systems during World War II. This foundation set the stage for Amphenol’s evolution into a key player across multiple high-tech industries.

Strong Financial Growth in 2024

Amphenol delivered record-breaking results in 2024, reinforcing its leadership in the industry. Annual sales surged 21% to $15.2 billion, with organic growth of 13%. The fourth quarter alone saw a remarkable 30% revenue increase, fueled by strong demand in IT datacom, mobile networks, commercial aerospace, broadband, and defense. Operating margins remained impressive at 21.7%, and free cash flow totaled $2.2 billion, highlighting the company’s financial strength.

Strategic Acquisitions Drive Expansion

Amphenol continues to grow through acquisitions, strengthening its market position. In 2024, it acquired Carlisle Interconnect Technologies and the German Lütze Group, expanding its expertise in industrial automation and railway technology. The company’s strategy of targeted acquisitions supports both revenue growth and technological innovation, further solidifying its dominance in the interconnect sector.

Valuation, Fundamentals, and Dividend Growth

Despite its premium valuation, Amphenol remains a high-quality investment due to its strong margins, stable revenue growth, and robust cash flow generation. Analysts project revenue to exceed $18 billion in 2025, driven by both organic growth and acquisitions. EBIT margins are expected to expand beyond 23% in the coming years. While the stock trades at a P/E ratio above 30, Amphenol justifies this through consistent earnings growth and financial flexibility.

Dividend Performance: A Track Record of Rapid Growth

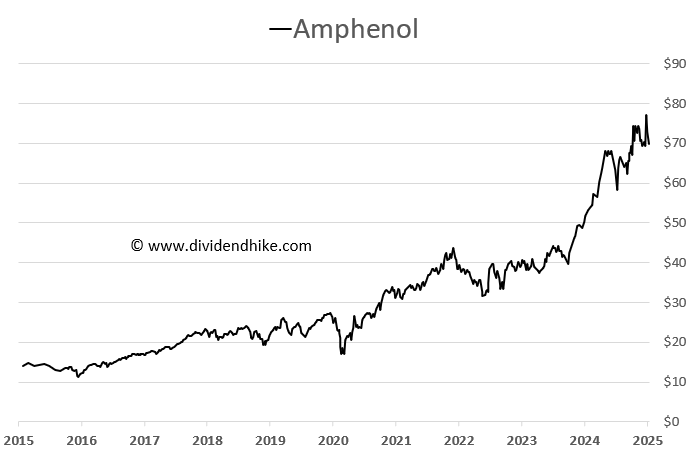

Amphenol’s dividend strategy is equally compelling. In 2024, the company increased its quarterly dividend by 50% to $0.165 per share, resulting in a total annual payout of nearly $800 million. Looking ahead, with free cash flow expected to grow from $1.70 per share in 2024 to nearly $3.00 per share by 2027, further dividend hikes are highly likely. Over the last decade, Amphenol’s dividend has surged 370%, closely mirroring a 420% increase in its stock price.

Future Potential for Shareholders

Although the current dividend yield of 0.9% may appear modest, Amphenol’s real appeal lies in its rapid dividend expansion and strong share buyback program. In 2024, the company returned nearly $1.3 billion to shareholders through dividends and stock repurchases. Given Amphenol’s history of aggressive dividend growth, rising cash flow, and consistent acquisitions, the stock remains highly attractive for long-term investors.

Outlook: Positioned for Future Growth

Despite short-term market fluctuations, Amphenol remains well-positioned to capitalize on technological advancements and increasing demand for connectivity solutions. The ongoing expansion of 5G, industrial automation, IoT, and electrification of vehicles presents significant opportunities for the company. Through organic innovation, strategic acquisitions, and strong shareholder returns, Amphenol continues to strengthen its competitive advantage, making it a compelling choice for growth-oriented investors.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.