A Hidden Dividend Champion in France

#2 Dividend Aristocrat (after Sanofi) with 30 consecutive years of increases

When talking about French stocks with an unbreakable track record of dividend growth, one name always comes to mind: a pharmaceutical giant that just announced a 4.3% increase, pushing its dividend to a record €3.92 per share.

A solid performer, no doubt. This stock is Sanofi with now 31 consecutive years of increased dividends.

Next to Sanofi there is another Dividend Aristocrat in France that remains largely unknown to most investors.

But there’s another stock—far less known, much smaller in market cap—that plays in the same league. This week, it quietly marked its 30th consecutive year of dividend growth. That’s right, nearly three decades of rewarding shareholders, year after year.

Sanofi has a 20 year CAGR of 6.1% for the dividend; our ‘hidden dividend champ’ that we will reveal below has an even more impressive 9.1% CAGR in the last 20 years!

So, what is this under-the-radar powerhouse that keeps delivering, rain or shine? Our premium subscribers will find out—exclusively!

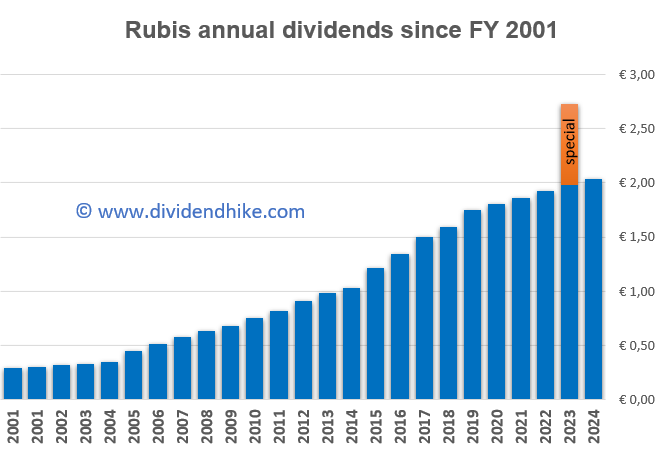

The company we are talking about is Rubis from France; they just announced a small 2.5% dividend hike for 2025, marking the 30th consecutive year of increased dividends.

Rubis: A Specialist in Energy with a Strong Track Record

Rubis is a French company specializing in the storage, distribution, and trading of petroleum and gas products. Founded in 1990, the company has expanded through strategic acquisitions across Europe, Africa, and the Caribbean. It operates through two main divisions: Rubis Énergie (fuel and LPG distribution) and Rubis Terminal (liquid storage facilities).

Historically, Rubis has stood out for its steady growth and shareholder-friendly dividend policy. It competes with major players like TotalEnergies, Shell, and regional energy distributors.

Rubis benefits from a certain moat due to its well-established logistics infrastructure, long-term contracts, and expertise in niche markets. However, its reliance on fossil fuels raises questions about its long-term adaptability in the face of the energy transition.

Rubis: Strong Performance and Outlook

Rubis shares surged 4% Today after the company reported better-than-expected full-year EBITDA of €721 million, exceeding the €703 million consensus estimate from Portzamparc. The firm described Rubis’ operational performance as solid.

Looking ahead, Rubis forecasts an EBITDA range of €710-760 million for 2025, with analysts estimating around €734 million. Following the announcement, the stock was among the top risers on France’s SBF120 index and could post its best trading day since November if gains hold.

Fundamentals and dividend

Rubis is up an impressive 12% on the stock market this year but has struggled significantly in recent years. For 2024, a barely higher revenue of €6.6 billion was reported, and for 2025, analysts expect growth of almost 7%, reaching over €7 billion. What stands out to us is the relatively high net debt position, which is roughly half of the current market value. With a P/E ratio of less than 8 for 2025, the stock appears incredibly cheap; however, the dividend yield of 7.8% at a price of €26.80 is a clear reason for caution.

So far, the dividend has been consistently increasing every year, and Rubis has made it clear it plans to pursue a growing dividend in the coming years. Last year Rubis also paid a €0.75 per share special dividend. This additional payment was related to the sale of the stake in Rubis Terminals.

However, the dividend growth is slowing down, and the increase in 2025 will be the smallest in over 20 years (as long as we've been tracking the data).

So, what do analysts think? They are overwhelmingly positive, with 2 strong buys, 1 buy, and 1 hold. No sell recommendations in sight. A high dividend yield and annual (albeit small) increases form the foundation for Rubis. One thing is certain: with Sanofi, Rubis is the only true Dividend Aristocrat in France!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.