Mueller Industries: A Dividend Powerhouse on the Rise

Parker Hannifin peer with a 5 year dividend CAGR of 35.1% (!!)

Investors seeking robust dividend growth and a solid track record of financial performance should look no further than our new Focus stock (#4): Mueller Industries (MLI). For all free subscribers please note that our 3 previous Focus stocks highlighted earlier (Korn Ferry, Discover Financial and Nexstar Media) returned 10.0% on average so far since we wrote about these companies.

This industrial manufacturing stalwart, Focus stock #4, has been making waves with its impressive dividend hikes, boasting an average annual increase of 35.1% over the past five years.

Last year alone, Mueller Industries, the $8 billion market cap peer to much bigger Dividend Hero Parker Hannifin (PH) raised its dividend by a substantial 33.3%, reflecting the company's commitment to rewarding its shareholders. The momentum has continued into this year, with the stock price soaring by 49%, highlighting the market's confidence in future prospects. Despite this price appreciation, the company still offers a current dividend yield of 1.1%.

Interestly enough the company we are talking about has a relative attractive valuation with an estimated p/e of 14 for 2024. We also love the company’s EBIT margin of 21.6% (FY 2023) and its high and consistant Return on Invested Capital (ROIC) of almost 46% for 2023. We also love: a debt free balance sheet and a balanced capital deployment with capex, share repurchases, dividends and acquisitions throughout the years.

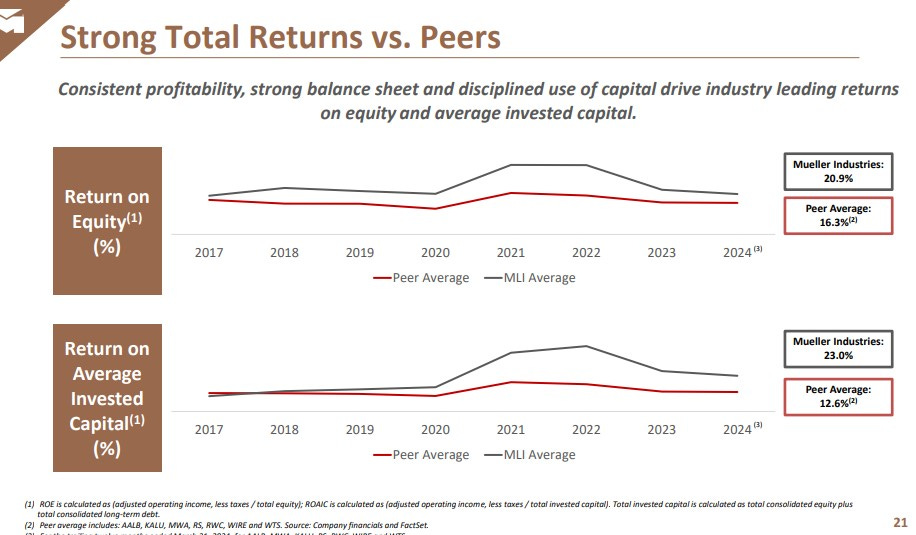

Our new focus stock also generates much stronger total returns versus peers based on Return on Equity and Return on Average Capital Invested (ROIC). is a low cost manufacturer with quality products, a resilient business model and strong customer relations resulting in profitability through all economic cycles, even during recessionary periods or the global (covid) pandemic. No surprise that this stock trades near its all time high. However, the stock price could rise much higher over time given the strong fundamentals. We will explain you why. First, lets learn everything about this beautiful company!

Mueller has three reporting segments: Piping Systems, Industrial Metals and Climate (see below). The company’s sales are 85% building construction related with 75% of FY 2023 revenue coming from the United States. The biggest end market for Mueller is Plumbing, with 46% of sales, with another 31% coming from HVAC. Non-building construction (15% of sales) markets include industrial manufacturing, transportation and equipment (automotive, mining and agriculture, construction equipment, aerospace, marine), medical, electrical, agriculture, military and defense, gas appliances, pool & spa, and solar.

Mueller Industries operates through several key subsidiaries, each specializing in various sectors. Streamline produces copper tubing, fittings, and related products for plumbing and HVACR systems. Westermeyer Industries focuses on oil separators, receivers, accumulators, and other refrigeration system components. Die-Mold Tool provides precision mold and tool manufacturing services for the plastic industry. Linesets, Inc. manufactures copper line sets for HVAC applications. Micro Gauge develops and produces specialty copper and aluminum tubing for automotive and HVAC markets.

Mueller is a low cost manufacturer with quality products, a resilient business model and strong customer relations resulting in profitability through all economic cycles, even during recessionary periods or the global (covid) pandemic. The company has a long term focus and is known for its balanced capital allocation and strong balance sheet, the foundation for a strong and growing dividend. The company also uses its strong cashflow for global expansion through acquisitions (totaling $210 million).

Mueller also generates much stronger total returns versus peers based on Return on Equity and Return on Average Capital Invested (see below: source company investor presentation May 2024).

What's particularly noteworthy is Mueller Industries' unwavering dedication to its dividend policy. Unlike many companies that faced the challenge of maintaining payouts during economic uncertainties, Mueller did not cut its dividend in recent years. In fact, since 2021, the company's dividend growth has accelerated significantly, underscoring its strong financial health and growth trajectory.

If Mueller Industries continues its trend of significant dividend hikes, investors can expect the yield to increase substantially over the coming years. This makes Mueller not just a compelling growth story but also an attractive income play for long-term investors. As we delve deeper into Mueller's history, current business operations, and competitive landscape, it's clear that this is a company with a solid foundation and a bright future ahead.

A Rich History of Excellence

Mueller Industries, Inc. (NYSE: MLI) is a name that has become synonymous with innovation and reliability in the industrial manufacturing sector. Established in 1917, the company has over a century of experience under its belt. From its humble beginnings as a producer of brass and copper products, Mueller Industries has grown into a diversified global manufacturer. Today, it stands as a leader in the production of copper, brass, aluminum, and plastic products, catering to a wide range of industries including plumbing, HVAC, refrigeration, and automotive.

Current Business Landscape

Mueller Industries operates through several segments, each playing a crucial role in the company's overall success:

Piping Systems: This segment includes copper tubes, copper and plastic fittings, valves, and related products. It's a vital part of the company's portfolio, serving residential and commercial construction, as well as industrial markets.

Industrial Metals: Focused on brass and copper alloy rods, bars, and shapes, this segment caters to a variety of industrial applications, including automotive and electrical components.

Climate Products: This division produces a wide array of components for HVAC and refrigeration systems, from heat exchangers to refrigeration valves.

Mueller Industries' robust business model is underpinned by its vertically integrated operations, extensive distribution network, and strong brand recognition.

Explosive Dividend Growth

One of the most attractive aspects of Mueller Industries is its impressive dividend growth. Over the past few years, the company has demonstrated its commitment to returning value to shareholders through substantial increases in its dividend payouts. This growth is a testament to Mueller's strong financial health and confident outlook for future earnings. Check out the 20 year dividend history on the company’s website.

Mueller annual dividend hikes

2024: +33.3%

2023: +20.0%

2022: +92.3%

2021: +30.0%

2020: no dividend increase

Challenges and Competitors

Despite its strengths, Mueller Industries faces several challenges:

Raw Material Price Volatility: Fluctuations in the prices of copper, brass, and other raw materials can impact profit margins.

Supply Chain Disruptions: Like many manufacturers, Mueller is vulnerable to global supply chain issues, which can affect production schedules and delivery times.

Economic Cycles: The company's performance is closely tied to the health of the construction and industrial sectors, making it susceptible to economic downturns.

Mueller Industries competes with several notable players in the industry, including:

Mueller Water Products (MWA): Despite the similar name, this company focuses more on water infrastructure products.

RectorSeal: Known for its HVAC and plumbing products, RectorSeal is a significant competitor in the same market segments.

Parker-Hannifin Corporation (PH): A diversified manufacturer with a strong presence in the industrial and HVAC markets.

Does Mueller Industries Have a Strong MOAT?

Mueller Industries has several factors contributing to a competitive advantage or MOAT:

Vertically Integrated Operations: By controlling every stage of production, from raw materials to finished goods, Mueller ensures high quality and cost efficiency.

Diverse Product Portfolio: Serving multiple industries helps mitigate risks associated with dependence on a single market.

Strong Brand and Reputation: With over a century of industry presence, Mueller has built a reputation for quality and reliability.

Robust Distribution Network: An extensive distribution network ensures that Mueller's products are readily available to customers across the globe.

The expectation is that revenue will grow by over 6% in 2024 to $3.6 billion. However, it is notable that Mueller Industries is followed by surprisingly few analysts (currently only one with a 'hold' recommendation). This is naturally due to its relatively low market value, but typically, the recent price surge and higher market cap should also result in more analyst attention. This would allow us to provide better estimates of future developments. After the significant price jump this year, caution with Mueller Industries stock is wise. What is certain is that in terms of dividend growth, the company has belonged to the absolute top tier in the United States in recent years. Therefore, Mueller Industries deserves a spot on our focus list of lesser-known stocks that excel in dividends.

Key Financial Metrics for Mueller Industries

Forward P/E for 2024: 14

Return on Invested Capital (ROIC): 45.7% in 2023

EBIT Margin: 21.6% (2023)

Revenue Growth: -14.11% in 2023 to $3.4 billion, expected to grow 6.2% in 2024 to $3.6 billion, with double-digit growth anticipated for 2025

Market cap: $8 billion (annual dividend $91 million)

Financial Position: debt free (Mueller had a $1.2 billion net cash position at the end of 2023, source: company website).

YTD performance: +49.2%

Stock price & yield: $70.33 & 1.14 (As of July 30, 2024)

Conclusion

Mueller Industries stands out as a robust investment opportunity, particularly for dividend growth investors. The company's long history, diversified operations, and strong competitive advantages position it well for continued success. While there are challenges ahead, Mueller Industries has demonstrated resilience and adaptability, making it a stock worth watching closely. Keep an eye on this hidden gem as it continues to build on its impressive legacy.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.