A unique Swiss dividend growth star

Market leading technology company with clean balance sheet

For our next Dividend Hike Focus Stock we move to Switzerland, home of many well known dividend payers and Aristocrats including Nestlé, Novartis and Roche. These are however big companies with slow dividend growth. We look mostly at smaller companies with a faster growing dividend. This new Focus Stock has a market cap of $10+ billion and grows its revenue in double digits annually. On top of that, the company we are talking about also has a growing dividend, with increases expected to jump the next couple of years together with the strong growth prospects.

The company we are talking about is semiconductor niche company VAT Group. The company has a market cap of CHF 13.2 billion and has Rudolph Maag as biggest shareholder with a 10% stake.

Rudolf Maag is a Swiss entrepreneur and philanthropist, best known for his work in medical technology. He started his career at the pharmaceutical company Sandoz AG and later moved to Straumann, a major dental technology company. In 1990, he bought Straumann’s medical division and took it public as Stratec Medical. He later merged Stratec with Synthes, another Swiss medical technology company, and built a significant stake, which he eventually sold to Johnson & Johnson.

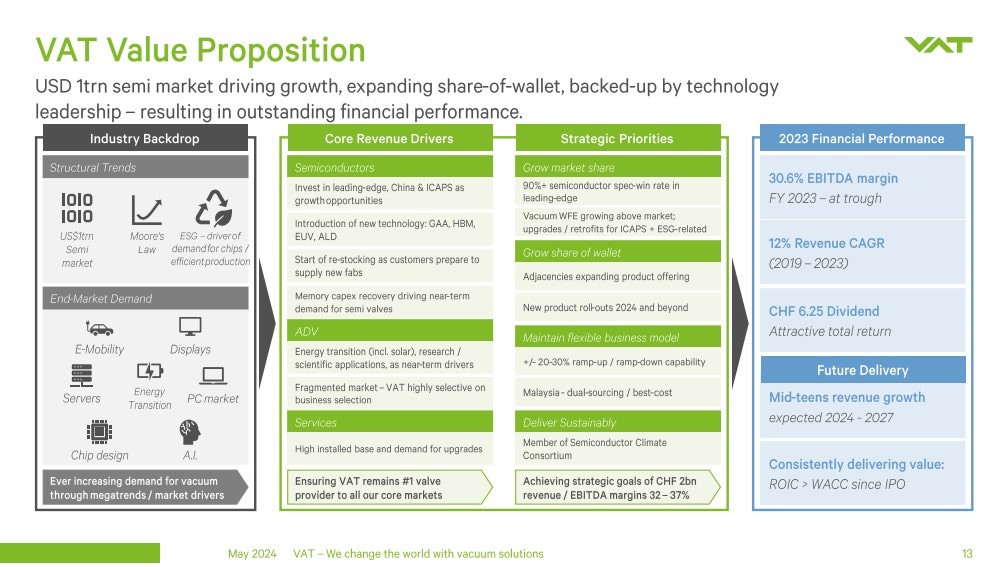

VAT Group is a Swiss company with a unique position in the niche market of vacuum valves, a critical technology for high-tech industries like semiconductors. The company’s specialization and expertise in vacuum technology set it apart and create a significant economic "moat."

Founded in 1965, VAT Group began as a small Swiss enterprise focused on producing high-precision valves. Over the decades, it has evolved into a global leader in vacuum valve technology, playing a vital role in industries that require ultraclean environments, such as semiconductor manufacturing, displays, and scientific research.

Several factors contribute to VAT Group’s uniqueness and competitive advantage:

Technological Leadership: VAT Group has developed a strong technological edge in vacuum technology. Their products are essential for maintaining the ultra-high vacuum conditions needed in advanced manufacturing processes like semiconductor production.

Strong Market Position: As a dominant player in a niche market with high entry barriers, VAT Group benefits from its specialized knowledge and experience, making it difficult for new competitors to enter the field.

Long-Term Customer Relationships: VAT Group has established long-standing relationships with leading companies in the semiconductor industry, such as ASML and other major manufacturers. These relationships provide a stable revenue stream and reinforce the company's market position.

High Quality and Reliability: VAT Group's products are renowned for their high quality and reliability, which are crucial in industries where even minor failures can lead to significant losses. This reputation fosters customer loyalty and allows the company to command premium pricing.

Patents and Know-How: The company holds a broad range of patents and possesses deep technological know-how, protecting it from competition and driving innovation.

These factors contribute to VAT Group’s strong economic moat, enabling it to maintain a sustainable competitive advantage in a specialized and growing market. The company's history of innovation and its commitment to quality and reliability have cemented its role as a critical supplier in the global high-tech industry.

Competitors

VAT Group operates as a market leader in a highly specialized niche, but it does face competition from several companies, particularly in the vacuum technology and semiconductor manufacturing sectors. Some of its key competitors include:

Edwards Vacuum: A part of the Atlas Copco Group, Edwards is a significant competitor in vacuum technology, providing vacuum pumps and related equipment used in similar industries, including semiconductors, displays, and scientific research.

INFICON: A Swiss company that supplies vacuum instruments, sensors, and process control software for semiconductor manufacturing, thin-film technology, and other industries requiring vacuum environments.

Pfeiffer Vacuum Technology AG: A German company specializing in vacuum pumps, components, and systems for various industries, including semiconductors and analytics. Pfeiffer Vacuum is well-known for its advanced vacuum solutions and competes directly with VAT Group in several segments.

MKS Instruments: An American company that provides instruments, subsystems, and process control solutions for advanced manufacturing, including vacuum solutions used in semiconductor production.

Brooks Automation: A U.S.-based company that offers automation solutions and vacuum technology for semiconductor manufacturing, life sciences, and other industries requiring precision environments.

Ulvac, Inc.: A Japanese company that provides vacuum equipment, components, and materials for a wide range of applications, including semiconductor production and other high-tech industries.

These companies, like VAT Group, operate in the specialized field of vacuum technology, where precision and reliability are paramount. Each has its own strengths, such as specific technologies or geographic market focus, but VAT Group’s strong position in the vacuum valve market and its relationships with key players in the semiconductor industry give it a competitive edge.

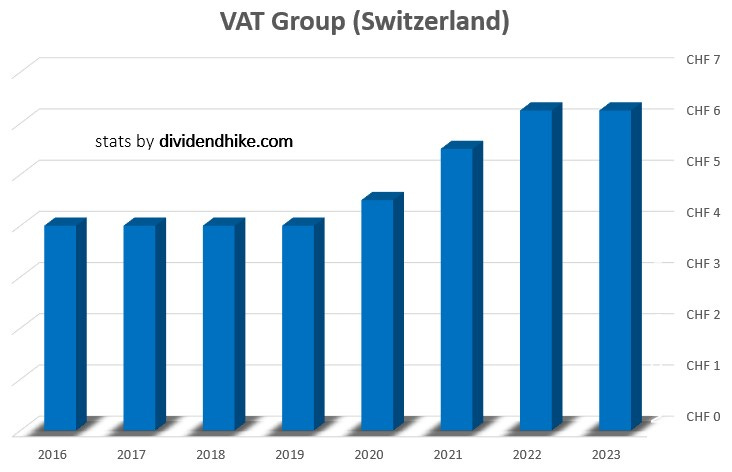

The Dividend

VAT Group has a strong track record with steady/higher annual payments since a dividend was first initiated in 2017. VAT now pays an estimated CHF 187 million in dividends annually with the payment being covered just slightly by the CHF 196 million free cash flow generated in 2023. The FCF is expected to improve only in 2025 and could reach CHF 350 million in FY 2026, leaving ample room for additional dividend increases. In its May 2024 investor presentation VAT says it has a strong dividend focus with a dividend payout of up to 100% of free cash flow to equity. The current dividend yield is 1.4% based on a stock price of CHF 442.

Key Financial Metrics for VAT

Forward P/E for 2024: 59

Return on Invested Capital (ROIC): 29.6% in 2023, expected to jump to 32.4% in 2024

EBIT Margin: Over 24.6% in 2023, expected to top 30% in two years

Revenue Growth/Decline: -22.7% in 2023 to CHF 885 million, but expected to grow almost 12% in 2024 to nearly CHF 990 million, with 20%+ growth anticipated for 2025 and 2026

Debt-Free: VAT Group had a net debt position of CHF 63.2 million at the end of 2023 and is expected to become debt free in the next couple of years

P/E Drop by 2026: The current P/E is expected to drop to 33 by 2026 based on analyst eps estimates

The revenue of VAT Group declined in 2023 primarily due to a downturn in the semiconductor industry, which significantly impacted their sales and many other semiconductor related businesses. This also explains an unchanged dividend for FY 2023 by VAT, with dividend growth expected to pick up in the next few years in line with expected sales and profit growth.

Conclusion

With an estimated p/e of 59 for FY 2024 the stock looks expensive. The dividend yield is low, but can grow significantly in the next couple of years. Professional analysts are in general ‘neutral’ on VAT stock with 2 strong buys, 2 buys and 12 holds. Not one analyst rates the stock as a ‘sell’ as of August 29, 2024.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.