🧄 Armanino Foods Declares an “All-Time High” Dividend — and That’s Worth Noticing

A rare company that celebrates the record that actually matters: its dividend

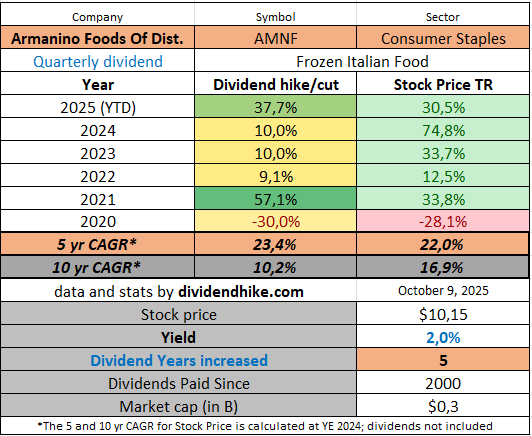

When Armanino Foods of Distinction (OTCQX: AMNF) announced its latest dividend hike this week, the number itself wasn’t shocking: a lift from $0.04 to $0.05 per share, payable October 24 to holders of record on September 30. What was surprising was the company’s choice of words.

🔑 Key Points in this Article

Armanino Foods (AMNF) lifts dividend 25% to $0.05, a new “all-time high.”

102 straight quarterly payouts and two raises in 2025 (+37.7% total).

Dividend growth averaging ~10% per year over two decades.

Rarely, a company calls its dividend—not its stock—an all-time high.

In the opening line of its press release, Armanino described the new payout as a “new all-time high” dividend.

That phrase — all-time high — is almost always reserved for stock prices, not payouts. Companies routinely talk about “record revenues” or “record earnings,” but very few ever label their dividend in such terms, even when it technically qualifies.

And yet, here’s a small Californian food company putting the spotlight on it.

A Rare Framing: Dividend as a Record, Not a Routine

For many dividend growers — think Coca-Cola, Pepsico, or Dividend Aristocrats like Procter & Gamble — each year brings an “all-time high” dividend almost by definition. The payout keeps rising; the record is broken automatically. But you’ll never see them brag about it that way.

So why did Armanino Foods decide to?

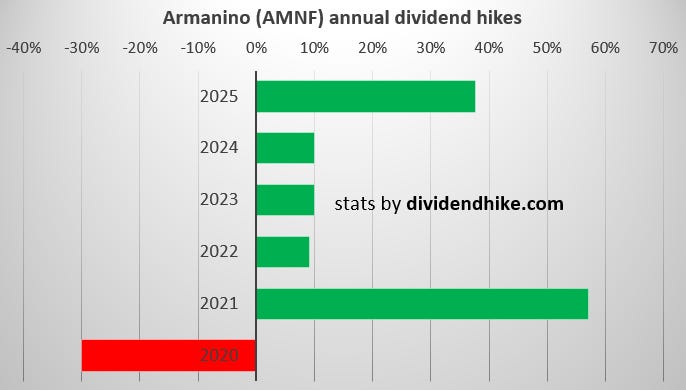

Perhaps it’s because for Armanino, this new record means something real. The company’s steady dividend habit stretches across 102 consecutive quarters — that’s over 25 years of uninterrupted payments — yet in 2020, COVID forced a rare 30% reduction, ending what had been a 15-year streak of raises.

Since then, management has rebuilt the track record with vigor. In 2025 alone, the dividend has been raised twice, for a total increase of 37.7%. Over the past two decades, Armanino’s dividend has compounded at roughly 10% per year, a remarkable pace for a company in the frozen foods niche.

To call the latest step an “all-time high,” then, isn’t just marketing — it’s redemption.

Behind the Numbers

Armanino Foods of Distinction makes and markets frozen Italian-style specialties — pestos, sauces, filled pastas, and meatballs — sold into foodservice, retail, and industrial channels. The product line ranges from the classic Basil Pesto to bolder flavors like Chipotle, Harissa, and Romesco.

In FY2024, Armanino Foods’ revenue grew from $63.6 million to $69.4 million. As a small-cap stock, it has no analyst coverage, so what we mainly see is its strong dividend track record and steady annual revenue growth.

If you have additional insights on the company, feel free to share them in the comments below!

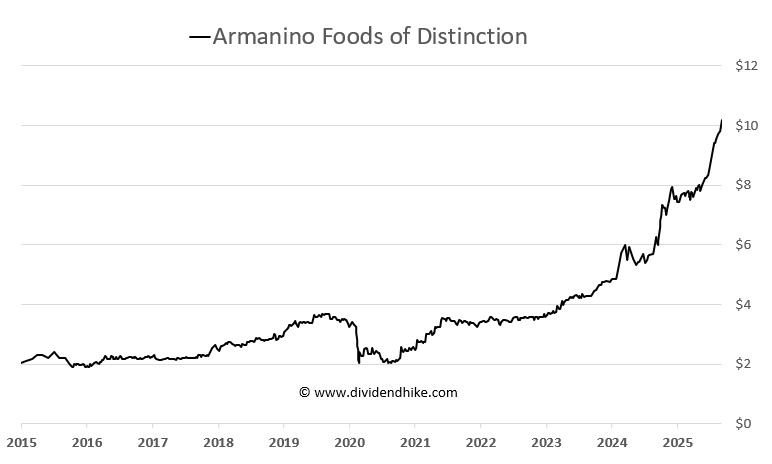

It’s a small-cap story ($316 million market cap) but a surprisingly strong one. After a 27% dip in 2020, AMNF shares surged with average annual gains of roughly 34% from 2021 through 2024, and they’re up another 28% so far in 2025. The stock trades near record highs, offering a 2% yield on this new dividend level.

The Symbolism of “All-Time High”

Maybe the phrase was chosen deliberately — to connect the company’s financial discipline and comeback with the kind of language normally reserved for growth darlings. Or maybe it was a simple stylistic flourish.

Either way, it works. It signals pride, confidence, and perhaps a quiet message to shareholders:

the dividend, not just the share price, is worth celebrating.

After all, for long-term investors, an all-time high dividend is the kind that keeps paying — even when the stock price isn’t.

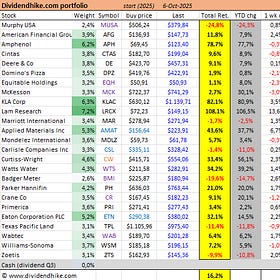

Dividend Hike Portfolio Update – October 6, 2025

The Dividend Hike Portfolio continues to outperform, posting a 16.2% return YTD as of October 6. This is notably ahead of The Dividend Heroes (+10.2%) and the Dividend Aristocrats (+5.8%), underlining the strength of a portfolio focused on consistent dividend growers.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.