The #1 Dividend Growth stock from Europe

This UK based company combines buybacks and massive annual dividend hikes

Our new Focus stock comes from the UK and actually is the highest ranked Dividend Hero from Europe in 2024. The dividend has been raised annually for almost 2 decades now with an absolutely impressive growth over that period.

This gem boasts a remarkable 10-year CAGR of over 20% for its dividend, a feat few companies from Europe or even the USA can match. What's more, its dividend growth has surged to an impressive average of over 26% annually in the past three years.

Earlier on we already mentioned the #1 dividend hero for the United States, Nexstar Media. This time we take a closer look at the #1 hero from Europe.

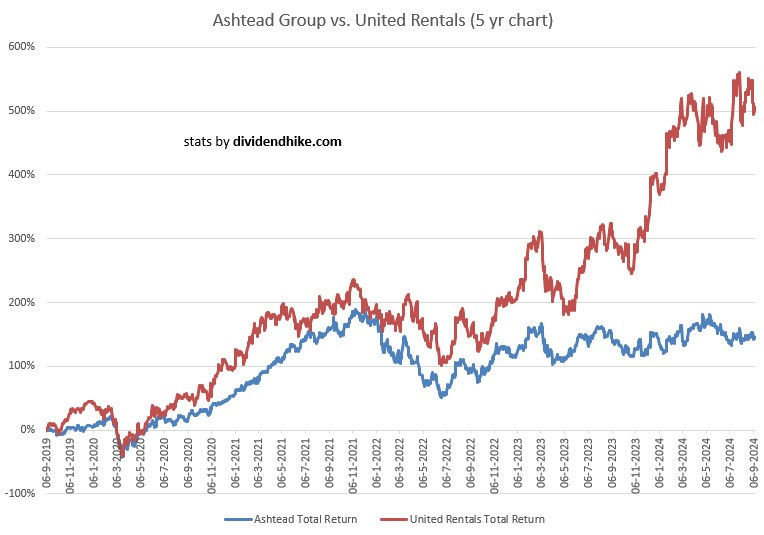

The company that we are talking about is Ashtead Group, one of the biggest equipment rental companies worldwide. Most of its business comes from the United States, where Ashtead is the #2 player behind United Rentals (URI) with its biggest brand Sunbelt Rentals.

Ashtead Group is a leading international equipment rental company, headquartered in London, UK. It operates under two main brands: Sunbelt Rentals in North America and A-Plant (rebranded to Sunbelt Rentals UK in 2020) in the UK. The group specializes in renting out construction, industrial, and general equipment to a diverse range of sectors including construction, manufacturing, utilities, and events. Ashtead Group has grown to become one of the largest equipment rental companies globally, with North America being its biggest market.

Company History

Early Beginnings (1947-1980s):

Ashtead Group was founded in 1947 as a small industrial plant hire company in the village of Ashtead, Surrey, UK. Initially, the company provided local equipment hire services but gradually expanded.

In the 1980s, Ashtead began growing through acquisitions, including buying out competitors and expanding geographically. This period saw the company venture into the U.S. market by acquiring Sunbelt Rentals in 1990.

Expansion and Growth (1990s-2000s):

The acquisition of Sunbelt Rentals marked a pivotal point in Ashtead's growth strategy, as the U.S. market proved highly lucrative. Over the years, Sunbelt became the company's dominant brand.

The 2000s were characterized by significant growth, particularly in North America, with strategic investments in new branches and rental fleets.

Global Dominance (2010s-present):

Ashtead continued its aggressive acquisition strategy, increasing its footprint both in the U.S. and in the UK, transforming itself into one of the largest equipment rental firms globally.

By 2020, Sunbelt Rentals had become the primary brand across its operations in North America and the UK. Today, Ashtead has more than 1,000 locations in North America and significant market share in the equipment rental industry.

Business Model and Operations

Ashtead's business model is rooted in equipment rental. Rather than owning or leasing expensive equipment, construction firms and other industries rent machinery, tools, and vehicles from Ashtead. The company's inventory includes earth-moving equipment, aerial work platforms, forklifts, power generators, pumps, heating equipment, scaffolding, and more.

The rental model is highly capital-intensive, as the company needs to continually invest in its fleet of equipment, but it offers long-term recurring revenue from customers. It also provides flexibility for customers who prefer not to tie up capital in owning equipment.

A key advantage for Ashtead is its ability to leverage economies of scale, purchasing large quantities of equipment, maintaining it, and renting it out to multiple customers. This reduces costs per unit and allows for competitive pricing while maintaining healthy margins.

Does Ashtead Group Have a Moat?

A competitive "moat" refers to the enduring competitive advantages that protect a company from rivals and help sustain its market share and profitability over time. For Ashtead, several factors contribute to its potential moat:

Scale and Network Effects:

Ashtead is one of the largest equipment rental companies in the world, particularly in North America, where Sunbelt Rentals dominates. Its extensive network of depots allows it to serve large geographic regions and industries with high demand for equipment. This scale creates a significant barrier for smaller competitors trying to match its breadth of services and equipment inventory.

Capital Intensity and Fleet Size:

The equipment rental business is capital-intensive, requiring significant upfront investment to maintain a large and diverse fleet. Ashtead’s fleet is one of the most extensive, which provides it with a competitive edge by offering a wide range of equipment that can meet the needs of large infrastructure projects and complex industrial tasks. This reduces the likelihood of new entrants being able to compete on a similar scale.

Long-Term Customer Relationships:

Ashtead has built strong, long-term relationships with contractors, utilities, and industrial customers. These relationships foster trust, reliability, and repeat business, further enhancing its competitive position.

Technological Advancements and Digital Infrastructure:

The group has invested in digital platforms to streamline the rental process, offering services like online booking, tracking, and predictive maintenance. These technologies provide a seamless customer experience, contributing to customer loyalty and differentiation from competitors who may not have the same technological capabilities.

Fragmented Market:

Despite Ashtead's large size, the equipment rental market remains highly fragmented, with many regional players. Ashtead's scale allows it to compete effectively in pricing, service quality, and availability, which smaller competitors may struggle to match.

However, while these factors provide a degree of moat, Ashtead does face competition, and the industry can be susceptible to cyclical downturns, particularly in construction activity.

Competitors

Ashtead competes with several global and regional players in the equipment rental industry, the most prominent being:

United Rentals:

United Rentals is the largest equipment rental company in the world and Ashtead's biggest competitor, particularly in North America. It operates over 1,100 locations across the U.S. and Canada. Like Ashtead, United Rentals has grown through aggressive acquisitions and offers a wide array of equipment for rent. The company has a comparable business model and benefits from economies of scale.

Herc Holdings (Herc Rentals):

Another key competitor, Herc Holdings (formerly part of Hertz), operates in the North American market and has over 270 locations. Although smaller than Ashtead, Herc Rentals remains a significant competitor in the equipment rental space.

Aggreko:

Aggreko is a UK-based global provider of temporary power generation and temperature control equipment. While not a direct competitor across all categories, it competes in specific segments like power and temperature control rentals.

Smaller Regional and Local Players:

The equipment rental market remains fragmented with many small and regional competitors across both North America and the UK. These players often cater to niche markets or specific geographic regions. However, their lack of scale compared to Ashtead limits their ability to compete in terms of fleet size and geographic coverage.

Industry Outlook and Challenges

The equipment rental industry benefits from several long-term trends, including increasing demand for rental solutions in construction, infrastructure projects, and industrial sectors. Many companies prefer to rent equipment to reduce capital expenditures and maintain flexibility.

However, the industry is also cyclical and can be vulnerable to downturns in construction or infrastructure investment, which could lead to reduced rental demand. Additionally, competitive pressures from other major players like United Rentals and smaller regional firms could erode pricing power.

The Dividend

Ashtead is a Future Dividend Aristocrat with now almost 20 consecutive years of increased dividends. The good thing is that dividend growth picked up in recent years, resulting in a Dividend Hero selection for Ashtead in 2024. Actually Ashtead is this years #1 dividend hero, mostly because of the superstrong dividend growth combined with a relatively attractive yield. Ashtead has a progressive dividend policy.

“We continue to have a progressive dividend policy which is designed to ensure sustainability through the economic cycle” (source: company 2024 annual report)

Ashtead hiked its dividend by 19.2% in FY 2023 and did a 58% hike for FY 2022. However the company dissapointed with a 1% hike for FY 2024 (ending April). At a current stock price of 5252 pence the dividend yield is 1.55%. Because of this mini hike Ashtead will be dropped from next year’s Dividend Heroes list. Please note that Ashtead declares its dividend in US dollars, announcing a 5% hike for FY 2024. In British pounds however this translates into a 1% increase.

Key Financial Metrics for Ashtead

Forward P/E for FY 2025 (current fiscal year): 17.4

Return on Invested Capital (ROIC): 13.9% for FY 2024, expected to jump to 14.2% for FY 2025 (ending April 2025).

EBIT Margin: 30.9% in 2024 and expected to drop to 25% in 2025

Revenue Growth: 12.3% in 2024 to GBP 10.859 billion, expected to grow 4.5% for FY 2025 to nearly GBP 11.3 billion, with high single digits growth anticipated for 2026 and 2027

Balance sheet: Ashtead has a net debt position of GBP 10.65 billion at the end of FY 2024.

P/E Drop by 2027: The current P/E is expected to drop to 13.5 by 2027 based on analyst estimates.

Astead also buys back its own shares annually with an estimated 13% of its stock retired in the last decade. Buybacks slowed down in 2023 and 2024 according to our own calculations.

Conclusion

Ashtead Group has established itself as a dominant player in the global equipment rental market, particularly in North America, where it has leveraged the strength of its Sunbelt Rentals brand. Its extensive scale, large fleet, and technological investments give it a strong competitive position and potential moat. However, it faces intense competition from United Rentals, Herc Rentals, and others in a cyclical and capital-intensive industry. Despite these challenges, Ashtead’s ability to generate consistent revenue from a broad customer base positions it well for long-term growth. Based on dividend growth Ashtead is a one of a kind company but the small increase just announced for FY 2024 makes us hesitant about investing in Ashtead right now, also since the company reported quarterly earnings below analyst expectations in at least the last four quarters. US peer United Rentals (URI) is the big winner the last couple of years with a record high stock price, strong buybacks and a quarterly dividend initiated last year, with a 10% hike in 2024. The dividend yield for URI is 1.0% and the company trades at a lower p/e of 15.5 for FY 2024, even with the stock near its all time high.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

Please share your thoughts on this new Focus Stock from the UK in the comments!