Atoss Software from Germany is a dividend growth monster

With record revenues, zero debt, and a dividend streak entering its 11th year, this high-growth software company proves that quality scales — even in a volatile market.

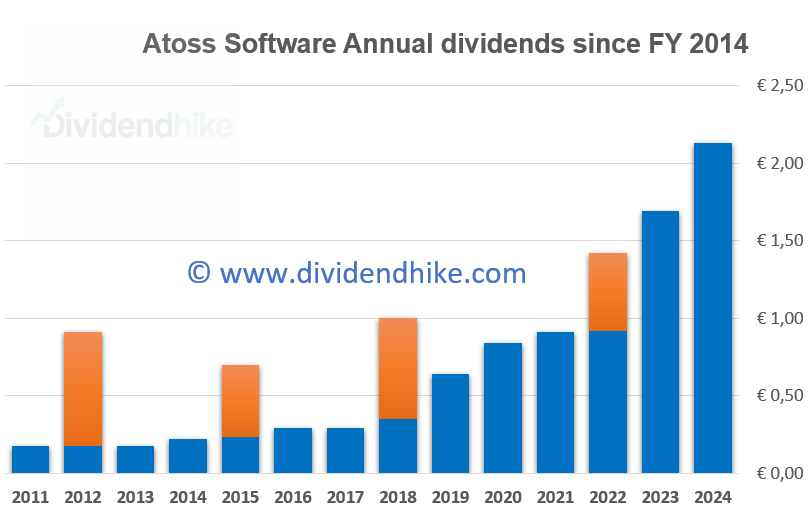

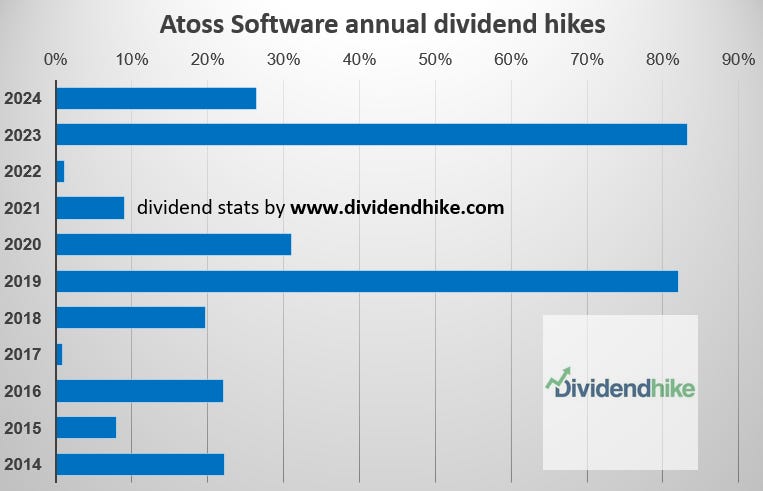

Our new Focus stock comes from Germany and actually is a Dividend Hero. Atoss Software has a strong dividend trackrecord with double digit annual increases combined with regular special dividend payments.

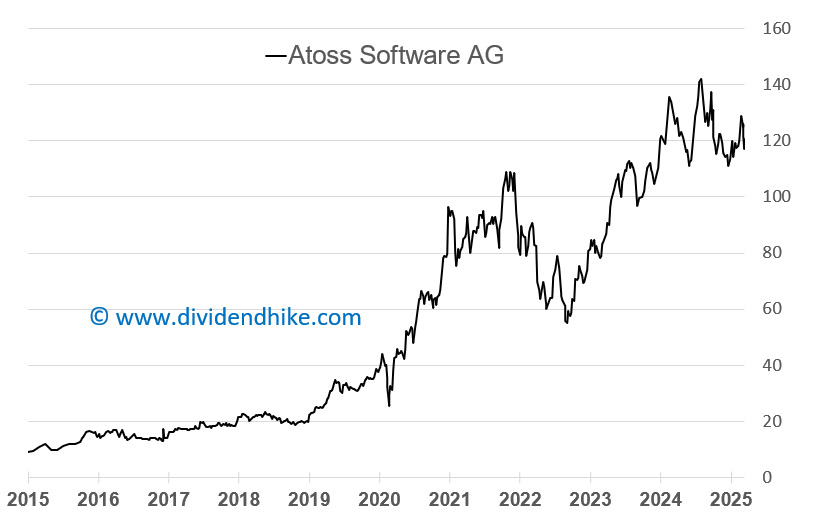

Atoss Software may fly under the radar as a small cap with a market value below €2 billion, but its performance over the past decade is anything but small. From 2014 to 2024, the stock delivered an astonishing +1,300% stock price return — averaging nearly +40% per year — while dividends surged by 868%, excluding four special payouts.

We’re absolutely not surprised to see Atoss shares surging in 2025 — even while the rest of the market is falling apart. Just weeks ago, a fellow European software/tech player Fortnox from Sweden — also a true Dividend Hero — got snapped up.

Atoss stands tall. This company is firing on all cylinders: double-digit growth in both revenue and earnings, and yes — the dividend is still climbing. And let’s not forget the cherry on top: zero debt. That’s right. Debt. Free.

In this market? It simply doesn’t get better than this.

ATOSS Software, headquartered in Munich, Germany, is a leading provider of workforce management solutions. Since its founding in 1987, the company has built a strong reputation for developing software that optimizes the deployment of personnel in organizations across various sectors, including retail, healthcare, logistics, production, and public services.

Last year, we also published an article on the German software company SAP, one of our first Focus stocks; since then, SAP has soared and reached new all-time highs in 2025.

Atoss Software’s success stems primarily from its SaaS business model, which generates recurring revenue and provides a stable, predictable cash flow. Specializing in workforce management solutions, Atoss serves large enterprises in sectors like retail and healthcare, offering mission-critical software that drives efficiency and cost savings. This focus on high-margin, subscription-based services enables strong customer retention and consistent financial performance, which has supported both impressive earnings and dividend growth over the years.

Let’s dive into the company’s financial performance, outlook for 2025 and beyond and most important, valuation, balance sheet and dividend prospects!

Business Activities and Focus

ATOSS specializes in digital workforce management, offering software solutions that cover workforce scheduling, time and attendance tracking, and compliance with labor laws. The company provides its software both on-premises and increasingly via cloud-based subscriptions. Its portfolio includes modular systems tailored for small and medium-sized enterprises (SMEs) as well as large-scale enterprise clients.

🔹 Niche Market Expertise

Atoss specializes in workforce management software — covering areas like time tracking, shift planning, and workforce optimization — serving industries such as retail, logistics, and healthcare. This is a mission-critical function for large enterprises, delivering direct cost savings and efficiency gains. As a result, customer retention is strong and switching costs are high.

🔹 SaaS Business Model with High Margins

The company has steadily transitioned to a SaaS model, which brings in recurring revenue and drives predictability. Gross margins typically exceed 85%, and operating margins are solid thanks to the scalability of the platform.

🔹 Exceptional Earnings and Dividend Growth

Revenue and earnings have been growing at double-digit rates for years. The dividend has followed suit: Atoss has now raised its dividend for 11 consecutive years, with total dividend growth of 868% over the past decade — not including special dividends. That kind of growth and payout consistency is rare, especially among small caps.

🔹 Debt-Free and Cash-Generative

Atoss maintains a rock-solid balance sheet, ending 2024 with a net cash position of nearly €80 million. Free cash flow per share was €3.74 last year, giving the company ample room to continue investing in growth, paying dividends, and maintaining flexibility — all without taking on debt.

🔹 Relentless Focus and Consistency

Unlike many tech companies chasing trends or acquiring aggressively, Atoss sticks to what it does best. No flashy pivots, no overreaching — just steady, focused growth in a core area. That discipline shows in its long-term performance.

🔹 Under-the-Radar Quality

Despite its outstanding 10-year share price CAGR of nearly 40%, Atoss remains underfollowed due to its sub-€2 billion market cap. Still, it operates with the transparency and financial maturity of a much larger company — and that makes it increasingly attractive to serious long-term investors.

A key component of ATOSS’s offering is its Software-as-a-Service (SaaS) model, which has become a significant growth driver in recent years. Alongside software, the company also generates revenue from consulting services and hardware sales related to time tracking.

Financial Performance in 2024 and 2025 outlook

In the 2024 financial year, ATOSS achieved record results for the 19th year in a row. Revenues rose by 13% to €170.6 million (2023: €151.2 million). Operating earnings (EBIT) increased by 22% to €63.4 million, representing an EBIT margin of 37%.

The Software division was the primary contributor to revenue, bringing in €124.9 million—15% more than the previous year. Within this segment, cloud and subscription revenues rose sharply by 37% to €72.4 million. Recurring revenues from cloud and maintenance combined increased by 26%, now accounting for 65% of total sales.

The cloud order backlog grew by 33% to €85.8 million, and Annual Recurring Revenue (ARR) from cloud services rose by 35% to €79.3 million. Total ARR, including maintenance, amounted to €118.4 million by year-end. Net profit for the year reached €45.5 million, an increase of 27%.

At year-end, ATOSS employed 820 people (2023: 775), reflecting continued investment in its workforce. The company’s liquidity position strengthened to €112.2 million.

ATOSS has announced plans to increase investment in sales and product development, particularly in its cloud offerings. For the 2025 financial year, the company forecasts revenues of at least €190 million with an EBIT margin of at least 31%. Long-term, the company aims to reach €400 million in annual revenue by 2030, indicating confidence in sustained market demand and ATOSS’s ability to scale.

Market Position and Competitive Landscape

ATOSS operates in a highly competitive environment, facing both global and regional players. Key international competitors include UKG (Ultimate Kronos Group), SAP (specifically its SuccessFactors suite), ADP, and Workday. In the DACH region (Germany, Austria, Switzerland), ATOSS holds a strong niche position due to its localized expertise, long-standing client relationships, and deep integration of legal compliance features in its products.

The market for workforce management software is expected to expand as companies seek to optimize labor costs, meet increasingly complex compliance requirements, and improve operational flexibility. Cloud transformation and digitalization trends continue to support this growth, benefiting providers like ATOSS with strong SaaS capabilities.

Fundamentals and Dividend

Atoss Software continues to deliver strong fundamental performance. In 2024, revenue grew by 12.8% to €170.6 million. For 2025, the company is guiding for at least 12.5% growth, pushing revenue to a new record level of over €190 million.

Atoss Software – Fundamentals (as of April 2025)

Revenue growth in 2024: +12.8% to €170.6 million

Expected revenue in 2025: at least +12.5% to exceed €190 million (new record)

Balance sheet (end of 2024): net cash position of nearly €80 million

Forecast for 2025: net cash expected to rise to over €100 million

Free cash flow per share (2024): €3.74

Dividend per share (2024): €2.13, up 26.4% year-over-year

Dividend growth: this marks the 11th consecutive year of dividend increases

CAGR (5-year and 10-year): both above 25%, excluding special dividends

Special dividends: paid out four times over the past 12 years

Current share price: €127, implying a gross dividend yield of 1.7%

Ex-dividend date: May 2, 2025

Analyst ratings: 1 Strong Buy, 3 Buy, 3 Hold, 0 Sell

The company maintains a rock-solid balance sheet, ending 2024 with a net cash position of nearly €80 million — expected to rise above €100 million by the end of 2025. Free cash flow per share came in at €3.74 last year, supporting a dividend of €2.13 per share. That dividend will rise by 26.4% this year, marking the 11th consecutive year of dividend increases.

Atoss also stands out with exceptional long-term growth: both the 5-year and 10-year compound annual growth rates (CAGR) are above 25%, not even including the four special dividend payouts seen over the past 12 years. Based on a current share price of €127, the gross dividend yield stands at 1.7%. The ex-dividend date is set for May 2, 2025.

Despite this strong track record, Atoss remains a true small cap with a market capitalization below €2 billion. The stock is currently trading not far from its all-time high.

Valuation-wise, the stock is undoubtedly priced for performance, with a 2025 price-to-earnings ratio of over 44. However, earnings are growing rapidly, and the forward P/E is expected to fall below 30 within two years. High-growth companies often carry premium valuations — a trend also seen with Fortnox, which consistently traded at high multiples but delivered strong returns year after year.

Atoss shares have returned an average of +39.9% annually over the past decade, with a total gain of over 1,300% between 2014 and 2024 — and an additional ~11% already added in 2025. Meanwhile, total dividend payouts have surged by 868% over the past 10 years, not even including the special dividends.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.