Three massive dividend cuts in the USA

ManpowerGroup and Wendy's shock investors with big cuts in 2025

Last week, Wendy’s, Manpower, and Cable One surprised markets by announcing unexpected dividend cuts. In this edition, we examine what prompted these decisions and what they might signal for income-focused investors.

Wendy’s (WEN)

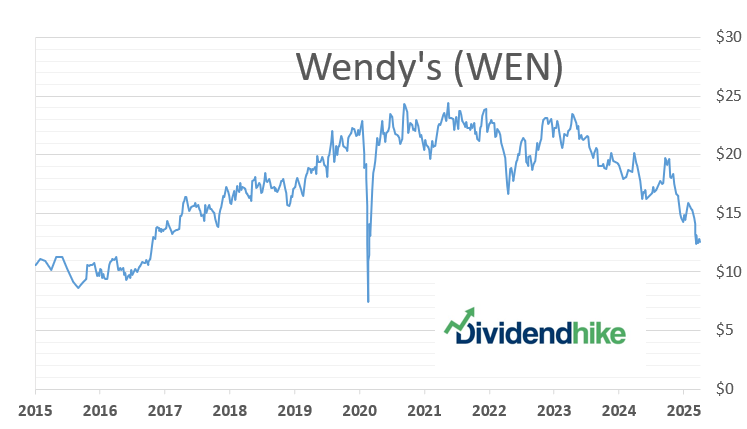

A rather unexpected 44% dividend cut came from quick-service restaurants operator Wendy’s Company WEN 0.00%↑. The company, operating more than 7,000 restaurants worldwide (company owned and through its franchisees), was known for its big annual dividend hikes AND buybacks in the last couple of years. However Wendy’s previously cut its dividend by 41.7% in 2020 during the covid-pandemic before raising it by triple digits to a record high 25 cents quarterly in 2024.

The new dividend of 14 cents quarterly yields 4.4% at a stock price of $12.56. Wendy’s stock price has declined in each of the last three years and is down a further 23% in 2025 touching new multi year lows.

With a p/e of 13 and growing revenues in the last couple of years things don’t look to bad for Wendy’s. The problem for Wendy’s however is that the current net debt ($2.8 billion at year end) is bigger than the company’s market cap ($2.4 billion). With the dividend cut the company saves almost $100 million annually.

Last week Wendy’s cut its 2025 outlook, expecting flat or slightly lower sales and reduced earnings, after weaker U.S. sales and lower revenue in Q1.

ManpowerGroup (MAN)

A shocking 53.2% dividend cut was announced by ManpowerGroup MAN 0.00%↑ last Friday. The employment services provider had already warned for weaker than expected earnings and a lower outlook for FY 2025 recently. The dividend cut was clearly not expected by investors since Manpower was known for its progressive payments combined with massive buybacks in the last couple of years.

Manpower had raised the dividend 15 consecutive years with a 4.8% hike announced in 2024. In the last decade the company repurchased no less than 40% of its shares outstanding. The stock performance has been disappointing with losses in the last three years and a 25% loss YTD. The new 72 cent semi-annual dividend yields 3.5% at a stock price of $41.

Manpower reported declining revenues in the last three years and analysts expect a 4% additional decline in 2025 to $17.1 billion. In 2021 the company’s sales peaked at $20.7 billion.

With a healthy balance sheet (net debt of $443 billion at the end of FY 2024), a dividend cut was not necessary. Most analysts remain positive with 1 strong buy, 2 buys, 9 holds and just 1 sell rating for ManpowerGroup.

Cable One (CABO)

Cable One CABO 0.00%↑ will suspend its quarterly dividend payment. The broadband communications provider previously raised its dividend 7 consecutive years with dividend growth slowing every year since the first hike of 16.7% in 2017.

The last dividend hike in 2023 was the smallest on record with 3.6%. CABO did not raise its dividend in 2024.

“After careful consideration and extensive review of its capital allocation strategy, the Company has decided to suspend the quarterly cash dividend paid on common shares. This change represents approximately $67 million annually and over $200 million over the next three years that the Company will be able to allocate to accelerated debt repayment, refinancing support and ongoing investment in organic growth initiatives.” (source: Cable One)

CABO stock is down 51% year-to-date and dropped by double digit in the previous four years (!). Revenue declined in 2023 and 2024 and is expected to drop by another 3.5% in 2025.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.