Broadcom Stock Analysis: Riding the Wave of AI and Dividend Growth

Dividend Hero keeps impressing with market value surpassing $1 trillion

Dividend Hero Broadcom (AVGO) has been making headlines recently, with its stock crossing the $1 trillion market cap milestone. Known for its strong track record, Broadcom has long been a favorite among investors, but its recent surge raises a critical question: Is it still a good buy, or is it too risky at these levels? Let’s unpack the latest developments and what they mean for the future of this tech giant.

A Record-Setting Year

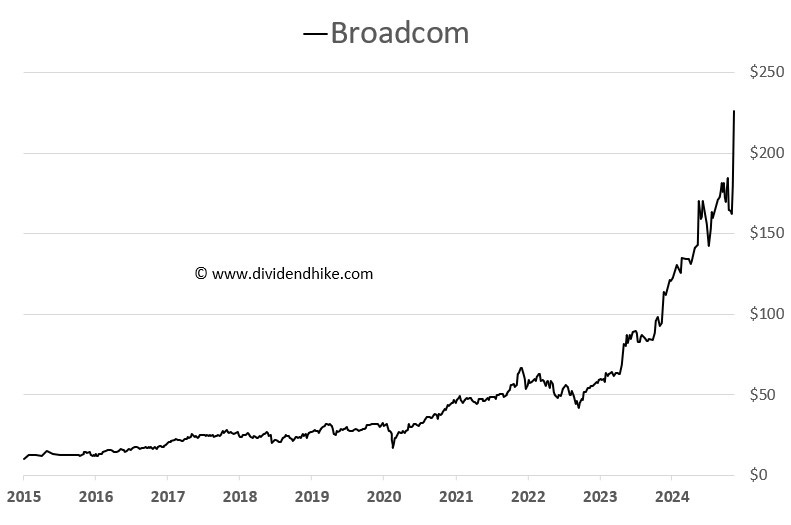

Broadcom’s stock has soared over 101% year-to-date (YTD), driven by a combination of robust earnings and a growing role in the AI semiconductor market. In its latest earnings report, Broadcom announced an 11% dividend hike, contributing to a stock price surge of 24.4% in just a few days. The company’s market cap now sits at a staggering $1.05 trillion, with an annual dividend payout of $11 billion supported by strong free cash flow.

Despite slightly missing revenue estimates, Broadcom beat earnings per share (EPS) expectations by 2.9%. So, what’s fueling investor enthusiasm? The answer lies in the company’s AI semiconductor business, a growing segment that promises significant long-term revenue opportunities. Additionally, Broadcom extended its streak of double-digit dividend hikes, continuing a pattern established since it began paying dividends in 2010.

Dividend Growth: A Standout Story

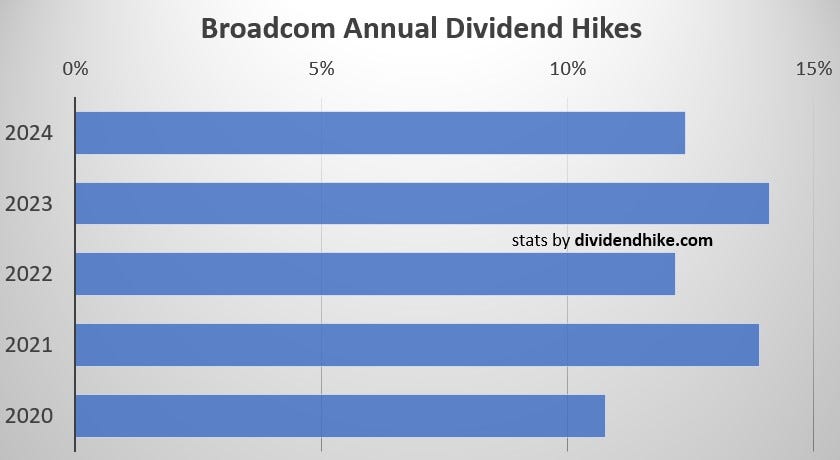

Broadcom’s consistent dividend growth is one of its most attractive features. Over the past decade, the company has increased its dividend by an astounding 1,585%, with a 10-year annual growth rate of 32.6%. Even with the stock’s meteoric rise, Broadcom’s dividend yield remains over 1%, making it a compelling option for dividend growth investors.

Broadcom’s free cash flow—a key driver of its dividend hikes—has been impressive. The company generated $19.4 billion in free cash flow in 2024, a figure expected to rise to $28.5 billion in 2025. By 2027, analysts project free cash flow per share to exceed $9.00, leaving plenty of room for continued dividend growth, debt reduction, and other shareholder rewards.

The AI Boom and Semiconductor Growth

AI is the cornerstone of Broadcom’s recent success. The company forecasts that by 2027, its AI semiconductor market could reach a value of $60 billion to $90 billion in annual revenue. Broadcom has positioned itself as a critical supplier for major tech companies seeking alternatives to Nvidia’s expensive and supply-constrained AI processors and could grab more than 50% of that market. Some analysts even forecast a 70% share exceeding $50 billion in AI-related revenue within a few years for Broadcom.

In fiscal 2024, Broadcom captured more than $12 billion of the total serviceable AI market, which is estimated at $15 billion to $20 billion. CEO Hock Tan revealed that Broadcom has secured two major hyperscaler customers and is actively negotiating an AI chip deal with Apple. These developments have fueled optimism and contributed to Broadcom’s 100%+ stock price growth this year.

Risks and Challenges

While Broadcom’s growth story is compelling, there are reasons for caution:

High Valuation: With a price-to-earnings (P/E) ratio of 36, Broadcom is trading at a premium compared to Nvidia’s 31 and approaching Marvell Technology’s 41.

Debt Levels: Broadcom’s acquisition strategy has led to significant debt. Following the VMware acquisition, the company’s net debt rose to over $60 billion, though this is expected to decline to $43.8 billion in 2025 thanks to robust cash flow.

These factors mean that while Broadcom’s outlook is strong, its stock price could face pressure if growth slows or market conditions deteriorate.

Acquisition Strategy: A Double-Edged Sword

Broadcom’s strategy of using cash flow for acquisitions has fueled revenue growth but also introduced risks. Historically, the company has cycled between taking on debt for acquisitions and paying it down. This approach has worked well so far, but the high debt levels mean that any slowdown in cash flow could become problematic.

Analyst Sentiment and Future Prospects

Analysts remain overwhelmingly bullish on Broadcom, with 10 “strong buy” ratings, 27 “buy” ratings, and 4 “hold” ratings. Several analysts raised their price targets following Broadcom’s earnings report, with JPMorgan increasing its target from $210 to $250 and Bank of America moving from $215 to $250.

Broadcom’s diversified business model, which spans semiconductors, software, and infrastructure, positions it well for long-term growth. While the current valuation is steep, the company’s strong dividend track record and promising AI revenue outlook provide a compelling case for continued investment.

Final Thoughts: Balancing Opportunity and Risk

Broadcom’s combination of AI-driven growth and consistent dividend hikes makes it an attractive option for many investors. However, its high valuation and debt levels underscore the importance of diversification. While Broadcom’s stock price could climb further on the back of its AI story, it’s crucial to maintain a balanced portfolio to mitigate risks.

With 10%+ dividend hikes likely over the next few years and a solid AI growth strategy, Broadcom remains a strong pick for long-term investors—but only as part of a well-diversified portfolio. As always, invest wisely and keep an eye on the broader market trends.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.