Buying the dips: 5 supercharged dividend growers that crashed

Double digit dividend growers down more than 15% recently

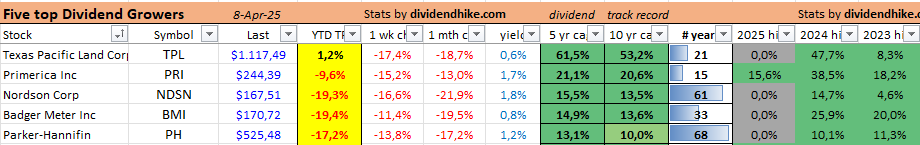

For this post, we are using the dividend hike database to search for the best dividend growth stocks that were hit hard by the Trump tariffs. We select stocks that are down by 15% or more over the past week/month, yet consistently deliver double-digit dividend hikes. Even better: these stocks have often already announced a double-digit dividend increase for the first quarter of 2025.

Now that stock prices are under pressure, even the best dividend growers are being heavily punished on the stock market, which creates exciting opportunities for long-term investors who focus on quality stocks with a strong dividend track record. Of course, stock prices could go even lower in the coming period, but you can either wait for that to happen or gradually take advantage of the sharp price declines. After all, top stocks are currently available at prices well below their all-time highs from just a few months ago.

We are selecting five stocks from the United States that:

Have dropped significantly in recent weeks,

Have increased their dividend for at least 15 consecutive years,

Increase their dividend by an average of more than 10% per year, and

Preferably have already announced their dividend increase for 2025.

The latter is not a strict requirement, but for those stocks that have not yet announced a hike for 2025, we expect a double-digit increase.

The selection is very broad at the moment, which is always the case during a selloff that also drags down the more expensive, better dividend growers. Alle of our five stocks are Dividend Heroes, which makes sense, as they are by definition the very best dividend growth stocks available!

The five stocks below all have strong dividend growth stats, led by Parker Hannifin PH 0.00%↑ with now 68 consecutive years of dividend increases. Nordson NDSN 0.00%↑ has raised the dividend 61 consecutive years.

All stocks below are Dividend Heroes for 2025, including Badger Meter BMI 0.00%↑, Texas Pacific Land TPL 0.00%↑ and Primerica PRI 0.00%↑ . Primerica is actually the #1 ranked dividend hero for 2025, based on dividend growth, buybacks, yield and other metrics.

Please note that Texas Pacific Land, Primerica, and Parker Hannifin are also part of the Dividend Hike Portfolio. All of the stocks listed above have experienced a decline of double digits, with Primerica already announcing a 15.6% dividend increase this year.

Despite the current tariff situation and the uncertainty surrounding the stock market, we anticipate strong dividend hikes for all the stocks mentioned above in 2025.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.