The five best dividend growth stocks from Canada

Five overlooked Canadian stocks with double digit increases and strong prospects

Forget Constellation Software (sorry, guys) and skip Couche-Tard for once — we're going off the beaten path.

This article isn’t about the usual names you see in every dividend portfolio. We’re shining the spotlight on five Canadian companies that not only pay dividends, but grow them year after year, often with less noise and more discipline.

🔑 Key Points

These five Canadian stocks offer consistent dividend growth, yet rarely make it onto mainstream lists.

No Constellation Software or Couche-Tard here — just under-the-radar performers with solid fundamentals.

Companies include: Jamieson Wellness, Intact Financial, CCL Industries and two other dividend growth beauties from Canada.

All five have global exposure, disciplined capital allocation, and a track record of annual dividend increases.

Canada has some solid dividend stocks, but when it comes to track records, it still trails the United States — which has over 100 Dividend Aristocrats. Canada, by comparison, has only 11, and most have been disappointing in terms of dividend growth for years. Top ‘Aristocrats’ Fortis and Canadian Utilities hiked their dividends by less than five percent in the last 3 years with utility Fortis now doing 1% hikes for five consecutive years. We love the track record but don’t like the dismal dividend growth.

So, what’s next? We decided to look beyond the usual suspects. Our real interest lies in:

⭐ Future Aristocrats (and the rare Double Digit growing Aristocrat)

Companies with 10, 15, or 20 years of dividend hikes, AND

Stocks with shorter records but strong potential to join the elite ranks.

🔍 How did we research this?

We combined two powerful approaches:

Our Dividend Heroes selection method

(Usually applied to Japan, Europe & the US — now exploring Canada!)A financial health & growth screen based on key metrics:

ROIC (Return on Invested Capital)

EBIT margin

Revenue growth

Net debt / EBITDA

Free cash flow yield

Dividend payout ratio

Projected revenue and dividend growth

🎯 The result?

We uncovered five standout Canadian dividend growers — some relatively small and still flying under the radar of most investors.

If you want to discover Canadian dividend stocks with genuine growth potential, these five deserve your attention. Here are our five under-the-radar dividend growers — real businesses, steady performance, and global relevance.

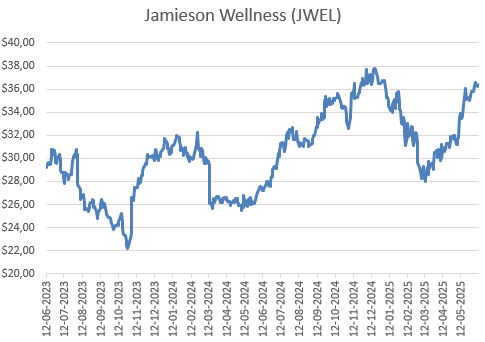

🟢 Jamieson Wellness (TSX: JWEL)

A legacy Canadian brand in vitamins and nutritional supplements, Jamieson Wellness is now a multi-brand wellness company with a global footprint. Think of it as Canada’s answer to the health supplement boom. With brands like Youtheory and Iron Vegan, they’re doubling down on premium wellness and international expansion. Its brands are available in more than 50 countries globally.

Management is committed to scaling the business and maintaining a steady dividend. They deliver on this with the dividend growing by double digits every single year……

We only discovered this stock in 2024, but we like it with double digit dividend growth since 2018: In 2024 they hiked by 10.5% to $0.21 quarterly

The dividend yield is 2.3%: not bad for a double digit dividend grower

The forward p/e is 19 for 2025

A 15%+ ebit-margin and growing free cash flow

Jamieson is expected to be debt free by the end of 2025!

Revenues expected to grow in the high single digits/double digits through 2027

Analysts seem to love the stock with 7 buy ratings, no sells and no ‘hold’ ratings.

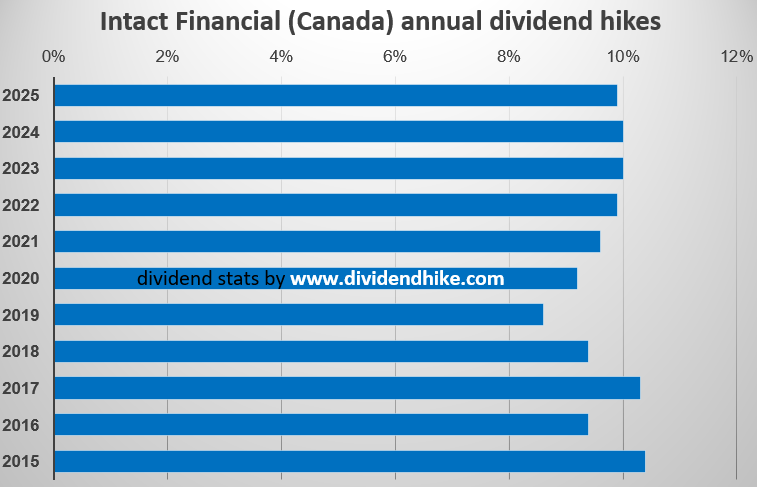

🟢 Intact Financial (TSX: IFC)

Canada’s largest property & casualty insurer Intact Financial has growing business in the UK, Ireland, and U.S. Intact combines old-school underwriting discipline with forward-thinking tech and AI integration. They’ve raised the dividend every year since going public in 2009 and target 10% annual growth in operating income per share. The combined ratio for Intact was 92.2% in 2024 and analysts expect a 91% ratio for 2025. This is a key metric for insurers that measures the profitability of underwriting by comparing claims and expenses to earned premiums. A ratio below 100% indicates an underwriting profit, while a ratio above 100% signals a loss.

Not a name everyone knows, but we know the company’s dividend history and its good!

21 consecutive years of increases

Super steady annual increases of about 10%: the 2025 dividend is up 9.9%

Smallest dividend hike in the last 15 years was 8.8%, the biggest 10.4%

Guess what: we expect dividend growth of 10% in the next couple of years also

The current yield is 1.7% and Intact Financial has a forward p/e of 18.

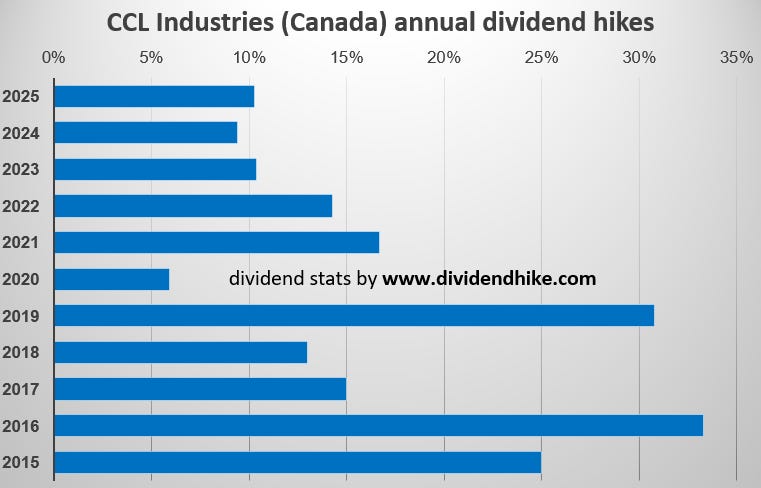

🟢 CCL Industries (TSX: CCL.B)

The world’s largest specialty packaging company CCL Industries has operations in 42 countries and clients across health care, personal care, security, and food.

Known for smart, bolt-on acquisitions and steady global expansion, CCL delivers consistent free cash flow and dividend growth, even in a cyclical industry.

CCL Industries has now raised the dividend 24 consecutive years

Forward p/e of 17 for 2025 with a 1.6% yield

A strong ebit-margin of 15% and double digit ROIC

Revenue growth of 9% in 2024 to C$7.2 billion with a 2025 forecast of 4.9% growth

Solid balance sheet with strong cash to cut down its debt annually

A 10.3% dividend hike in 2025 and a 10 year CAGR of 15.9%

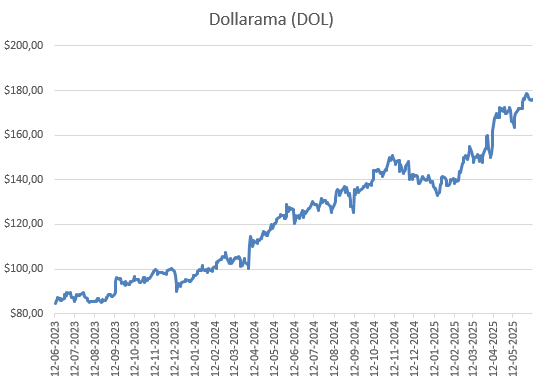

🟢 Dollarama (TSX: DOL)

Canada’s king of value retail, Dollarama runs over 1,600 stores and continues to grow at a disciplined pace. With operations extending into Latin America via Dollarcity and new plans for Mexico and Australia, it’s a quietly global story. The company keeps increasing its dividend while expanding profitably — a rare combo in retail.

This one ticks all the boxes and scores better than retail peers Couche-Tard, Metro, Lawson etc.

Dividend has been raised for 14 consecutive years

A 15% hike announced for 2025 with a 5 year CAGR of 19.4%

Strong annual revenue growth: +9.3% for FY 2025 (ending January) and 6 to 10% annual growth expected annually through 2029

With a forward p/e of 39 the valuation is high though…..

Great ROIC of 30%+ going forward and a super strong 25%+ ebit-margin

The dividend yield is only 0.24% but hey, this stock is flying so the double digit hikes are just not enough to keep up with the soaring stock price.

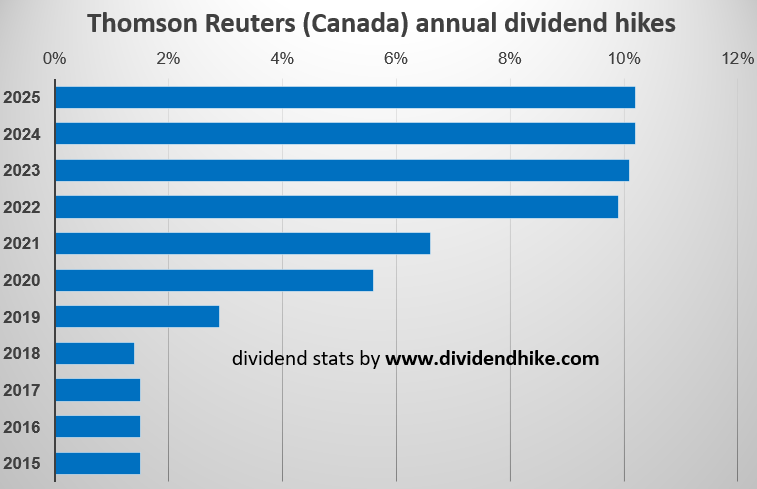

🟢 Thomson Reuters (TSX/NYSE: TRI)

An essential service provider for legal, tax, and media professionals, Thomson Reuters has transformed into a global software and data powerhouse. With acquisitions like Casetext and SurePrep, and over 80% of revenue now recurring, it’s a slow-moving compounding machine. Dividend increases have been regular, backed by strong margins and cash flows.

Super predictable because of recurring revenues

Best track record with now 32 consecutive years of increased dividends

A 10.2% dividend hike just announced for 2025, in line with the previous years and dividend growth picking up since 2019/2020

A forward p/e of 50; high, we know, but eps will continue to grow by double digits

Expect revenue growth of 8% in the next couple of years

A 1.3% dividend yield

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

CCL.B and DOL in my portfolio! Great write-up.