Curtiss-Wright: From the Dawn of Flight to Nuclear-Powered Defense

Why we added CW to our dividend portfolio

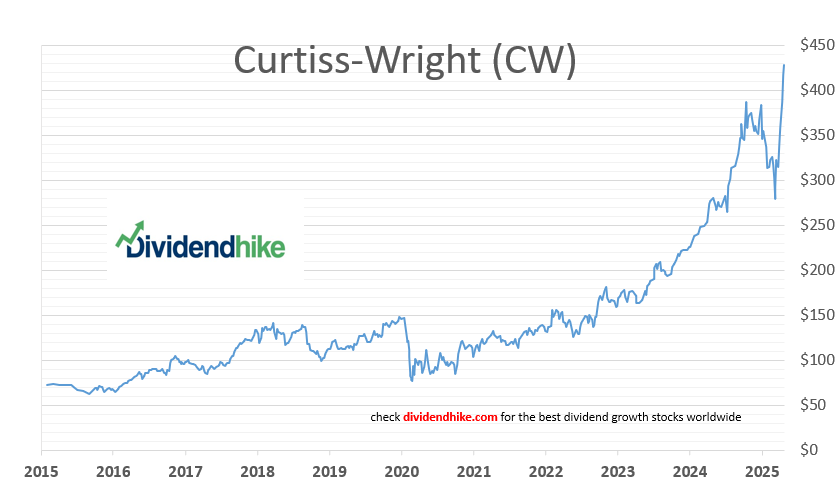

Curtiss-Wright CW 0.00%↑ isn’t just another defense stock—it’s where the story of powered flight began. From courtroom battles between the Wright brothers and Glenn Curtiss to nuclear-powered submarines, this company has been quietly compounding for nearly a century. We just added it to our dividend portfolio—and with a payout ratio under 8% and free cash flow set to double in the next couple of year, we believe the current dividend is only getting started.

The company was founded on July 5, 1929, through the merger of twelve aviation businesses, the most prominent being the Curtiss Aeroplane and Motor Company and Wright Aeronautical Corporation. This historic union brought together the legacies of two of the most important names in aviation: Glenn Curtiss, inventor of the first practical seaplane and an early pioneer of military aviation, and the Wright brothers, Orville and Wilbur, who flew the first powered aircraft and patented essential flight control systems.

In the early 20th century, Curtiss and the Wrights were fierce rivals—locked in legal battles over flight patents and technological dominance. Their rivalry shaped the development of aviation in the United States. But with the onset of World War I, the U.S. government intervened, pushing both parties to settle their disputes in the national interest. A decade later, the two giants were formally united under the Curtiss-Wright banner—creating what was, at the time, the largest aircraft manufacturer in America.

During World War II, Curtiss-Wright cemented its place in military history, becoming one of the country’s top producers of military aircraft and engines. Its contributions included the iconic P-40 Warhawk, flown by the Flying Tigers, and the rugged C-46 Commando transport aircraft, which played a vital role in supply missions over the Himalayas ("The Hump") into China.

A Modern Defense Powerhouse

Fast forward nearly a century, and Curtiss-Wright has reinvented itself as a high-performance industrial and defense technology company. Its operations now span three critical sectors:

Aerospace & Industrial: Think turbines, compressors, and hydraulic systems—vital components for both commercial and military aircraft.

Defense Electronics: Supplying radar systems, mission computers, and flight data systems for advanced defense applications.

Naval & Power: A quiet but crucial leader in providing pumps, motors, and generators used in the nuclear propulsion systems of submarines and aircraft carriers. The same technology is also leveraged in commercial nuclear power.

This isn’t just a legacy player coasting on its history. Curtiss-Wright is executing—and growing.

Fundamentals & Financials

73% of revenue comes from the U.S., with Naval & Power contributing the largest share at 41%.

Top-line growth has been steady: 8–10% annually, with each division delivering at least 5% year-over-year growth.

The company is actively consolidating: three acquisitions in 2024, and three more back in 2022.

Forward P/E for 2025 sits at 33—not cheap, but reflective of a high-quality, high-moat business.

Capital Allocation: Smart and Shareholder-Friendly

Curtiss-Wright has a progressive dividend policy, and while the yield may not be headline-grabbing, it’s consistent—and increasingly powerful when viewed in the context of the company’s earnings and cash flow trajectory.

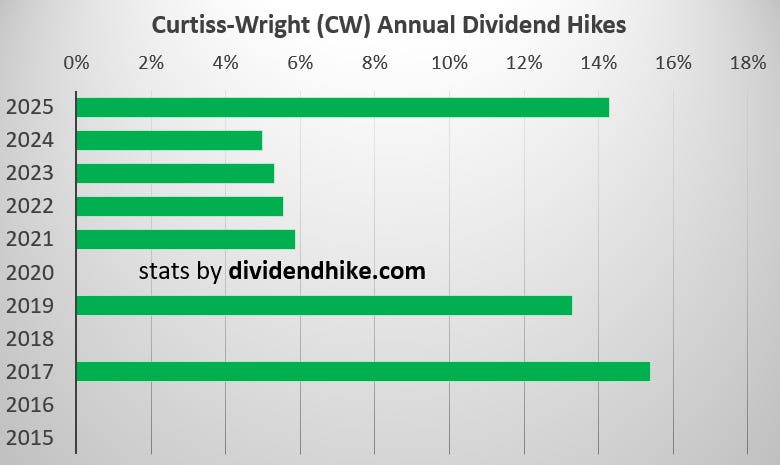

In 2025, the company (just recently) increased its dividend by a strong 14%, to $0.83 per share annually.

Over the last five years, the dividend has grown at an average rate of 4.3%, with the previous double-digit hike occurring in 2019 (+13%).

Despite this growth, the payout ratio remains extremely low. In 2024, EPS was $10.55, which means the current dividend represents a payout ratio of just under 8%—leaving ample room for future increases.

The dividend has now been raised for 9 consecutive years (if we add annual payments YOY)

On top of that, Curtiss-Wright has been buying back shares consistently: about 20% over the last decade.

Looking ahead, the financial flexibility only gets better. The company is on track to become debt-free within a few years, and free cash flow per share is expected to reach $20 by 2028. That’s more than 20 times the current dividend—a clear signal that today’s modest sub-$1 dividend has tremendous room to grow.

Analyst Coverage & Sentiment

Investor sentiment is steadily positive. Currently, nine analysts cover Curtiss-Wright:

4 Strong Buy

2 Buy

3 Hold

0 Sell

The absence of sell recommendations speaks volumes about the company’s positioning, performance, and outlook.

Why It Matters

Curtiss-Wright is a rare industrial compounder. It combines deep defense exposure, high engineering complexity, and long-term contracts—especially in nuclear propulsion, which has enormous barriers to entry. This is not a flashy growth tech stock, but it offers something just as valuable: a quietly compounding business with a century of staying power.

From propellers to nuclear submarines, Curtiss-Wright has consistently found ways to stay relevant—and profitable.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.