Uncovering one of Sweden's many Hidden Dividend Gems

A Lesser-Known Investment Opportunity | Debt-Free with Accelerating Dividend Growth

This new Focus Stock also hails from Europe; it’s a Swedish online retailer that has just announced the largest dividend increase in its history. Moreover, it’s a company with a debt-free balance sheet that experiences double-digit revenue growth annually.

The great thing about Sweden is that the Nordic country is home to many great dividend growth stocks, including this one!

👉 Some quick stats:

Market cap: $500 million (SEK 5.2 billion)

Dividend yield: 2.6%

Dividends paid since: 2021

2024 dividend hike: +39.5%

Estimated p/e (2024): 15

Now let’s dive into this fast growing company from Sweden!

Hi there paid subscriber, the company we are talking about is RVRC Holding AB from Sweden, the company behind the online outdoor brand RevolutionRace.

RVRC conducts online sales of outdoor and leisure clothing as well as associated products and related activities. RevolutionRace offers multifunctional products including clothing, shoes, backpacks and accessories for people (and their pets) with an active lifestyle. The Company offers its multi-functional clothing under its own RevolutionRace brand and targets a global and broad customer base that lives an active life mainly in the age category between 18 and 70 years.

MUST READ: Dividend Heroes update: +18.6% YTD

RevolutionRace conducts its business within the framework of a digital D2C2 business model, which means that the sale takes place exclusively online and is aimed directly at consumers. The company reaches out to customers in more than 35 countries via its online stores.

COMPANY HISTORY

RevolutionRace was founded in 2014 by Pernilla and Niclas Nyrensten, driven by their passion for outdoor adventures and nature. The brand emerged from a desire to offer high-quality, functional, and affordable outdoor gear for adventurers worldwide.

Starting with a focus on practical and durable products, RevolutionRace quickly gained a reputation for its innovative designs and commitment to performance. The company initially thrived through direct-to-consumer sales, enabling them to provide exceptional value while maintaining quality.

Today, RevolutionRace is established in over 30 countries and continues to grow, having sold more than one million pairs of pants globally. With 642,684 genuine reviews on our webshop, we are getting closer every day to our goal of becoming one of the most recommended outdoor companies in the world. We've outgrown our garage and moved to an office spacious enough to keep all our employees happy. Yet, some things remain the same. Most of our pants are still sewn by the same factory in Vietnam, where we have become one of their largest clients and good friends with the owner.

As the brand expanded, so did its product line, which now includes a diverse range of outdoor clothing and gear for activities such as hiking, skiing, and climbing. Our dedication to sustainability and functionality continues to resonate with outdoor enthusiasts, fostering a loyal customer base and supporting our global expansion.

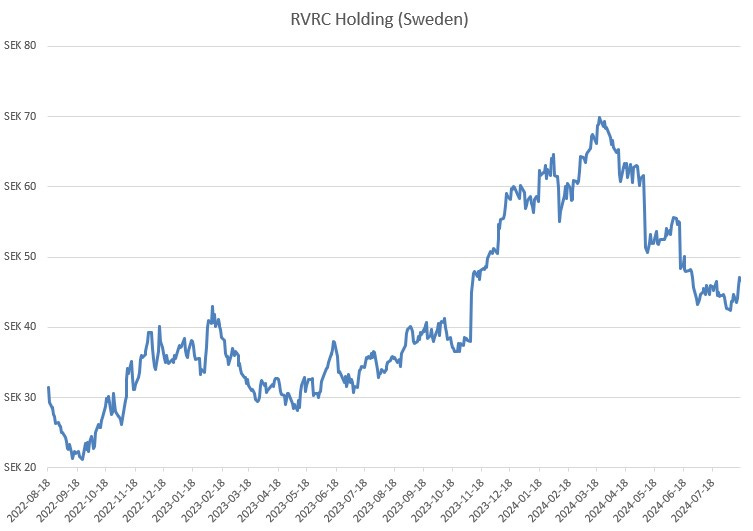

The company became publicly listed in June 2021 with the RVRC Holding AB stock trading briefly above SEK 100. After a dip in 2023 to a low of SEK 20 the stock rebounded to current levels of SEK 46.66 SEK as of August 15, 2024.

BUSINESS MODEL

The RVRC business model is really pretty simple. The company only sells its outdoor clothes online, directly to our customers. By cutting out agents and retailers from the mix, RVRC can get new products to market faster. While other brands typically need a year for new product development, it only takes RVRC six months. A faster, slimmer process without middlemen means that RVRC can offer high-quality clothes with a reasonable price tag.

Many other brands refresh their entire range each year, resulting in significant losses on unsold stock. In contrast, RVRC keeps most of its models year-round and continuously adjusts and improves designs based on customer feedback. By selling each garment through its collection before discontinuing it, RVRC reduces waste. The products are timeless and do not become obsolete with changing seasons.

RVRC just announced that it is increasing the pace in product development by expanding the company’s product team. This autumn RVRC will again have a whole range of new products. In the shell category, three new series will be available in different price categories. RVRC also continues to introduce new outdoor garments designed for more active training. Additionally, RVRC is expanding its successful alpine collection from last year with a variety of new colors, and will further develop the shoe category with more products

RVRC’s engaged online community plays a crucial role in product development. By sharing honest reviews and commenting on social media, customers influence decisions on new colors and upgrades. Together, RVRC and its community enhance products to ensure an exceptional outdoor experience for all. For RVRC this all results in above average profit margins with a 20%+ EBIT-margin reported in the last couple of years.

STRONG (DIVIDEND) GROWTH

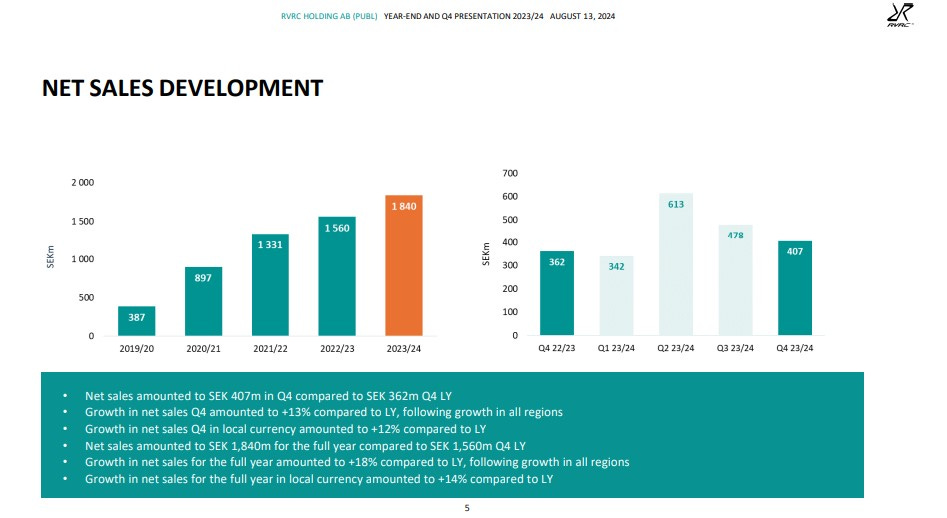

In the most recent financial year, the company demonstrated continued growth and profitability. During the fourth quarter (April 1 – June 30), net sales rose by 13% to SEK 407 million, with gross profit increasing to SEK 293 million. The gross margin for this period was 71.9%, slightly down from 74.5% the previous year. EBIT grew by 9% to SEK 74 million, resulting in an EBIT margin of 18.3%. Earnings per share (EPS) before dilution increased to SEK 0.54 and after dilution to SEK 0.53.

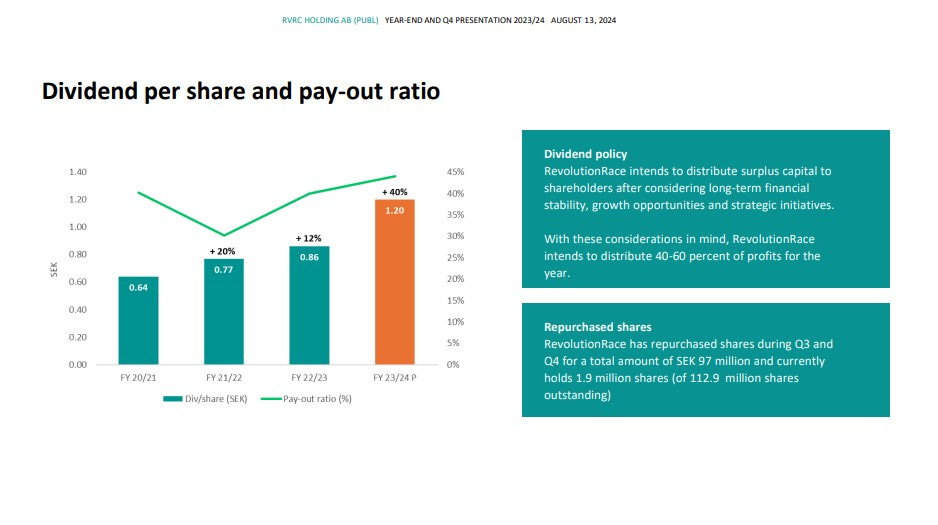

For the full year (July 1 – June 30), net sales saw an 18% increase, reaching SEK 1,840 million. Gross profit grew to SEK 1,312 million, with a gross margin of 71.3%. EBIT surged by 24% to SEK 386 million, with an EBIT margin of 20.9%. Adjusted EBIT also rose by 21% to SEK 389 million, achieving an adjusted EBIT margin of 21.1%. EPS before dilution reached SEK 2.73, and after dilution, SEK 2.72. The Board has proposed a dividend increase to SEK 1.20 per share, up from SEK 0.86.

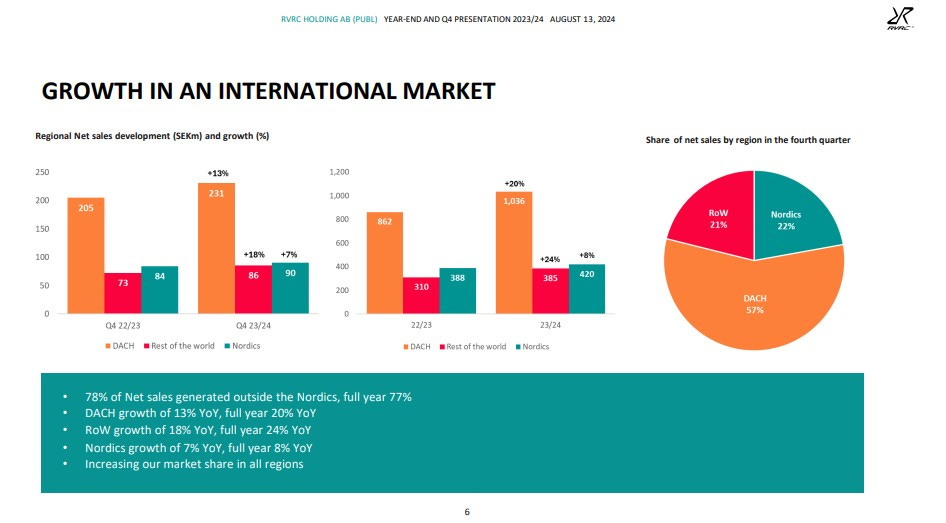

RVRC had 78% of its sales FY 2024 sales generated outside the Nordics with the DACH region (Germany, Austria and Switzerland) being the most important market with a 57% share.

RVRC has grown its revenue by double digits every year since the IPO with a 17.95% growth reported for FY 2024 (June). Analysts expect a 14% revenue growth for RVRC for the current fiscal 2025 year (ending June next year).

Earlier this year, the company announced new long-term financial goals. These new targets mean that over the next three years, RevolutionRace aims for sustainable and profitable growth with an annual growth target of 20 percent, while maintaining an industry-leading annual adjusted EBIT margin of 20 percent.

FINANCIAL POSITION AND DIVIDEND

This year’s results also reflect strong cash flow, with a net cash position of SEK 282 million, up from SEK 139 million, and an unused credit facility of SEK 600 million. In light of the company’s ongoing growth and robust cash flow, the Board proposes a dividend of SEK 1.20 per share, up from SEK 0.86, in line with the company's dividend policy.

Additionally, a share buyback program was initiated in the third quarter to adjust the capital structure. In the fourth quarter, 1,565,511 shares were repurchased at a cost of SEK 80 million. Over the recently concluded fiscal year, SEK 195 million was distributed to shareholders—SEK 97 million through the dividend for 2022/23 and SEK 97 million through share buybacks.

RVRC ANNUAL DIVIDEND GROWTH

2024: +39.5% to SEK 1.20 per share

2023: +11.7% to SEK 0.86 per share

2022: +20.3% to SEK 0.77 per share

2021: SEK 0.64 per share dividend initiated

The current dividend yield for RVRC is 2.6% at a stock price of SEK 46.66. The ex-dividend date is November 20, 2024.

Despite strong growth figures, RVRC's stock price has lagged significantly in recent years, largely due to the poor sentiment surrounding the entire sector. Consumers are spending less, costs are rising, and so on. Nonetheless, the current stock price appears to be excessively low for RVRC, which is down 22.5% in 2024. With an estimated P/E ratio of 15.5 for 2025, the valuation is not excessively high, especially for a debt-free company that continues to grow at double digits annually and maintain high margins. However, it is primarily economic uncertainty that seems to be holding back the stock price, similar to what is observed with companies like Nike and VF Corporation in the United States.

Key Financial Metrics for RVRC Holding

Forward P/E for 2024/2025: 15,5

Return on Invested Capital (ROIC): 30.1% for 2023/2024, expected to jump to 41.6% in 2024/2025

EBIT Margin: 21.0% (2024 fiscal year)

Revenue Growth: 17.95% to SEK 1.84 billion (FY 2024)

Debt-Free: RVRC ended FY 2024 with a net cash position of SEK 246 million

Dividend growth: 39.5% hike just announced, third consecutive year with double digit increases.

Dividend yield: 2.6% at a stock price of SEK 46.66. The dividend is expected to grow further the next couple of years together with the company’s earnings.

Finally, there are very few analysts covering the stock, partly due to RVRC's relatively small market capitalization. Currently, three analysts follow the stock, with one rating it as a strong buy, one as a buy, and one as a hold. Given the volatile stock performance in recent years, investing in RVRC seems suitable only for investors willing to take on more risk.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.