One of Germany's best dividend (and AI) stocks

Software company with 15 years of increased dividends

SAP, based in Walldorf, Germany, is a global leader in enterprise software solutions. As one of the largest technology companies in the world with a market cap of €241 billion, SAP plays a crucial role in helping businesses streamline their processes, manage data effectively, and implement innovative solutions.

This post, available for all free subscribers to dividendhike.substack.com (thank you all!), delves into what SAP does, who their competitors are, how they are handling artificial intelligence (AI), and what threats they might face.

What Does SAP Do?

SAP offers a wide range of software products and services that help businesses improve their operations. At the core of their offerings is SAP S/4HANA, an enterprise resource planning (ERP) suite that assists companies in managing their finances, logistics, human resources, and other business processes. Additionally, SAP provides solutions for customer relationship management (CRM), supply chain management, and business intelligence.

SAP also has a strong presence in the cloud with SAP Cloud Platform, enabling businesses to develop and integrate their applications. This platform supports companies in their digital transformation by providing flexible and scalable solutions.

Competitors of SAP

SAP operates in a highly competitive market and faces competition from several major players. Some of the key competitors are:

Oracle: Oracle offers a wide range of enterprise software solutions, including ERP, CRM, and supply chain management. Oracle's strong cloud offerings directly compete with SAP's cloud solutions.

Microsoft: With Microsoft Dynamics, Microsoft provides powerful ERP and CRM solutions that rival SAP's offerings. Additionally, Microsoft’s robust cloud platform, Azure, helps businesses accelerate their digital transformation.

Salesforce: Salesforce is particularly strong in CRM solutions and has built a strong position with its cloud-based products. Their platform is widely used by companies looking to enhance their sales, service, and marketing processes.

Workday: Workday is a significant player in the HR and financial software market, offering cloud-based solutions that compete with SAP's offerings.

SAP and Artificial Intelligence

SAP has embraced AI as an integral part of their strategy to transform business processes. Their AI offering, known as SAP Leonardo, integrates AI, machine learning, Internet of Things (IoT), and blockchain into their enterprise software. This helps businesses work smarter through automated processes and enhanced data analytics.

SAP uses AI to provide predictive analytics, enabling companies to make better-informed decisions. For example, in supply chain management, AI models can improve demand forecasting, leading to more efficient inventory management and reduced waste.

Additionally, SAP invests in AI-driven chatbots and digital assistants to improve customer service and personalize user experiences. These tools help businesses serve their customers better and streamline internal processes.

Dividend Performance

SAP has been consistently raising its dividend for 14 consecutive years and has not cut it for decades. Over the last decade, the average dividend growth rate has been 8.3% per year. In 2024, the dividend increased by 7.3% to a new record of €2.20 per share. At a share price of €197, SAP’s dividend yield stands at 1.2%.

Based on track record SAP is one of the best dividend stocks in Germany with only two stocks with more consecutive years of increases. Another great dividend grower is reinsurer Munich Re.

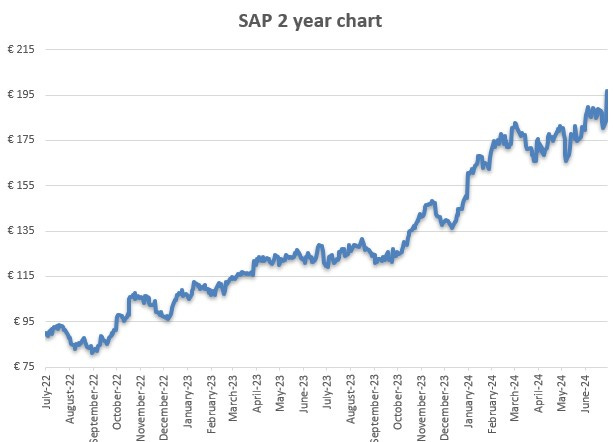

Recent Performance and All-Time High

Today, on July 23, 2024, SAP's stock reached an all-time high following the release of strong financial results. SAP, Europe's largest software maker, reported better-than-expected quarterly operating income, driven by revenue growth and intensified cost-cutting efforts.

The German company, whose software is used for operations ranging from accounting to supply chain management, announced that second-quarter operating profit, adjusted for special items, jumped 33% to 1.94 billion euros ($2.1 billion), surpassing the median analyst estimate of 1.81 billion euros.

SAP also expanded its restructuring efforts, stating that about 9,000 to 10,000 positions would be affected, up from the 8,000 announced in January. Most affected employees would be retrained with AI skills or offered voluntary buy-out packages.

"We continue to invest in our transformation to be the leader in Business AI. Given our progress and strong pipeline, we are confident in achieving accelerating topline growth through 2027," said CEO Christian Klein in a statement.

The company's total quarterly revenue rose 10% to 8.29 billion euros, slightly ahead of analysts' consensus of 8.25 billion euros, driven by demand for its business planning software. Cloud revenue of 4.15 billion euros matched analyst expectations.

SAP also increased its 2025 adjusted operating profit forecast to 10.2 billion euros from 10 billion euros, reflecting anticipated efficiency gains from its transformation program.

Key Financial Metrics for SAP

Forward P/E for 2024: 44

Return on Invested Capital (ROIC): 10% in 2023, expected to jump to 16.7% in 2024

EBIT Margin: Over 20%

Revenue Growth: 1.1% in 2023 to €31.2 billion, expected to grow almost 9% in 2024 to nearly €34 billion, with double-digit growth anticipated for 2025 and 2026

Debt-Free: SAP has a net cash position of €3.5 billion at the end of 2023

P/E Drop by 2026: The current P/E is expected to drop to 27 by 2026 based on analyst estimates, even with the stock at an all-time high

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.