Dividend Hike Portfolio Hits All-Time High with +9.7% Return in 2025

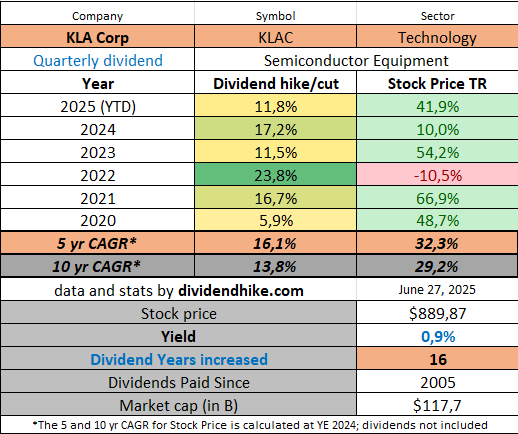

Amphenol and KLA Corp lead with +41%; Murphy USA lags, but 2025 remains strong for dividend growers

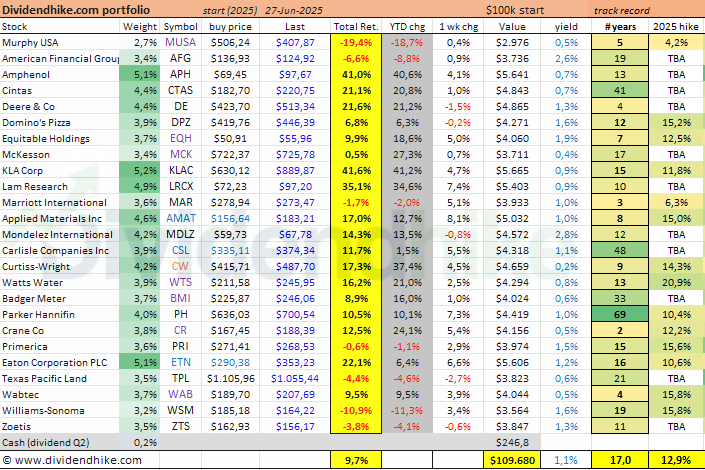

The Dividend Hike Portfolio was launched in 2025 and now, almost six months later, it has delivered a return of 9.7%. After a strong week, it reached an all-time high.

Key Points

+9.7% return YTD, outperforming the S&P 500 (+5%) and Dividend Aristocrats (+1.3%)

Amphenol and KLA Corp lead with +41% total return each

14 out of 25 stocks raised dividends in 2025, with an average hike of 12.9%

Average dividend yield: 1.1% | Average growth streak: 17 consecutive years

Top performers in 2025 are Amphenol and KLA Corp, both delivering a total return of 41%. The worst performer is Murphy USA, a stock we only bought on May 7, 2025. In hindsight, that was not a fortunate choice, and the recent drop has been further accelerated by developments in the oil price. That’s just bad luck—and it's important to look at the entire portfolio, which includes 25 stocks: the gems lift the average significantly. Two standouts are KLA, a semiconductor stock, and Amphenol, one of our Focus Stocks this year, a global leader in interconnect, sensor, and antenna solutions. KLA is also one of our Dividend Heroes.

The average return in 2025 now stands at 9.7%. That means we're outperforming all major U.S. indices by a wide margin, including the S&P 500 (+5%). And let’s not forget: the Dividend Aristocrats are having a particularly weak year with just +1.3% on average. Our own Dividend Heroes, while trailing the Dividend Hike Portfolio at +3.7%, are still doing much better than the Aristocrats—and that's the comparison that matters most to us.

Some additional stats: the average dividend yield of the Dividend Hike Portfolio is currently 1.1%, and the average dividend growth streak (consecutive years of increases) is exactly 17. So far in 2025, 14 of the 25 stocks have already raised their dividends, with an average increase of 12.9%. A few stocks even increase dividends multiple times per year, including Murphy USA—so the average is likely to rise further! Another positive note: every stock added to the portfolio in 2025 is currently showing at least a 10% gain—except for MUSA.

For our paying subscribers, the full portfolio with all details and dividend stats is available behind the paywall!

Below we display the full Dividend Hike Portfolio based on Friday’s closing prices. Please remember that you can track all stocks daily on the Dividend Portfolio Page.

We are very happy with the current 25 stocks and won’t be doing any changes for now. On June 30, 2025 we will reinvest all dividend received in the second quarter, currently $246.80 or 0.2% of the total portfolio.

If you have any questions please let us know in the comments below this article. Thank you and have a great weekend!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.