🔥 Dividend Hike Portfolio — Mid-July 2025 Update: Big Gains, Bigger Payouts

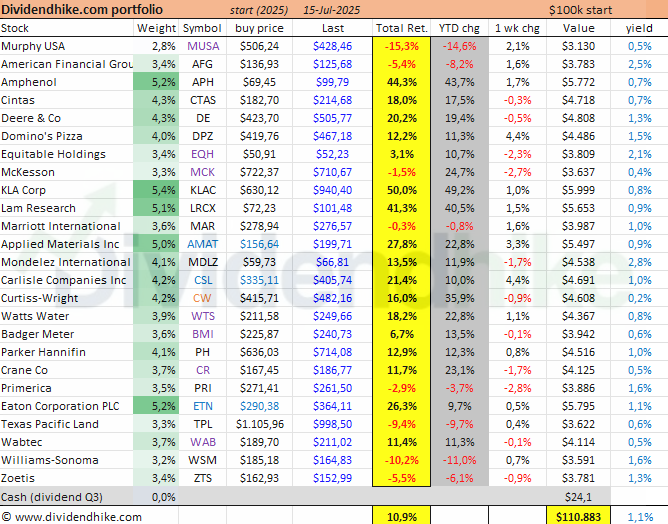

YTD Total Return: +10.9% with KLAC, APH and LRCX as biggest gainers

Initial Capital: $100,000 | Current Value: ~$110,900

The Dividend Hike Portfolio has hit a +10.9% total return as of July 15, 2025, continuing its strong run fueled by dividend growers with pricing power, secular tailwinds, and disciplined capital allocation. But beneath that solid headline, the story of 2025 so far is one of extremes — with semiconductors surging, fuel retailers faltering, and dividends quietly compounding in the background.

Let’s unpack where the momentum — and the drag — is coming from.

🚀 Semiconductor Strength Leads the Charge

This year’s biggest winners aren’t just outperforming — they’re soaring. KLA Corporation leads the pack with a 50% gain, cementing its position as a key enabler of next-gen chip production. Amphenol has delivered a stunning 44% return, reflecting broad-based demand across automotive and industrial sectors. Lam Research, up over 41%, and Applied Materials, climbing nearly 28%, round out a semiconductor quartet that has carried the portfolio higher.

The average dividend hike so far in 2025 for the Dividend Hike Portfolio is 13.6% with 13 stocks having announced an increase for this year. The average track record is 17 years of increases for all 25 stocks combined. The average dividend hike in 2024 was 19.9% for the Dividend Hike Portfolio.

These companies aren't just riding AI hype — they're selling the picks and shovels of the digital gold rush. Equipment orders, capex spending, and pricing power remain robust. And what’s more: all four have boosted dividends in 2025, continuing their shareholder-friendly track records.

🏗️ Industrials Deliver Quiet Strength

Beyond tech, industrial leaders are also pulling weight. Eaton Corporation has posted a 26.3% return so far this year, riding the electrification wave. Carlisle Companies, known for its performance roofing and engineered materials, is up over 21%. Defense and aerospace specialist Curtiss-Wright (we bought CW 0.00%↑ late on May 20, 2025 as our last purchase) has added 16%, benefiting from modernization spending and operational leverage.

These companies may not dominate headlines, but their business models are solid, and dividend growth remains central to their capital strategy.

📉 A Few Names Fall Behind

Not every holding has kept pace. Murphy USA is the worst performer so far, down over 15% as retail fuel margins normalize and consumer traffic shows signs of softness. Williams-Sonoma has declined 10.2%, caught in the post-pandemic fade in home goods demand. Meanwhile, Texas Pacific Land, down 9.4%, remains sensitive to oil price swings and sentiment toward resource-linked assets.

Zoetis, despite being a high-quality animal health name, is also down over 5%, as the market cools on high-multiple defensives. American Financial Group has seen similar declines, reflecting pressure in the insurance and investment landscape.

💵 Yield Snapshot: Modest, but Rising

The portfolio’s overall yield sits just above 1%, in line with its focus on growth over income. But under the surface, dividend increases are stacking up. Several holdings now offer 2%+ yields, including Mondelez (2.8%), American Financial Group (2.5%), and Equitable Holdings (2.1%). Even among lower-yielding stocks like McKesson and Watts Water, dividend hikes in 2025 have added meaningful income momentum.

This isn’t about chasing high yields — it’s about owning companies that raise their payouts every year and compound shareholder returns in the process.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.