Dividend Hike Portfolio Update: Solid 7.3% Gain

Curtiss-Wright and Amphenol Gain While Dividend Growth Averages 12.9%

The Dividend Hike Portfolio continues to perform well with a 7.3% return so far in 2025. The biggest gainer in 2025 is Amphenol APH 0.00%↑

Key Points in this Article

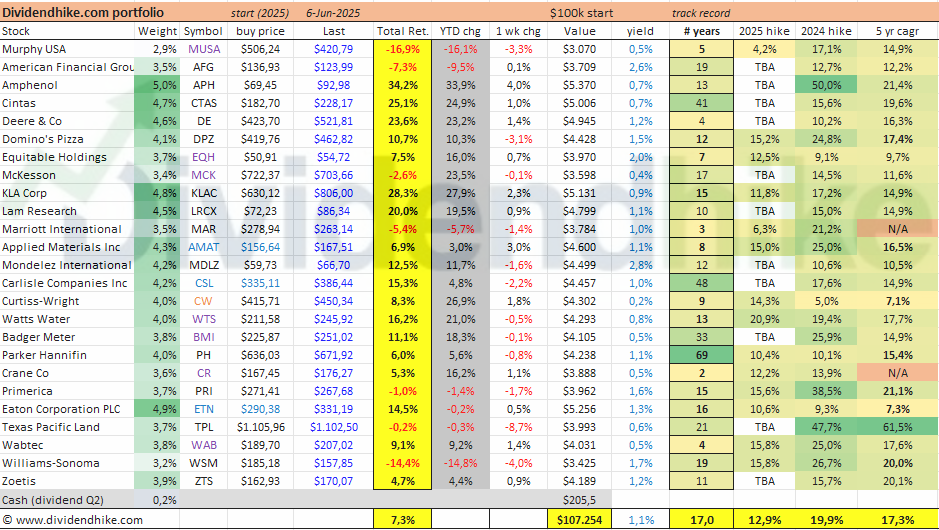

📈 Portfolio up 7.3% YTD – Strong gains from Curtiss-Wright, Amphenol, and semiconductor names like Applied Materials and KLA fuel performance.

🛢️ Weak spots in oil & retail – Murphy USA is down 17% after a poorly timed entry, though it continues to raise dividends.

💸 Dividend growth stays solid – Average increase of 12.9% among raisers so far, with more double-digit hikes expected later this year.

Our latest purchase, Curtiss-Wright CW 0.00%↑ , started off strong, but many other stocks are also doing excellently. The biggest weekly gainer is Amphenol, which reached an all-time high, while semiconductor stocks like Applied Materials AMAT 0.00%↑ and KLA KLAC 0.00%↑ also performed very well.

On the downside, oil and retail-related stocks have further declined. In that respect, the recent purchase of Murphy USA MUSA 0.00%↑ was unfortunately poorly timed, now showing a 17% loss. This is disappointing, but we remain confident in the company, which typically raises its dividend every quarter. In 2025, Murphy USA’s dividend was recently increased by 4.2%, and we expect two more hikes later this year. Marriott MAR 0.00%↑ also disappointed with only a 6.3% increase, but dividend growth may pick up again in the coming years. All other stocks that have announced dividend increases so far did so with double-digit hikes.

Later this year, we also expect double-digit raises from AFG, APH, CTAS, DE, MCK, LRCX, MDLZ, CSL, BMI, TPL, and ZTS — essentially all stocks that have not yet increased their dividends. The average dividend growth in 2025 currently stands at 12.9% for the 13 stocks that have raised dividends, compared to an average of 19.9% in 2024 for these same stocks. The average dividend yield is 1.1%, and the average track record of consecutive increases is 17 years.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.