Dividend Hike Portfolio: Strong Debut in 2025, Powerful Start to 2026

From a 22.8% gain in its first year to an 11% return in early 2026, driven by dividend growth leaders.

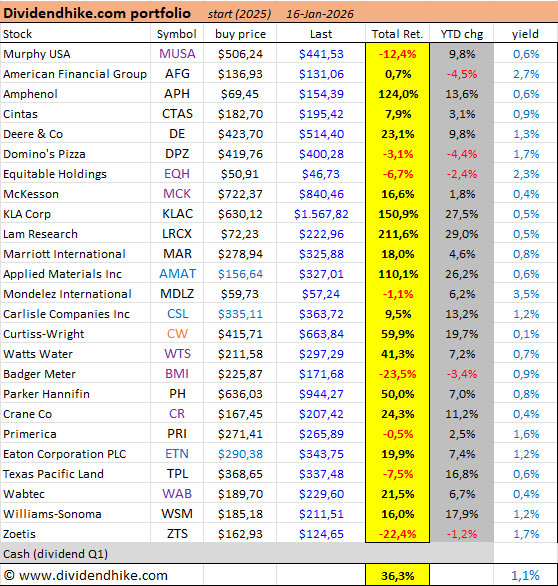

The Dividend Hike Portfolio completed its debut year in 2025 with a strong result and has started 2026 at an equally impressive pace. Since inception at the beginning of 2025, the portfolio continues to focus on dividend growth, supported by long-term capital appreciation rather than high headline yield.

Key Points

Debut year 2025 closed with a +22.8% return, ending at $122,805 from a $100,000 start

Total return since inception now stands at 36.3%

2026 started strongly, with a +11% return by January 16

Lam Research leads both 2025 and 2026 performance and now shows a 211% total return

$1,405 in dividends received and reinvested in 2025; $54.72 received so far in 2026

Looking Back at the Debut Year 2025

The Dividend Hike Portfolio finished its first full year with a 22.8% gain, reaching a total value of $122,805. Throughout the year, the portfolio consisted of 25 stocks, selected for their ability to grow dividends consistently over time.

Dividend income played a supporting role in 2025. A total of $1,405 in dividends was collected and fully reinvested. The average dividend growth rate reached 14.1%, underscoring the portfolio’s emphasis on dividend increases rather than yield. The largest dividend increase during the year came from Amphenol, which raised its dividend by 51.5%.

In terms of share price performance, Lam Research stood out as the strongest contributor in 2025, delivering a return of nearly 144% and earning its position as the portfolio’s leading Dividend Hero.

Strong Momentum at the Start of 2026

The positive momentum has continued into the new year. As of January 16, 2026, the portfolio is already up 11% year-to-date, lifting the total return since inception to 36.3%.

Once again, Lam Research is the top performer, rising 29% in the opening weeks of 2026. Since the portfolio’s launch, Lam Research has now generated a total return of 211%, making it the single largest contributor to overall performance.

In 2025, the Dividend Hike Portfolio also clearly outperformed the Dividend Heroes portfolio, despite the fact that Lam Research was included in both portfolios last year. This highlights that overall portfolio construction and stock selection beyond the top performer played an important role in the final outcome. The Dividend Heroes ended 2025 with a 9.7% gain.

Other semiconductor-related holdings also show strong results. KLA Corp is up 27.5% YTD, with a 150.9% total return, while Applied Materials has gained 26.2% YTD, bringing its total return to 110.1%. Amphenol continues to build on its strong 2025, adding 13.6% so far this year and reaching a 124.0% total return.

Portfolio Performance Across Holdings

Several industrial and engineering companies show solid long-term results. Curtiss-Wright now posts a 59.9% total return, Parker Hannifin stands at 50.0%, and Watts Water has reached 41.3%. Crane, Eaton, Deere & Co, and Wabtec all report total returns in the high teens to mid-twenties.

Not all positions have contributed positively. Badger Meter and Zoetis remain the weakest performers, with total returns of -23.5% and -22.4%, respectively. Murphy USA is still negative on a total return basis at -12.4%, while Texas Pacific Land shows a -7.5% total return, despite a strong start to 2026.

Dividend Income and Yield

Dividend income continues to accumulate gradually. In 2026 so far, the portfolio has received $54.72 in dividends. Due to strong share price appreciation across many holdings, the average portfolio yield has declined to approximately 0.9%, consistent with the portfolio’s focus on dividend growth rather than income maximization.

At DividendHike.com, we focus on tracking dividend growth trends and highlighting companies with consistent payout policies across global markets. By combining dividend data with clear, factual context, we aim to surface income-focused opportunities that may deserve closer attention. Stay tuned as we continue to follow dividend hikes, long-term payout trends, and the companies behind them.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

The Lam Research dominance here is both impressive and a little worrying tbh. When one stock delivers 211% while your average yield is sub-1%, you're basically betting on capital appreciation over income—which is fine but definately not what most people think of when they hear 'dividend portfolio.' Curious how this would look if semiconductors hit a rough patch. Still, 36% total return speaks for itself i guess.