Dividend hikes and cuts for Week 22, 2025

Only One Winner in a Dull Week for Dividend Growth

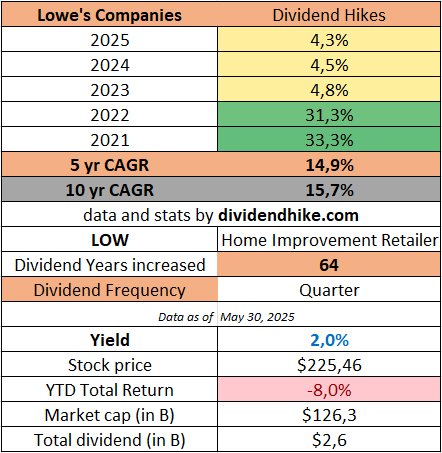

In Week 22 of 2025 (May 26–30), we saw just six dividend increases — a striking slowdown. For us, a quieter week is always a welcome breather, but let’s be honest: it was a remarkably uneventful week for dividend investors. The only standout was Lowe’s LOW 0.00%↑ , which extended its impressive track record by raising its dividend for the 64th consecutive year — a true Dividend King in action.

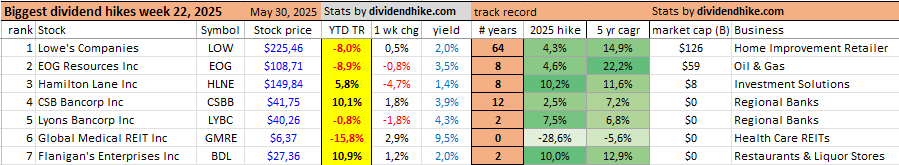

Other notable names this week include EOG Resources EOG 0.00%↑ — a former member of our Dividend Hike Portfolio — and Hamilton Lane, which has now raised its dividend at a double-digit pace for eight consecutive years.

Hamilton Lane HLNE 0.00%↑ , a leading private markets investment management firm, is rapidly positioning itself as a future Dividend Hero. To earn that title, however, it will need to hit 10 straight years of double-digit dividend growth — it's close, but not there yet.

Hamilton Lane also delivered the biggest dividend hike this week: +10.2%. At Dividend Hike, we focus on the trajectory of dividend growth, not just the size — and in that regard, Hamilton Lane stands out as the only stock this week to post a larger increase than last year. All others are showing signs of slowing growth — including Lowe’s (more on that below).

Below you’ll find all dividend increases from Week 22, including current yield, track record, 5 year CAGR for the dividend, YTD performance, and weekly price return.

Runner-up this week was Flanigan's Enterprises Inc. BDL 0.00%↑ , which announced a clean 10% dividend hike. This company, known for its chain of restaurants and liquor stores in Florida, pays a dividend just once per year, making its annual raise especially noteworthy.

On the downside, we also had a dividend cut, this time from Global Medical REIT GMRE 0.00%↑ — a clear warning signal for income-focused investors.

The table below ranks the companies by market cap — starting with Lowe’s at the top and ending with the small caps: CSBB , LYBC , GMRE 0.00%↑ , and BDL 0.00%↑ .

Lowe’s: From Dividend Star to Red Flag

Lowe’s continues to lose momentum in its dividend growth. Just a few years ago, this was one of the top-tier Dividend Aristocrats, delivering increases of over 30% in both 2021 and 2022. But the picture has changed dramatically.

In each of the past three years, dividend growth has fallen below 5% — and worse, it’s declining year over year. That’s a clear red flag for us. Lowe’s lost its Dividend Hero status a few years ago, and we’re glad it did — because its share price has struggled right along with its dividend growth.

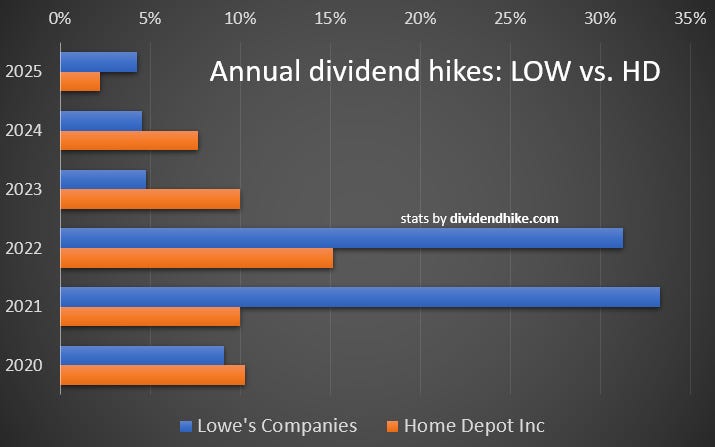

Home Depot HD 0.00%↑ is facing the same fate as its sector peer Lowe’s — weakening dividend growth. As shown in the table above, Home Depot’s 2025 dividend increase came in at just 2.2%, even lower than Lowe’s already modest hike.

If we had to choose between the two, Lowe’s still comes out on top, thanks to its stronger long-term track record and better dividend growth over the past several years.

While Home Depot has managed to raise its dividend for 16 consecutive years, its growth rate over both the 5-year and 10-year periods is significantly weaker than Lowe’s.

In short: both stocks are no longer Dividend Heroes, but Lowe’s still holds the edge in terms of historical dividend strength.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.