Dividend Portfolio Update: Three New Buys

We are selling Mastercard, MSCI Inc (and already sold Prologis)

Today, we are making three new additions to our dividend portfolio: Applied Materials (AMAT), Carlisle Companies (CSL), and Eaton (ETN). These stocks have seen notable pullbacks in recent weeks, creating strong entry opportunities, especially given their solid dividend growth outlooks.

At the same time, we are parting ways with MSCI Inc. (MSCI) and Mastercard (MA), following our earlier exit from Prologis (PLD).

In this update, we will take a closer look at these moves, discussing the reasoning behind our decisions and providing the latest dividend statistics to support our strategy.

While MSCI remains a high-quality business, its latest 12.5% dividend increase (vs. a 5 year CAGR of 18.7%) and earnings report were somewhat underwhelming. Mastercard, meanwhile, continues to perform exceptionally well, reaching all-time highs, but its yield has become quite low, and its market cap is now enormous. We are sure that MA will do 15%+ dividend hikes in the next couple of years, but with a $500+ billion market cap and a 0.5% yield we prefer other stocks that have dropped significantly in the last couple of weeks.

Earlier this week we sold Prologis (they hiked the dividend by 5.2% vs. a 5 year CAGR of 12.6%) with a 13% gain. Today we are also taking profits on MA (up 7.3% since we bought it) while selling MSCI with a small 2.9% loss and reallocating to stocks with more attractive valuations and stronger recent dividend trends. Let’s dive into the 3 new purchases!

Why These Three?

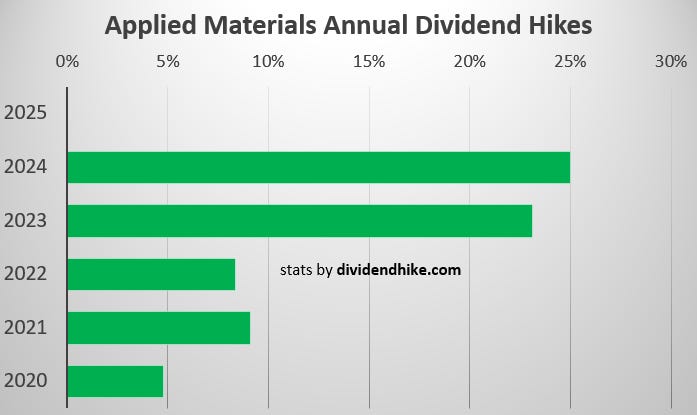

Applied Materials (AMAT): A global leader in semiconductor manufacturing equipment. The long-term demand for chips remains strong, and AMAT’s dividend growth has been consistent with bigger increases in the last couple of years.

Why we love this stock? AMAT hiked the dividend by 25% in 2024 and 23.1% in 2023. The stock closed down 7% Today at $156.64 down from $255 last July. With a 1% yield and a p/e of 18 we love AMAT after the big correction.

Carlisle Companies (CSL): Specializes in high-performance building products and materials, benefiting from infrastructure and construction tailwinds. Carlisle is one of the best dividend growers with an average hike of 22.8% in the last three years. This is for a company with now 48 consecutive years of increased dividends. On top of dividend hikes, CSL buys back big amounts of its own stock every single year.

The current stock price of $335 is down from its all time high of $481 last October. With a 1.2% yield, double digit dividend growth, high margins and a strong ROIC we also like to add CSL, even with the cyclical business (also check roofing/insulation peer Owens Corning (OC), one of the other dividend portfolio stocks, down 10.7% YTD being the biggest loser in our 25 stock dividend portfolio )Eaton (ETN): A powerhouse in electrical systems and power management solutions. Notably, Eaton announced an 11% dividend increase today—its largest in a decade and the 16th consecutive year of increases! With the stock down in recent weeks, this presents an excellent buying opportunity for this strong growth company.

Eaton closed at $290.38 today, down from its all time high of $379.99 that was set just this November. The yield is 1.3% with the 2025 p/e dropping below 25 Today. We are buying the ETN dip!

We will publish a fully updated portfolio next week, incorporating these latest moves. Stay tuned!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.