Europe Dividend Update: A Dividend Hero in big trouble?

Dividend Drama in Europe with Bunzl Crashing and ASML disappointing

Several notable European companies have recently made dividend announcements, reflecting a range of corporate strategies—from stable growth to final payouts and even cuts. Here's a roundup of the most recent developments.

FDJ United (France), formerly known as Française des Jeux, has declared a dividend of €2.05 per share for 2025. This represents a dividend yield of 6.7% based on a share price of €30. The stock will trade ex-dividend on May 27. The company has consistently increased its dividend at a double-digit annual rate in recent years. FDJ United operates France’s national lottery and also offers sports betting and online gaming.

OCI N.V. (Netherlands) is distributing a special dividend of €4.74 per share in 2025. This follows an earlier payout of €14.50 in 2024, which came after several substantial distributions. OCI is effectively winding down and returning all available cash to shareholders, making this likely its final dividend. At a share price of €6.52, the yield on this payout is an exceptional 73%. The ex-dividend date is April 15, 2025. OCI is a global producer and distributor of nitrogen-based fertilizers and industrial chemicals, including ammonia and methanol, with operations in Europe, the Middle East, and the U.S.

WH Smith (UK) has announced an interim dividend of 11.3 pence, slightly up from 11 pence in 2024. The company has now raised its dividend for two consecutive years following a suspension during the COVID-19 pandemic. WH Smith was previously known for its consistent dividend track record and is showing signs of recovery. The current dividend yield is 3.5% at a share price of 930 pence. WH Smith operates retail outlets focused on books, stationery, and convenience products, with a strong presence in airports, railway stations, and other travel hubs, as well as traditional high street stores.

S&U (UK), a specialty finance company, has reduced its final dividend for the second consecutive year. The final payout has been set at 40 pence, bringing the total 2024 dividend to 120 pence—a 17% decline from the previous year, which itself saw a 10% cut. S&U remains distinctive in its policy of paying dividends three times annually. Despite the reduction, the gross yield remains high at 8.4%. The company provides motor finance and consumer credit services.

Tesco (UK) has announced a 13% increase in its total dividend for the 2024 fiscal year, raising it to 13.7 pence per share. The final dividend of 9.45 pence will go ex-dividend on May 15, 2025. This marks the second consecutive year of dividend growth and continues Tesco’s track record of stable or growing dividends for the past eight years, following the reinstatement of payouts in FY2015. The current dividend yield is 4% at a share price of 345 pence. Tesco is the UK’s largest grocery retailer, operating supermarkets, convenience stores, and online channels in the UK, Ireland, and Central Europe.

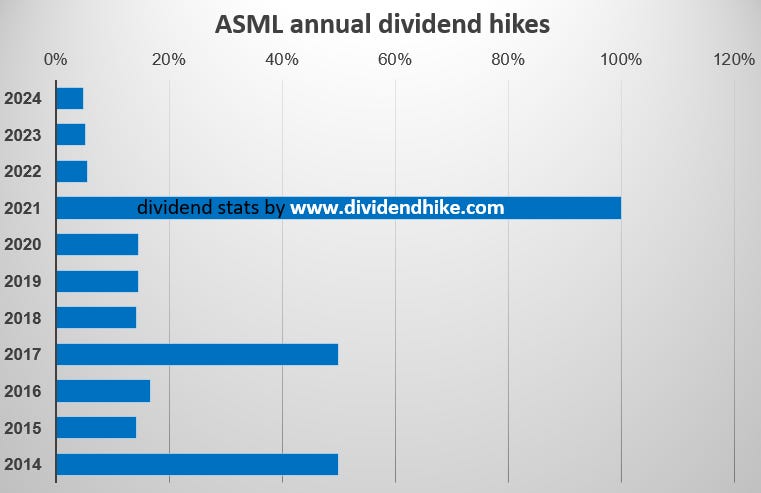

ASML (Netherlands) has confirmed a total dividend of €6.40 per share for 2024, representing a 4.9% increase from 2023. This includes three interim dividends of €1.52 each already paid across 2024 and 2025, and a proposed final dividend of €1.84 to be approved at the upcoming AGM. Despite the dividend increase, the company’s share price fell 7% following weaker-than-expected quarterly results, bringing the year-to-date performance to -17%.

The dividend yield currently stands at 1.1%. ASML designs and manufactures photolithography machines used to produce advanced semiconductors, and is a key supplier to leading global chipmakers. In addition, the company repurchased around €2.7 billion worth of shares in Q1 as part of its ongoing 2022–2025 buyback program.

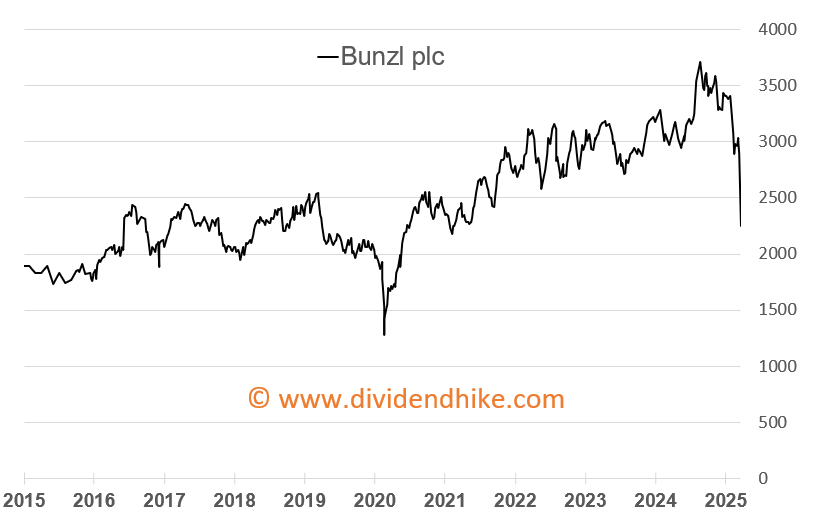

Bunzl (UK) delivered the biggest shock of the week among European dividend names, with shares plunging over 25% after a sharp cut to its 2025 guidance and a suspension of its share buyback programme. Despite the drop, the company confirmed its dividend remains intact. In March, Bunzl announced an increased interim dividend of 5.38 pence, continuing its decades-long streak of annual dividend increases.

For 2025, the total dividend is expected to grow by nearly 9%, following an 11% rise in 2024. The current dividend yield is 2.4%. Bunzl, a global distributor of business supplies such as packaging, hygiene products, and safety equipment, cited weakness in its North American operations as a key reason for the revised outlook. The company also noted ongoing uncertainty due to U.S. tariffs, which have contributed to broader volatility in global markets and a more cautious business climate.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.