📉 Dividendhike.com Portfolio Update: Red Numbers, But Far from Red Flags

Market Setback Creates Opportunities: Navigating the Decline with a Focus on Long-Term Dividend Growth

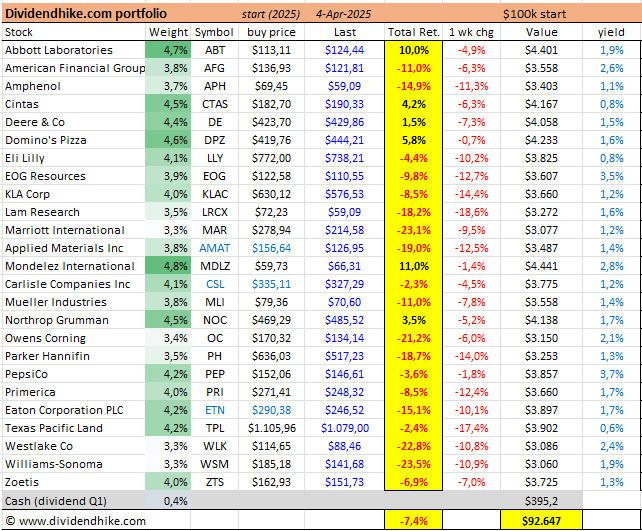

As of April 4, 2025, our Dividendhike Portfolio is showing a -7.4% total return. Not a great feeling, we know. Losses hurt—no way around it. But context matters: the Dividendhike Portfolio is actually holding up better than the broader market.

Take the S&P 500, which is down nearly 14% year-to-date. The Nasdaq and Russell 2000 are performing even worse. So yes, we’re down—but in relative terms, it’s a shallower dip than most.

Long term Focus

Despite the red numbers, the core philosophy behind this portfolio hasn’t changed. Every stock we hold shares a defining trait: they raise their dividend every year—consistently and at an above-average rate.

That commitment to returning capital to shareholders makes these businesses resilient and shareholder-friendly. Even with economic headwinds, we still believe these companies will continue growing their dividends in 2025, tariffs or not.

Historically, periods of widespread market decline have proven to be great long-term buying opportunities, particularly for income investors. That’s not advice—just perspective.

When reviewing the portfolio as of April 4, 2025, there are a few notable outliers that have had a significant impact—both positive and negative—on the overall performance.

For instance, Abbott Laboratories ABT 0.00%↑ stands out as one of the positive performers. The stock has appreciated by 10% since the initial purchase, despite a recent drop of 4.9% over the past week. The dividend yield remains stable at 1.9%, adding to the overall return and reinforcing its long-term growth potential.

On the negative side, Williams-Sonoma WSM 0.00%↑ has seen a significant decline, down 23.5% since the purchase. The stock has been heavily impacted by the recent market downturn, and it dropped another 10.9% in the past week.

Semiconductors and cyclicals were hit especially hard, as trade-related uncertainty and macro headwinds weighed heavily: 4 stocks lost more than 20% last week. Let’s dive into the portfolio with all updated stats en yields.

In summary, while some stocks have experienced significant declines, the core focus remains on the stable dividend growth within the portfolio. The biggest losers have been heavily impacted by broader market conditions, but the long-term outlook for these companies—who consistently raise their dividends—remains promising.

The Dividendhike Portfolio is strategically diversified across a range of sectors, with a particular emphasis on those that provide steady income and growth potential. As of now, the largest sector allocation is in Industrials, which makes up 24.1% of the portfolio. This sector includes companies that have a history of stable dividends and are often resilient to economic fluctuations.

Following Industrials, Financials represent 15.6% of the portfolio, making it another key area of focus. These companies are generally known for their ability to generate strong cash flow and return capital to shareholders, particularly in the form of dividends. Healthcare, another critical sector, comprises 12.9% of the portfolio. Healthcare stocks are well-suited for dividend investors due to their steady demand and relatively inelastic nature.

Consumer Discretionary and Consumer Staples represent 11.2% and 9.0%, respectively. Consumer Discretionary stocks can offer higher growth potential, while Consumer Staples provide stability, as these companies sell essential products that people continue to buy regardless of economic cycles.

The Technology sector also holds a solid position in the portfolio at 11.2%. Though typically known for growth rather than dividends, some tech companies are increasingly prioritizing shareholder returns, making this sector a promising source of both appreciation and income.

The Energy sector makes up 8.1% of the portfolio. Despite the sector's volatility, energy companies are often strong dividend payers, particularly when oil prices are favorable.

Materials (3.3%) round out the portfolio’s sector breakdown, contributing to diversification.

At this moment, the portfolio holds 0.6% in cash, a result of the dividends received during Q1. We plan to reinvest this cash asap. All cash will be reinvested in the stocks that paid the dividend in Q1.

The average dividend yield for the portfolio is currently 1.7%, reflecting a balanced approach between income and growth. In the near future, we will provide an update on the dividend growth across our holdings, detailing how the companies are raising their dividends and what that means for the future income potential of the portfolio.

For now, we remain satisfied with the portfolio composition and will not be making any changes. If you have any questions about the portfolio or a stock, please leave us a message by chat or email!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.