DividendHike.com Portfolio: A Strong Start to 2025, Up 7.8% YTD

Lam Research, Deere & Co and Williams-Sonoma have a huge week

As we move deeper into 2025, the DividendHike.com portfolio is off to an impressive start, delivering a solid 7.8% year-to-date (YTD) return.

With a carefully curated selection of 25 high-quality dividend-paying stocks, our portfolio continues to strike a balance between capital appreciation and income generation. Let’s take a closer look at some of the key performers, recent developments, and the broader outlook.

Standout Performers

While the overall portfolio has performed well, a few names have led the charge:

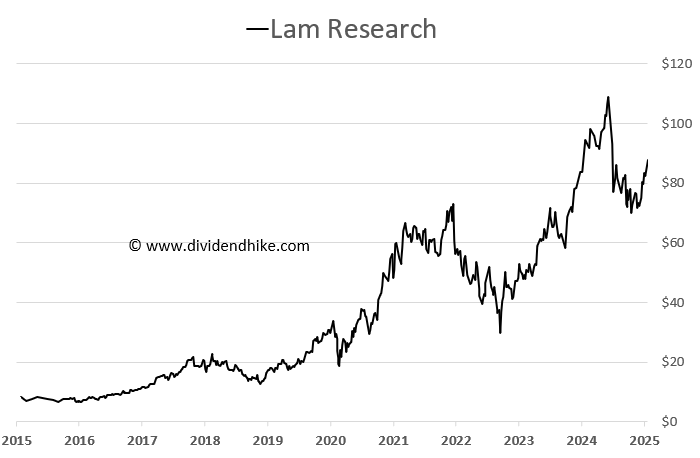

Lam Research (LRCX) +21.4% YTD – Another semiconductor giant benefiting from robust industry trends. Lam Research’s recent stock surge is driven by a combination of factors, including strong AI-related demand, a positive long-term financial outlook, and new product innovations. As the semiconductor industry continues to evolve, Lam Research is well-positioned to capitalize on the increasing need for advanced chipmaking tools. Investors appear to recognize this potential, fueling the stock’s impressive performance in recent months.

Lam Research’s stock has surged due to strong demand for advanced semiconductor tools, particularly for AI chip production. The company’s recent analyst day reinforced investor confidence with optimistic revenue projections of $25-28 billion by 2028 and a targeted gross margin of 50%. Additionally, the unveiling of new chipmaking tools further solidified its market position. Despite already rising 22% year-to-date, the stock remains below its 52-week high, with a higher-than-average valuation reflecting strong growth expectations.Deere & Co (DE) +20.2% YTD – Strong earnings and increased agricultural demand have propelled Deere’s stock price higher. Deere actually touched a new all time high this week. This is no surprise to us: we highlighted Deere multiple times on X the last couple of years and also did an article in 2024 when Deere was one of our Focus Stocks.

Williams-Sonoma (WSM) +15.4% YTD – The home furnishings retailer is riding a wave of strong consumer demand and operational efficiencies. Our paying subscribers know that WSM is a Dividend Hero. We highlighted the stock in 2024.

WSM Hits New All-Time Highs in 2025—Which Other Dividend Growth Stocks Are Soaring?

WSM continues its impressive rally, reaching new all-time highs in 2025 and boosting the Dividendhike.com portfolio alongside Deere, Lam Research, and 22 other dividend growth powerhouses. Want to know which stocks are leading the charge? Subscribe now for the full breakdown!

Texas Pacific Land (TPL) +27.0% YTD – This land management company has surged ahead, benefiting from strong demand in the energy sector.

KLA Corp (KLAC) +23.0% YTD – The semiconductor sector continues to shine, with KLA delivering impressive gains.

Dividend Strength & Stability

A key feature of the DividendHike.com portfolio is its reliable dividend income. The average portfolio dividend yield remains attractive, with some notable contributors:

PepsiCo (PEP) – 3.7% Yield: Despite a slight pullback in stock price, PepsiCo remains a rock-solid dividend payer.

Prologis (PLD) – 3.2% Yield: The logistics real estate giant continues to reward shareholders with a steady dividend stream.

Mondelez (MDLZ) – 3.0% Yield: A defensive consumer staple with consistent dividend growth.

Recent Weakness & Opportunities

Not every stock has been a winner this year, but some short-term pullbacks may present attractive entry points:

Zoetis (ZTS) -3.9% YTD: Despite recent weakness, this animal health leader remains a long-term compounder.

Northrop Grumman (NOC) -7.6% YTD: Defense stocks have faced pressure, but geopolitical tensions may support a rebound.

American Financial Group (AFG) -11.0% YTD: Insurance stocks have been volatile, but dividend strength remains intact.

Market Outlook

With continued economic resilience, earnings season in full swing, and interest rate expectations evolving, the DividendHike.com portfolio is well-positioned to navigate volatility. Dividend growth investing remains a powerful strategy for long-term wealth creation, combining income and appreciation.

We’ll continue monitoring performance and making adjustments where needed, but for now, the portfolio is off to a fantastic start in 2025. Stay tuned for future updates, and happy investing!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.