Dividendhike.com portfolio: Outperforming with strong dividend growth

Average increase of 15.3% YTD with now seven double digit hikes

We love our portfolio! It’s been another fantastic week, with 3 double-digit gainers led by Amphenol APH 0.00%↑ , which delivered impressive quarterly results. Our semiconductor stocks also had an outstanding week. The overall return is now 1.5% in 2025 – which might seem modest, but keep in mind the S&P 500 is down 6% this year, and the Russell 2000 (-14%) and Nasdaq (-10%) are facing double-digit losses. Even the Dividend Aristocrats are underperforming, with an average of -2.4% in 2025.

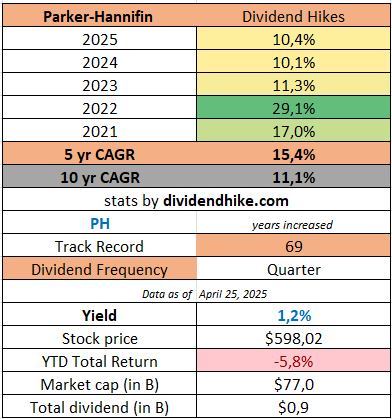

Our secret? Top stocks with rock-solid dividend growth. The numbers speak for themselves: In 2025, 7 out of the 25 stocks in our portfolio have increased their dividends. All increases were over 10%, with one industrial stock raising its dividend by 25% – a stock we also highlighted as a focus stock in 2024. On Friday, Parker Hannifin PH 0.00%↑ raised its dividend by 10.4%.

With 69 consecutive years of increases, it holds our portfolio's best track record. The average dividend growth for the portfolio now stands at 20.6%. In 2025, the average dividend growth is 15.3% (EAT THAT!), and over the last 5 years, it’s even been +19.4% for all 25 stocks combined.

We told you: only the absolute best stocks in our portfolio. Below, the current stats!

The table below shows the current status of our dividend portfolio of 25 stocks; in the last 4 columns, we’ve now also included the dividend growth statistics. You can see the number of years of increases, the dividend increase in 2025 (if already announced), the dividend growth in 2024, along with the average growth over the last 5 years.

So far this quarter we received 5 dividends (based on ex-date) for companies that have now paid 2 dividends since we started the portfolio this year: Abbott, American Financial, EOG Resources, Williams-Sonoma and Zoetis. The total dividend is $103.63 and will be reinvested periodically.

For now, we remain satisfied with the portfolio composition and will not be making any changes. If you have any questions about the portfolio or a stock, please leave us a message by chat or email!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.