Dividendhike.com Portfolio Kicks Off 2025 with a 7.9% Gain

LAM Research Tops Gainers After Earnings | 10 Stocks with Double-Digit Gains YTD

At the start of this year, we officially launched our brand-new DividendHike.com Portfolio, featuring 25 carefully selected dividend growth stocks from the United States. These companies boast impressive histories of annual dividend increases and strong growth rates, positioning them well for long-term dividend expansion.

As of January 30, 2025, the portfolio has delivered an impressive 7.9% total return, far exceeding our expectations. Given the robust dividend growth track records of these companies and the underperformance of many in Q4 2024, this strong start to 2025 isn't entirely surprising.

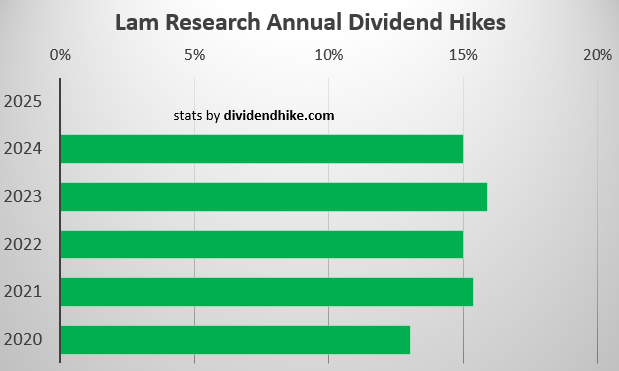

Today's earnings reports fueled even more gains, with Lam Research (LRCX) leading the way. The semiconductor giant, also one of 2025’s Dividend Heroes, posted the biggest jump of the day.

Remarkably, 10 of our 25 holdings are already up by double digits in just under a month—an extraordinary start to the year!

For our paying subscribers, we provide detailed weekly updates, including performance statistics and insights. Several of our portfolio selections are also featured in The Dividend Heroes, a curated list of standout dividend-growth stocks. While The Dividend Heroes are updated annually, our DividendHike.com Portfolio is handpicked with a long-term view, with dividends reinvested to maximize growth.

As of Today two stocks are down YTD, with the biggest loser Mondelez International losing only 2.5%. Learn everything about the other 23 stocks (apart from Mondelez and Lam Research) in this post including detailed stats on dividend growth, YTD performance, yields and more!

The table below shows the current weight of all positions, the total return since the purchase on January 2, 2025 and the current dividend yield. In our next update we will also add dividend growth stats for all 25 stocks.

We launched the portfolio with a $100,000 paper/hypothetical investment and intend to hold the stocks for the long term. We intend to actively manage the portfolio and will replace stocks if dividend growth slows down too much or, of course, if the dividend is cut. We will also reduce positions if the weighting becomes too large, especially when it exceeds 10%.

The average forward p/e (2025) for the 25 stocks is 24.7 with a 5 year CAGR for the dividend of almost 18%. The current average dividend yield of these 25 stocks is 1.5%.

For more information on the dividendhike.com portfolio check our special launch page.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.