Eaton PLC: A Strategic Addition to the Dividend Growth Portfolio

New addition to the Hike Portfolio with positive dividend growth trend

One of the latest additions to the Dividend Hike portfolio is Eaton PLC ETN 0.00%↑ , an “intelligent power management company” with strong structural tailwinds and a compelling long-term dividend growth profile.

📌 Key Points – Eaton (Dividend Portfolio Addition)

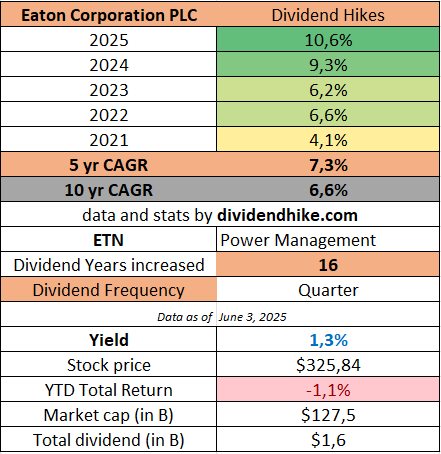

🚀 Dividend growth re-accelerated: +10.6% in 2025 after +9.3% in 2024.

💰 2025 free cash flow expected at $3.9B vs. $1.5B in dividend payouts.

📈 Revenue projected to hit a record $27.25B in 2025 (+9.5% YoY).

⚡ EBIT margin consistently >20% — strong operational profile.

🔄 Share buybacks in 2024: 0.9% of shares retired; room to increase.

📊 29 analyst ratings: 6 strong buys, 13 buys, 10 holds — 0 sells.

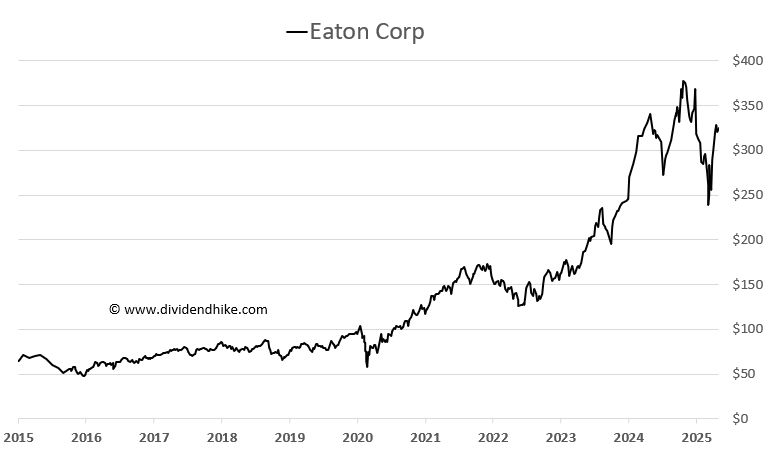

The position was initiated last month. We added Eaton to the portfolio last month at $290. Now trading at $325, the stock still trades at a forward P/E of 27—far from excessive given its strong growth outlook.

Eaton impressed with a double-digit dividend hike earlier this year, a structurally high EBIT margin above 20%, and a 1.3% dividend yield—elevated for the sector, especially for a company with the potential for sustained double-digit dividend growth.

History and Transformation

Eaton’s roots go back more than a century to 1911, when it was founded in the United States by Joseph Eaton as a manufacturer of truck transmissions. Over the decades, the company evolved into a diversified industrial player. A major strategic shift occurred in 2012 when Eaton completed a merger with Ireland-based Cooper Industries, relocating its corporate domicile to Ireland and formally becoming Eaton PLC. This move not only expanded Eaton’s global footprint but also accelerated its transition toward electrical systems and energy management.

Business Overview

Eaton is a global technology leader focused on managing electrical, hydraulic, and mechanical power. Its products and systems support a broad range of end markets, helping businesses, governments, and households use energy more efficiently, safely, and sustainably. The company plays a key role in global electrification trends, including grid modernization, energy resilience, decarbonization, and digital infrastructure.

The business is structured around several key segments:

Electrical Systems and Services: By far Eaton’s largest division, this segment accounts for the majority of total revenue and includes electrical components, power distribution systems, and digital infrastructure. It is a central growth engine for the company.

Aerospace: Eaton supplies mission-critical systems for commercial and defense aviation. This segment has shown consistent and stable growth.

Vehicle: Focused on components like transmissions and engines, this segment has recently faced headwinds due to declining production volumes in the global light vehicle market.

eMobility: Though still a small part of Eaton’s total revenue, this division is dedicated entirely to electric vehicle technology and is considered a strategic long-term growth pillar.

Growth Drivers

Eaton is well-positioned to benefit from multiple structural trends, including:

The electrification of industrial and consumer applications

Expansion of renewable energy and distributed generation

Growing demand for energy storage and grid stability solutions

The build-out of AI and cloud-related data center infrastructure

The rise of electric vehicles and related powertrain systems

In particular, the company’s exposure to the AI-driven data center boom—through its electrical distribution systems, backup power solutions, and thermal management offerings—has increasingly attracted attention from investors.

Recent Developments

Eaton shares experienced significant volatility in the first half of 2024, declining sharply from their late-2023 highs amid a broader selloff in high-valuation and growth-oriented industrial names. The downturn was partially driven by investor rotation away from AI-infrastructure plays and concerns about elevated valuations. However, the pullback opened the door for strategic long-term investors to build positions at more attractive levels.

Despite short-term headwinds in its Vehicle division, Eaton continues to report strong growth in its core Electrical and Aerospace businesses, underpinned by robust end-market demand. Analysts expect continued revenue and earnings growth, supported by Eaton’s healthy balance sheet, growing free cash flow, and disciplined capital allocation strategy.

Dividend Profile and Fundamentals

Eaton has paid a dividend every year since 1923. In recent years, the pace of dividend increases has accelerated. In 2025, the company implemented its first double-digit dividend hike since 2018, following another strong increase in 2024. This marks a notable inflection in Eaton’s dividend growth trajectory and reflects confidence in future cash generation.

The dividend is supported by a growing base of free cash flow, a moderate payout ratio, and a strong financial position. In addition to dividends, Eaton regularly returns capital to shareholders through share repurchases and pursues strategic acquisitions to strengthen its portfolio in high-growth areas.

We added Eaton to the portfolio last month at $290. Now trading at $325, the stock still trades at a forward P/E of 27—far from excessive given its strong growth outlook. Eaton impressed with a double-digit dividend hike earlier this year, a structurally high EBIT margin above 20%, and a 1.3% dividend yield—elevated for the sector, especially for a company with the potential for sustained double-digit dividend growth. Eaton also buys back stock annually: in 2024 they retired 0.8% of shares outstanding and this percentage is expected to increase in the next couple of years together with the growing free cash flow.

We think that Eaton’s dividend can grow by at least 50% in the next 3 to 4 years to more than $6.00 per share in 2029.

Revenue is expected to grow by 9.5% in 2025 to a record high of $27.25 billion. Eaton is cash generating machine with a net debt of $7.07 billion at the end of 2024. With free cash flow expected to jump to $3.9 billion in 2025 this is very solid, considering that Eaton only pays $1.5 billion in dividends annually.

Last but not least, Eaton is also a favorite among analysts, with 6 strong buy ratings, 13 buy ratings, 10 holds, and not a single sell recommendation.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.