European Dividend Highlights: week 9/10, 2025

Swiss Co. Increases Dividends for 30th Year, #1 Dutch Dividend Stock

Several major European companies have announced significant dividend actions in recent weeks. Below is a summary of the most notable updates:

Dividend Increases:

Thales (France): The aerospace and defense company announced a 8.8% dividend increase to €3.70 per share for 2024, a new record high. The final dividend is €2.85, up from €2.60, with an ex-dividend date of May 20, 2025. The yield stands at 1.55% at a share price of €228.

Allianz (Germany): The insurance giant raised its dividend by 12% to €15.40 per share in 2025, marking its third double-digit hike in four years. The current yield is 4.7%.

Hensoldt (Germany): The defense technology company increased its dividend by 25% to €0.50 per share in 2025.

Veolia Environnement (France): The French utility hiked its dividend by 12%, marking its fourth consecutive double-digit increase. The company boasts a 5% yield.

Haleon (UK): The healthcare and consumer goods company announced a 10% dividend increase for FY 2024, offering a 1.7% yield.

Danone (France): The food and beverage company will pay a €2.15 per share dividend in 2025, up from €2.10 in 2024. The ex-dividend date is May 5, 2025, with a 3% yield.

Wolters Kluwer (Netherlands): The European dividend leader raised its FY 2024 dividend by 12%. However, its stock declined following news of the CEO’s departure. Wolters Kluwer has the best dividend track record in The Netherlands with almost 4 decades without a dividend cut and double digit increases in the last 7 years.

AB InBev (Belgium): The world’s largest brewer increased its dividend by 22% to €1.00 per share in 2025. While still far from its record €3.60 payout, this is its largest hike in the past decade.

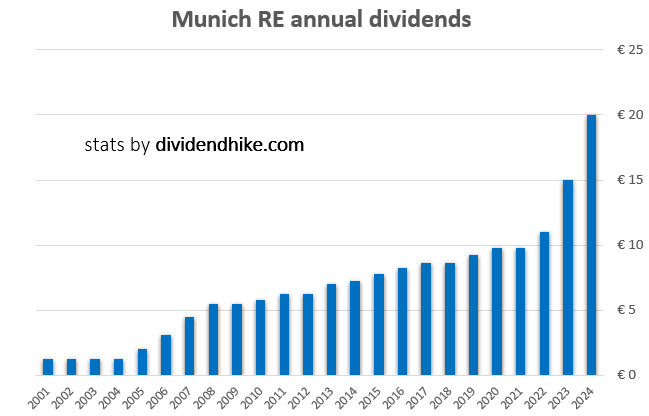

Munich Re (Germany): The reinsurer will boost its dividend by 33.3% to €20 per share in 2025, continuing its impressive streak of 12.2% average annual increases over the past 20 years.

Ferrari (Italy): The luxury sports car maker raised its 2025 dividend by 22% to €2.896 per share. Despite its traditionally low yield, the stock price and dividend continue to surge.

Aegon (Netherlands): The Dutch insurer increased its FY 2024 dividend by 17% to €0.35 per share. With a 6% yield, the next ex-dividend date is June 16, 2025.

Lindt & Sprüngli (Switzerland): The Swiss chocolatier raised its dividend for the 30th consecutive year by 7.1%, bringing it to CHF 1500 per share for 2025. The ex-dividend date is April 22, 2025, with a yield of 1.3%.

VAT Group (Switzerland): Our focus stock, VAT Group, will pay a dividend of CHF 6.25 per share, offering a yield of 1.8%.

Continental (Germany): The automotive supplier will pay a 14% higher dividend of €2.50 per share in 2025. The ex-dividend date is April 28, 2025, with a yield of 3.2%.

Ageas (Belgium): The Belgian insurance company raised its dividend by 7.7%, marking its fourth consecutive year of growth. The yield stands at 6.1%.

Dividend Cuts & No Changes:

BASF (Germany): The chemical giant cut its dividend by 33.8% to €2.25 per share in 2025, ending a 14-year streak of steady or rising payouts.

Aalberts (Netherlands): The Dutch industrial company kept its dividend unchanged at €1.13 per share in 2025. The yield is 3.4%, with an ex-date of April 14, 2025.

Beiersdorf (Germany): The skincare and personal care giant maintains its dividend at €1.00 per share for 2025, following last year’s increase, which may have been a one-off.

These announcements highlight a dynamic period for European dividend investors, with a mix of record-breaking hikes, sustained payouts, and notable cuts.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.