European Dividend Highlights: week 7, 2025

Nestlé, Orkla, Hermes, Kering and Nibe Industrier announce their dividend

As we move further into 2025, several major European companies have announced dividend changes, reflecting shifting financial landscapes and company-specific strategies. Here’s a summary of the latest dividend increases, cuts, and steady payouts from key players:

Dividend Increases

Nestlé (Switzerland): Nestlé will raise its dividend by 1.7% to CHF 3.05 per share in 2025. This marks nearly 30 consecutive years of dividend increases. However, the company’s dividend growth rate has slowed significantly, with a 5-year compound annual growth rate (CAGR) of just 2.5%, compared to its 30-year average of 8.5%.

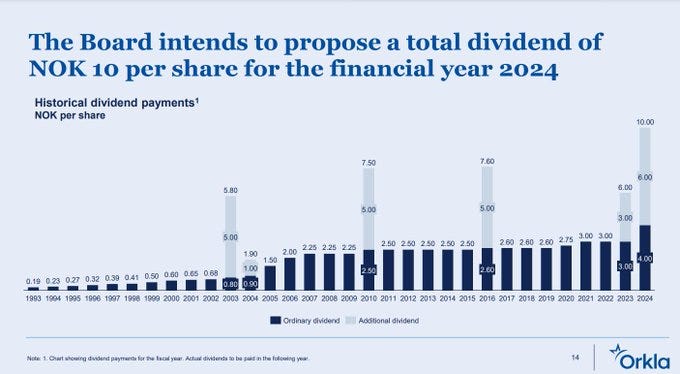

Orkla (Norway): Orkla is rewarding shareholders with a NOK 10.00 per share dividend this year, translating into a high yield of 9%.

This Norwegian dividend star was highlighted on DividendHike.com in 2024 for its impressive payout in an article with three special dividend paying kings from Europe.

Hermes International (France): Luxury co Hermes from France will hike the dividend by 6.7% to €16.00 per share in 2025. On top of this a €10.00 per share special dividend will be paid, just like in 2024. The dividend yield for Hermes is 0.9% at a stock price of €2,839. The first ex-date is Today, on Monday Feb. 17, 2025.

Dividend Cuts

Nibe Industrier (Sweden): The Swedish heating technology company is halving its dividend, an unexpected move. Interestingly, despite the cut, the stock is soaring, indicating strong investor confidence in the company’s future growth prospects.

Kering (France): The luxury goods giant behind brands like Gucci has drastically cut its dividend. The final dividend for FY 2024 will be €2.00 per share, down from €9.50 last year. This brings the total dividend for the year to €4.00 per share, representing a steep 71.4% decline from FY 2023. The ex-dividend date is May 4, 2025, and the current yield stands at 1.6%.

Thule Group (Sweden): The Swedish outdoor and transportation gear manufacturer is trimming its dividend by 12.6% to SEK 8.30 per share for FY 2024. The dividend yield remains at 2.3%, with ex-dividend dates set for April 30 and October 3.

Dividend Stability

Sartorius AG (Germany): The German laboratory and pharmaceutical supplier has opted to keep its dividend unchanged at €0.73 per share. The ex-dividend date is March 28, 2025, signaling a conservative yet stable approach in a fluctuating market.

A new Dividend Superstar from Europe

Focus stock update: Our latest Focus Stock from Europe is combining big annual dividend hikes with annual special dividends. This stock just announced a 40%+ dividend hike for 2024 bringing the 5 year CAGR to a whopping 32%. Even better: A special dividend was announced on top of this big dividend hike; this is the 6th consecutive annual special dividend by our new Focus Stock from Europe. And last but not least: this is a debt free company…….

If you want to know everything about this company consider becoming a paid sub to dividendhike.com and get access to all Focus Stocks and our Dividend Portfolio.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.