From $1000 to $10,000 with dividend stocks

We show you how you can achieve a huge total return in the long term by reinvesting dividends.

In a very realistic scenario, an investment of $1000 becomes $10,000 in 20 years. We explain how this works using a number of examples.

Investing in dividend growth stocks is the way to achieve a large capital in the long term. It is then important to reinvest the dividends every quarter. It is also important that the dividend grows annually and that the dividend yield is as high as possible at the start.

The bizarre thing is that the total return of a stock that increases the dividend significantly every year is much higher if the stock price does nothing. The idea behind this is simple: by reinvesting, the total position (the number of shares) grows further each time; in our calculation example we start with 1 share of $1000 with a dividend yield of 2.5% and an annual dividend growth of 10%.

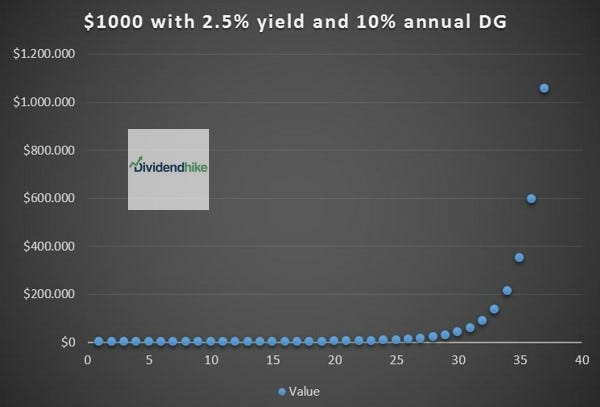

1A. EXAMPLE OF REINVESTING DIVIDEND AT THE SAME PRICE

• Start with $1000 in one share

• Dividend yield 2.5%

• Annual dividend growth 10%

• After 25 years, $1000 has grown to $10,000

• After 33 years, $1000 has grown to $135,000

• After 37 years, $1000 has grown to $1 million

It takes exactly 25 years for the $1000 investment to grow to $10,000, then it takes only 8 years to break through the $100,000 barrier and four years later your $1000 investment is already worth $1 million.

Unfortunately, the stock price will also rise…….

Note: The above example is correct on paper but is not realistic in practice because a dividend that is continuously increased will also result in a price increase. Simply because the dividend yield would otherwise be far too high and investors would buy the stock because of the high yield. We will again assume a starting dividend yield of 2.5% and 10% annual dividend growth.

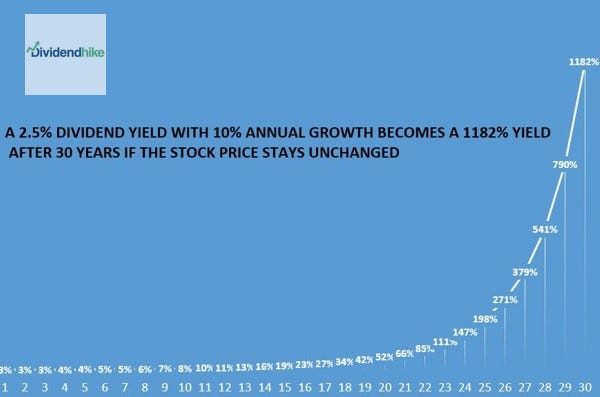

1B. DIVIDEND YIELD AT THE SAME PRICE

• Year 1: 2.5%

• Year 10: 8.2%

• Year 12: 11.2%

• Year 20: 52.2%

• Year 30: 1182%

The calculation example does show how extreme the dividend yield can increase if the stock market price of a dividend growth stock remains the same. No investor will ignore a stock with a 10% dividend yield, let alone a 1100% dividend yield;

The stock market price will therefore move along with the growth of the dividend; for the best dividend stocks, the stock market price even anticipates the development of the dividend.

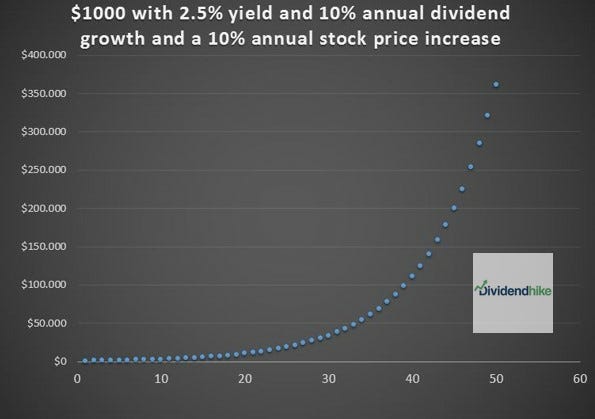

2. A REALISTIC EXAMPLE

The above examples clearly show how great the compounding effect is in dividend investing. The great thing is that a dividend that increases annually will also lead to a higher stock price, otherwise we get the absurdly high dividend yields that we just showed.

That is why we show a more realistic example with the same assumptions only together with a rising stock price. What now appears: We see five years earlier, after 20 years, already at a value of $10,000.

EXAMPLE OF REINVESTING DIVIDEND WITH RISING STOCK PRICE

• Start with $1000 in one share

• Dividend yield 2.5%

• Annual dividend growth 10%

• Stock price also rises by 10% annually

• After 20 years, $1000 has grown to $10,000

• After 40 years, $1000 has grown to $111,000

• After 59 years, $1000 has grown to $1 million

However, it takes longer before we reach $100,000 and $1 million, simply because the dividend yield does not continue to grow exponentially due to the rising stock price, which means that less is reinvested as the years go by. It therefore takes more than 40 years for $1000 to grow to $100,000, compared to 33 years if the stock price does not rise.

It is therefore bizarre that an investment of $1000 with a 2.5% dividend yield, 10% dividend growth and no capital gain has already grown to $1 million after 37 years, while with a 10% capital gain per year it takes 59 years.

CONCLUSION

By reinvesting dividends you can achieve an enormous total return if you invest for the very long term. Very important in this respect is the (starting) height of the dividend yield and the annual growth of the dividend. The higher both, the higher the final compounding effect.

It is important to know that a rising dividend always ultimately also ensures a rising stock price. In fact; in practice the stock price will often run ahead of the growth of the dividend. With a 2.5% dividend yield and 10% growth of the dividend and 10% capital gain per year, $1000 becomes $10,000 after 20 years.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.