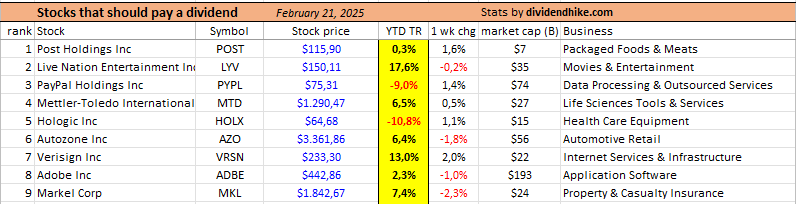

🔥 Dividend Delayers: 10 Cash Machines That Could Start Paying Soon

Ten cash-rich stocks that could and should start paying a dividend ASAP

🚀 The Hidden Dividend Gems: 10 Stocks That Could Start Paying Soon

💰 Investors love dividends. Who doesn’t want a steady stream of cash flow, especially when certain companies are practically printing money? These firms are flush with free cash, buying back shares like there’s no tomorrow, and hovering near all-time highs. And yet… no dividend. 🤯

📈 We’ve seen some long-time holdouts finally give in—Expedia, WillScot Corp, and Regeneron recently joined the dividend club. Among the megacaps, Amazon is the most logical candidate still holding out. But we’re looking at smaller, lesser-known names that are just as financially equipped to start paying.

🔥 We’ve got our eyes on ten high-flying stocks that check all the boxes. We will reveal the first one, Post Holdings (POST) right now; the other 9? Those are for our subscribers. 👀 Read on behind the paywall.

🏆 The Contenders: 10 Stocks Poised for a Dividend

✅ Post Holdings (POST) – A major player in packaged foods, Post owns a diverse portfolio of brands, including Honey Bunches of Oats, Weetabix, Bob Evans, and Peter Pan Peanut Butter. Consistent demand and strong pricing power make it a cash-generating machine.

Revenue increased by 13.3% to a record high $7.9 billion in 2024 (September) with Post Holdings expected to generate a record high free cash flow of more than $670 million for FY 2025, up from $502.2 million in 2024.

A $2.00 per share annual dividend would cost Post Holdings an estimated $116 million and would yield 1.7% at a current stock price of $116. It’s obvious that this leaves a lot of room for future increases with more than $500 million in free cash flow annually

For now, Post Holdings prioritizes share buybacks over dividend payments, consistently repurchasing 4% to 6% of its outstanding shares each year. With a FY 2025 P/E of 18, its valuation remains reasonable.

Which other 9 names will be next to initiate a dividend? We break it all down for these stocks behind the paywall. 🔒

✅ Live Nation (LYV) – The giant behind concerts and live events, Live Nation dominates the industry with Ticketmaster, Live Nation Concerts, and Front Line Management. With the return of live entertainment booming, its cash flow is soaring. LYV doesn’t do buybacks and does not (yet) pay a dividend.

With the stock trading at an all time high and a growing free cash flow, expected to rise from $1.07 billion in 2024 to over $2 billion by 2027, a potential $2.00 per share annual dividend would cost LYV an estimated $465 million annually, leaving enough room for future increases.

✅ API Group (API) – This specialist in safety and specialty services operates in recession-resistant industries, providing a steady revenue stream and high-margin growth. Brands under its umbrella include JCI Fire Protection, Viking, and Chubb Fire & Security.

API is expected to generate a free cash flow of $2.40 per share in 2024. At a stock price of $40 per share even a small annual dividend would give the stock a very nice dividend yield.

✅ Verisign (VRSN) – The company behind .com and .net domain registrations, Verisign enjoys a monopoly-like status, generating steady and highly profitable recurring revenue. Warren Buffett is one of the biggest shareholders in Verisign. Verisign has yet to initiate a dividend, but it has aggressively repurchased its own shares, buying back nearly 30% of its outstanding stock over the past decade.

With an expected free cash flow of nearly $10 per share in 2024—and further growth ahead—a small dividend wouldn’t strain its finances. In fact, Verisign can easily afford both buybacks and a dividend, and we'd love to see them do both.

✅ Hologic (HOLX) – A key player in medical diagnostics and women’s health, Hologic benefits from strong secular tailwinds and robust cash flow. Its brands include ThinPrep, Novodiag, and Panther Fusion.

HOLX is another standout stock that has long refused to pay a dividend, despite operating in a sector known for its dividends. The company consistently repurchases 2% to 5% of its own shares each year and notably maintains a stable net debt level, meaning it spends its entire free cash flow on buybacks and other initiatives—just not a dividend. With over $1 billion in free cash flow, introducing a small dividend would be easily manageable.

Five more Contenders

The five stocks below are larger companies by market cap that have caught our attention for years due to their lack of a dividend—despite having more than enough financial strength to pay one. Most of them prefer buybacks over dividends and have a growing free cash flow. Here’s a quick look at their names and businesses.

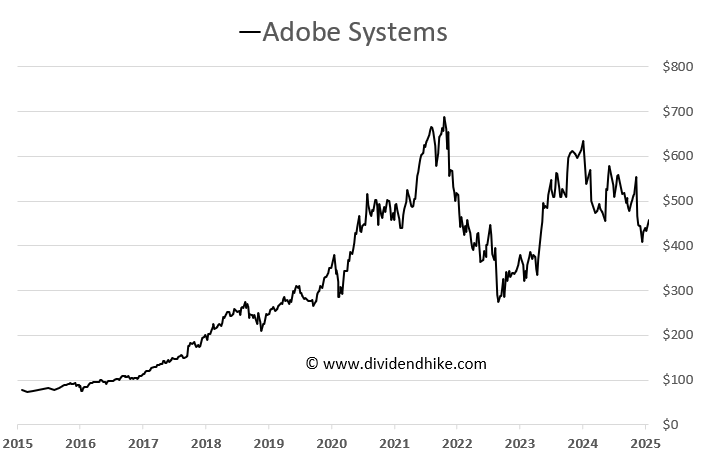

✅ Adobe (ADBE) – A software powerhouse with dominant creative tools, Adobe’s subscription model ensures predictable, high-margin revenue. Its flagship products include Photoshop, Acrobat, Illustrator, and Adobe Experience Cloud.

Adobe has a debt-free balance sheet with $2.2 billion in cash at the end of 2024 (fiscal year runs until November); this will increase to over $10 billion in the coming years, meaning a small and growing dividend can easily be financed.

✅ PayPal (PYPL) – A digital payments leader, PayPal remains profitable with strong user engagement, despite competition. It owns key brands such as Venmo, Braintree, Honey, and Xoom, giving it an extensive ecosystem.

✅ AutoZone (AZO) – This auto parts retailer thrives on steady demand for repairs and maintenance, consistently delivering strong financials. It operates under its primary brand, AutoZone, with a strong presence in DIY and professional auto services.

✅ Markel (MKL) – Often referred to as a "mini Berkshire Hathaway," Markel combines insurance operations with a successful investment portfolio. It owns brands like Markel Insurance, SureTec, and AMF Bakery Systems.

✅ Mettler Toledo (MTD) – A leader in precision instruments and laboratory equipment, Mettler Toledo benefits from strong pricing power and consistent demand in scientific and industrial markets. Its brands include Rainin, AutoChem, and LabX.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.