India has a Dividend Aristocrats problem

Asian Paints lost its Dividend Aristocrat status in 2025 after a dividend cut of more than 25%.

India Loses a Dividend Aristocrat as Asian Paints Cuts Dividend

India has lost one of its very few Dividend Aristocrats. After more than two decades of uninterrupted dividend growth, Asian Paints cut its dividend sharply in 2025, immediately ending its 25-year growth streak. The move highlights how fragile dividend records can be in emerging markets, even after decades of consistency.

In Short

Asian Paints loses its Dividend Aristocrat status in 2025 after a dividend cut of more than 25%

The company had achieved 25 consecutive years of dividend growth only one year earlier

The cut followed a sharp decline in revenue and net profit in fiscal year 2025

India now has only one remaining Dividend Aristocrat

Despite this setback, several Indian stocks remain long-term Aristocrat candidates

From rare achievement to abrupt reversal

With a substantial dividend cut by Asian Paints in 2025, India loses one of its only two Dividend Aristocrats. As a result, just a single Indian company still qualifies as a true Aristocrat with 25 consecutive years of dividend increases. At the same time, a broader group of Indian stocks continues to build dividend track records that could, over time, grow into full Aristocrat status.

Asian Paints was founded in 1942 as a small partnership and grew into India’s leading paint company within 25 years. The company has been the market leader since 1967 and produces decorative and industrial paints, alongside waterproofing, adhesives, services, and a broad home décor portfolio. Learn more about Asian Paints on the company’s website.

Earlier this year, Asian Paints still stood out as a remarkable exception. The company, India’s largest paint manufacturer focused on decorative and industrial coatings, raised its dividend for the 25th consecutive year in 2024, becoming only the second Dividend Aristocrat in India. That achievement, however, proved short-lived.

In 2025, the dividend was cut by more than 25%, falling from 33.30 INR to 24.80 INR, immediately ending the long-standing growth streak.

A sharp contrast with the recent past

What makes the dividend cut particularly striking is Asian Paints’ recent history. Over the previous five years, the company had increased its dividend by nearly 27% per year on average. The sudden reversal was not gradual, but the direct result of a weak fiscal year.

In fiscal year 2025, which ended in March, Asian Paints reported a 4% decline in revenue, down to 339 billion INR. Net profit fell even more sharply, declining 26% to 40.3 billion INR. For the first time in many years, both revenue and earnings moved decisively lower.

Dividends in emerging markets remain earnings-driven

As in many other Asian countries and emerging markets, dividends in India remain closely linked to earnings and revenue development. In practice, this means that a weak year often leads directly to a lower dividend. In this case, that dynamic came at the expense of one of India’s very few Dividend Aristocrats.

The challenges faced by paint manufacturers are not unique to India. Globally, the sector has struggled in recent years. Even PPG Industries PPG 0.00%↑ , a long-established Dividend Aristocrat in the United States, has faced similar headwinds, as have many listed peers worldwide.

High valuation and divided analyst sentiment

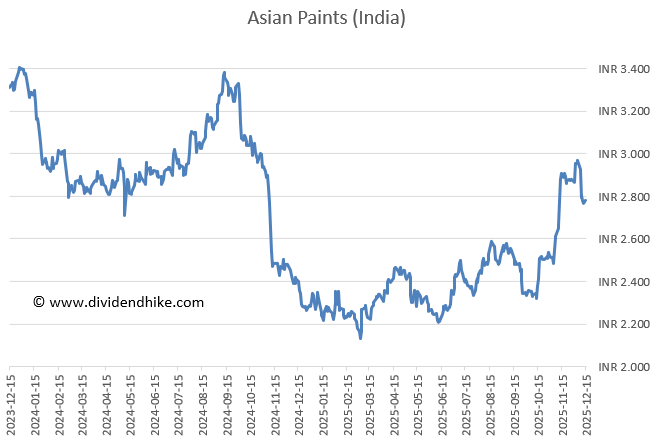

Despite the operational setback, Asian Paints remains highly valued. Like many Indian equities, the stock trades at an elevated multiple, with an estimated price-to-earnings ratio close to 60 for fiscal year 2026 at a share price of around 2,780 INR. Even so, the stock is still up approximately 22% in 2025.

With a market capitalization of roughly $29.4 billion, Asian Paints remains one of India’s largest listed companies. However, the share price has moved largely sideways for several years. Analyst opinion is currently deeply divided, with 11 buy ratings, 9 hold ratings, and 15 sell or strong sell ratings. In recent months especially, sentiment has turned noticeably more negative.

Comparing Asian Paints with the Indian market

The contrast with the broader Indian market is noteworthy. The Sensex index is up about 9% in 2025 and trades near all-time highs. The index carries an average P/E ratio of around 24 and offers an average dividend yield of approximately 1.2%.

That yield remains higher than Asian Paints’ current dividend yield of about 0.9%. While analysts expect dividend growth to resume in coming years, the dividend cut after 25 years of uninterrupted increases remains a major disappointment.

Only one Dividend Aristocrat left in India

At present, only one Indian company still qualifies as a Dividend Aristocrat. That company has a market capitalization of nearly $60 billion and operates in a business that stands out within the Indian market.

We will take a closer look at that remaining Indian Dividend Aristocrat in a follow-up article.

Sign up for our free newsletter to stay up to date with developments in global dividend growth.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.