UK insurer with 8.4% yield and 5% annual growth

Life insurer Legal & General Group combines high dividend with steady annual growth

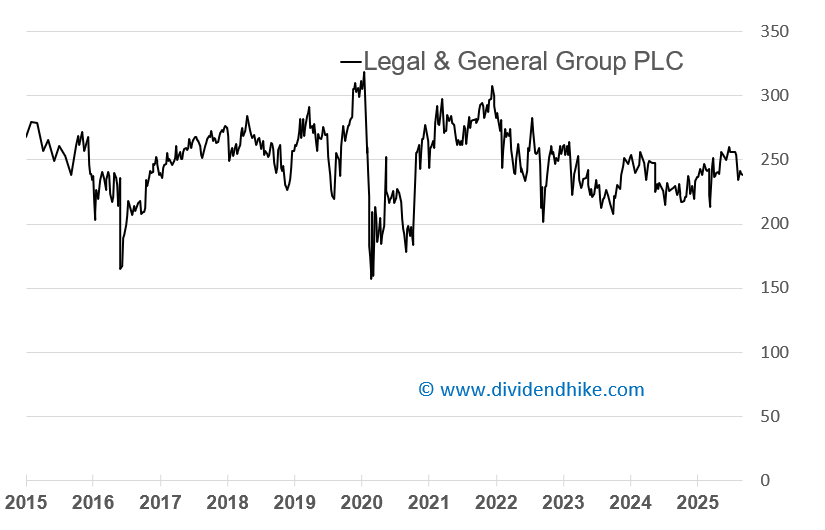

Sometimes we come across stocks that make us pause and think: okay, this is interesting. Legal & General (L&G) is one of those names.

Key Points in this article

High dividend yield: around 8.4% gross, with dividends paid twice per year

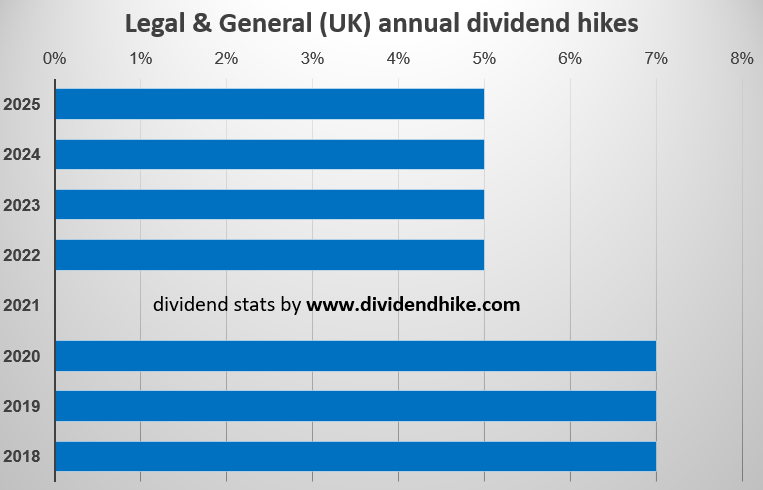

Dividend growth: historically ~5% annually, with similar growth expected ahead

Valuation: trades at a P/E of ~12 with an EBIT margin around 13.0%

Mixed outlook: analyst views are divided, with price targets close to the current share price

What immediately stands out is the combination of a very high dividend yield and a historically stable growth profile. Over the long term, L&G has increased its dividend at an average rate of around 5% per year. A notable footnote: during the COVID period in 2020, the dividend was not increased, while in the years before that, dividend growth averaged closer to 7% annually.

Still, an 8%+ dividend yield that continues to grow by roughly 5% per year is hard to ignore. Analysts expect a similar pace of dividend growth in the coming years. Legal & General pays dividends twice a year. For 2025, this consisted of an interim dividend of 6.12 pence and a final dividend of 15.36 pence. At the current share price of 255.2 pence, this translates into a gross dividend yield of approximately 8.4%.

Analyst sentiment is clearly divided.

At present, 15 analysts cover L&G: 1 Strong Buy, 4 Buy, 7 Hold, 2 Sell, and 1 Strong Sell. The average price target stands at around 260 pence, only a few percent above the current share price.

Looking at the numbers, revenue fell by nearly 23.0% in 2024, declining to GBP 10.67 billion. For 2025, however, a rebound of close to 25.0% is expected, bringing revenue to approximately GBP 13.1 billion. EBIT is forecast to increase by 4.9% in 2025, reaching GBP 1.695 billion, with growth expected to accelerate in the years thereafter. The shares trade at a P/E ratio of about 12, the EBIT margin is around 13.0%, the stock is up roughly 11.0% year-to-date in 2025, and the current market capitalization is approximately GBP 14.5 billion.

From a business perspective, Legal & General generates the majority of its revenue from institutional retirement solutions (about 46.4%), followed by insurance activities (26.5%) and retail retirement products (12.5%), with smaller contributions from group-level expenses (7.9%) and asset management (6.7%). Geographically, revenue remains heavily concentrated in the United Kingdom (81.7%), while the United States accounts for 16.7%, and the rest of the world for roughly 1.6%.

What does Legal & General do?

Legal & General is a UK-based financial services group focused on long-term savings, pensions, insurance, and asset management. According to its own website, the company aims to support long-term financial security for individuals and institutions, while also investing in areas such as housing and infrastructure.

India has a Dividend Aristocrats problem

India Loses a Dividend Aristocrat as Asian Paints Cuts Dividend

For context, Legal & General operates in a sector that in the US includes companies such as MetLife MET 0.00%↑ , Prudential Financial, Principal Financial Group, and Aflac AFL 0.00%↑ , which also combine insurance, retirement, and asset management activities.

We do not actively follow this stock and are not specialists in insurers or financials. That makes us curious about your perspective.

What do you think of Legal & General at current levels? Would you consider owning L&G today? Let us know in the comments.

More information is available on the company’s official website:

https://group.legalandgeneral.com/

At DividendHike.com, we focus on tracking dividend growth trends and highlighting companies with consistent payout policies across global markets. By combining dividend data with clear, factual context, we aim to surface income-focused opportunities that may deserve closer attention. Stay tuned as we continue to follow dividend hikes, long-term payout trends, and the companies behind them.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.