Another big dividend hike for Matador Resources

MTDR increases dividend by 25% in 2024, continuing strong streak

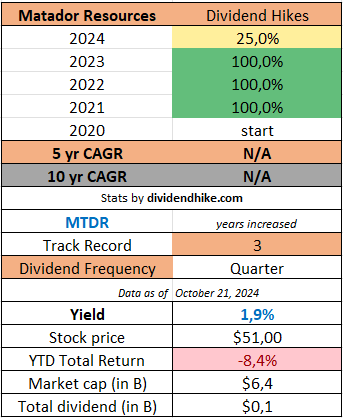

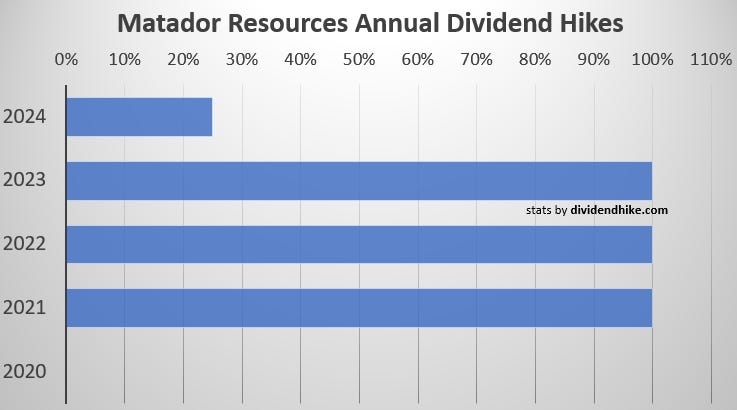

Matador Resources (MTDR) announced a 25% dividend hike to $0.25 quarterly per share. This marks 3 straight years of double digit dividend hikes by the oil and gas exploration company if we leave out the 2021 dividend hike in the same year that a dividend was initiated.

Actually, MTDR did 100% dividend hikes in both 2023, 2022 and 2021 and now pays 10 times more than in 2021 when a 2.5 cent quarterly dividend was initiated.

The ex-dividend date is Friday, November 15, 2024 and the record date is Friday, November 15, 2024 and it is payable on Friday, December 06. The dividend yield for MTDR is 1.9% at a stock price of $50.95.

The estimated p/e for Matador is 6.9 for FY 2024 with analysts expecting the company to earn $7.05 per share this year. This compares to the dividend of $1.00 per share. Free cash flow estimated at $580 million for this year also more than covers the new annual dividend rate of $125 million for Matador.

Matador Resources Company is an independent energy company. The Company is engaged in the exploration, development, production and acquisition of oil and natural gas resources in the United States, with an emphasis on oil and natural gas shale and other unconventional plays. It operates through two segments: exploration and production and midstream. The exploration and production segment are engaged in the exploration, development, production and acquisition of oil and natural gas resources in the United States and is focused primarily on the oil and liquids-rich portion of the Wolfcamp and Bone Spring plays in the Delaware Basin in Southeast New Mexico and West Texas. The midstream segment conducts midstream operations in support of the Company's exploration, development and production operations and provides natural gas processing, oil transportation services, oil, natural gas and produced water gathering services and produce water disposal services to third parties.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.