🆕 New: Dividend Heroes Now Included in Our Coverage

Two portfolios, two approaches—both built for long-term dividend growth.

We’re excited to announce that starting this week, DividendHike.com will also include updates on the Dividend Heroes, exclusively for our paying subscribers.

Are you looking for the best dividend growth stocks to build long-term income and wealth? At DividendHike.com, we now provide updates on both our actively managed Dividend Hike Portfolio and the newly featured Dividend Heroes—a data-driven selection of 25 elite stocks with at least 10 years of consecutive dividend growth.

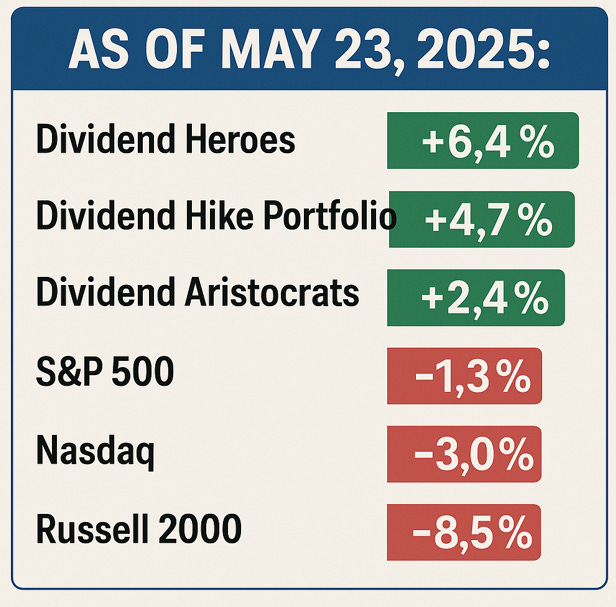

As of May 23, 2025, the Dividend Heroes Portfolio is up 6.4% year-to-date, significantly outperforming our Dividend Hike Portfolio at 4.7%. Meanwhile, major US indexes are in the red: the Russell 2000 has dropped 8.5%, the Nasdaq is down 3%, and the S&P 500 fell 1.3% YTD. Even the Dividend Aristocrats, known for stability, managed only a 2.4% gain—less than half the return of the Dividend Heroes.

These two strategies offer complementary insights for anyone serious about dividend investing, combining real-time portfolio management with systematic, rules-based stock selection.

🔄 Alternating Updates

From now on, our updates will alternate between:

Both consist of 25 high-quality dividend growth stocks. There’s significant overlap between the two, but each also includes a few unique names that stand out.

🧠 What Are the Dividend Heroes?

Meet the Dividend Heroes: the top dividend stocks identified through our unique system—a blend of decades of research, data analysis, and a touch of personal insight from the Dividend Hike team that created the Heroes back in 2016.

Each year, we produce a new ranking of the best dividend growth stocks based on our proprietary formula. The selection is fully data-driven, with no manual handpicking. The process is unrestricted by market cap, sector, or liquidity. The only thing that matters: dividend growth and long-term strength.

We then track the performance of the top 25 Dividend Heroes annually, using an equal-weighted model and measuring total return (price appreciation plus dividends).

The list remains static throughout the year, only adjusted in case of a dividend cut or takeover. A completely new set of 25 stocks is selected each January based on fresh year-end data.

🔧 How Is This Different from the Dividend Hike Portfolio?

The Dividend Heroes focus on quality, track record, and historical dividend growth. In contrast, the Dividend Hike Portfolio is more dynamic:

Includes companies with newer or less consistent dividend histories

Allows for higher potential and earlier-stage dividend growers

Actively managed throughout the year, including dividend reinvestment

Aimed at maximizing long-term income and compounding

Bottom line:

Both portfolios deliver strong dividend growth—historically and looking forward.

They simply approach it from different angles.

With this update, we’re giving our paying subscribers twice the insight and a broader view of the dividend growth universe.

Stay tuned—more to come!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.