New Dividend Initiators in 2025: Verisign Joins the Club

Buffett Favorite Verisign Begins Dividend — Plus 5 Other First-Time Payers

Last week, Verisign VRSN 0.00%↑ has made a major move by announcing its first-ever dividend payout. This marks a significant shift in their shareholder return strategy. With massive buybacks and strong free cash flow, Verisign is now in a position to pay a dividend, demonstrating confidence in its financial strength and long-term stability. We’re closely following this development, as Verisign leads the way as one of the new dividend payers of 2025.

🎯 On February 21, 2025, we published a post about potential new dividend payers — and guess what? Verisign was on our list! We also highlighted nine other great stocks that are well-positioned to start paying a dividend. 🎯

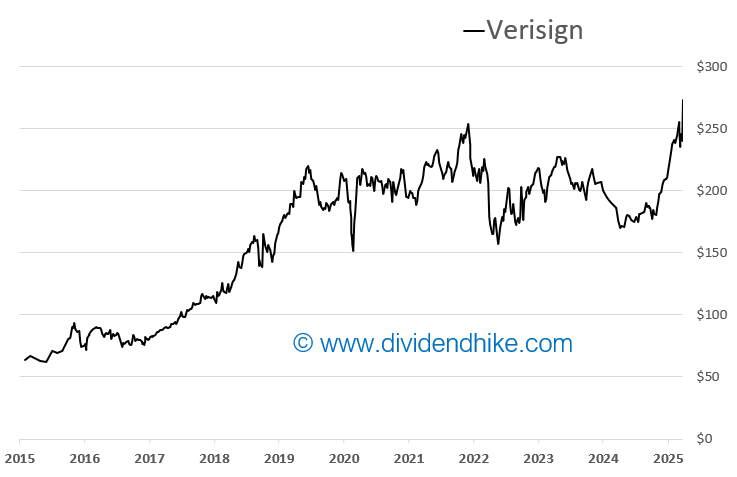

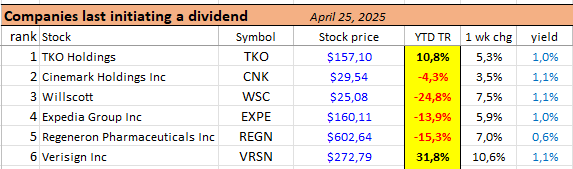

One of the most prominent names among the new dividend payers is Verisign VRSN 0.00%↑ , best known for operating the .com and .net internet domains. Verisign announced last week that it would begin paying a quarterly dividend of $0.77 per share. At the current stock price of $272.79, this equates to a 1.1% dividend yield. The stock has already delivered a year-to-date return of nearly 32%, and the dividend adds an additional layer of shareholder return going forward.

Verisign’s business model is simple but powerful: it runs critical internet infrastructure with high margins and minimal capital needs. The company is also a long-time favorite of Warren Buffett, who holds a position in Verisign through Berkshire Hathaway.

The video below explains Buffett’s position in Verisign: VRSN conducts massive buybacks and generates significant free cash flow, now making a dividend possible.

Historically, Verisign returned capital mainly via share buybacks, having repurchased nearly 30% of its outstanding shares over the past decade, including 6% in 2024 and over 2% already in 2025. The newly announced annual dividend commitment of about $290 million is easily covered by Verisign’s strong free cash flow. Given the company's financial strength, many expect Verisign’s dividend to grow in the years ahead.

Beyond Verisign, several other companies have also initiated dividends this year.

TKO Holdings TKO 0.00%↑ , the parent company of the WWE and UFC brands, began paying a dividend with an initial yield of about 1.0%. Cinemark Holdings CNK 0.00%↑ , a major U.S. movie theater operator, introduced a dividend yielding approximately 1.1%. Willscott Mobile Mini, which provides portable storage and modular office solutions, started paying a dividend with a yield of 1.1% as well.

In the travel sector, Expedia Group EXPE 0.00%↑ initiated its first dividend at a 1.0% yield, despite the stock being down so far in 2025. In biotechnology, Regeneron Pharmaceuticals REGN 0.00%↑ began paying a dividend for the first time too, albeit with a more modest 0.6% yield.

Each of these companies operates in a very different industry, but they share a common theme: strong cash flows and a renewed commitment to returning capital directly to shareholders.

While this post is purely for informational purposes, it's notable to see such a diverse group of companies taking this step in 2025 — a sign of maturing business models and confidence in long-term profitability.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.