Royal Gold (RGLD): The #1 gold stock for Dividend Investors

No Other Gold Stock Comes Close to this 'High Yield' Dividend Aristocrat

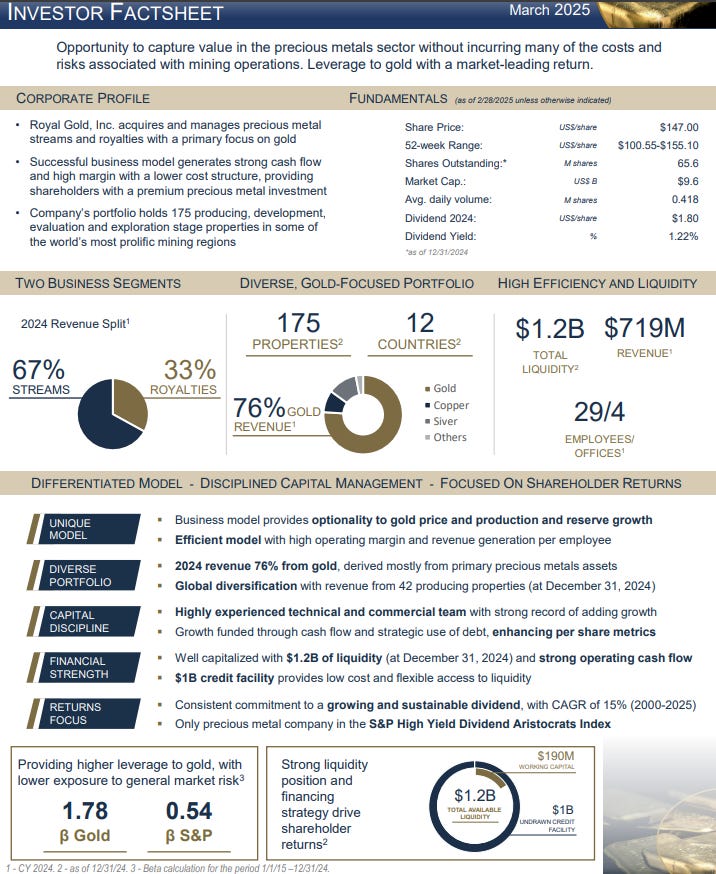

Royal Gold Inc. RGLD 0.00%↑ stands out not just for its unique business model but also for its exceptional track record of returning capital to shareholders. And another good thing is that the company has more cash than debt on its balance sheet, further fueling strong dividend growth in the next couple of years.

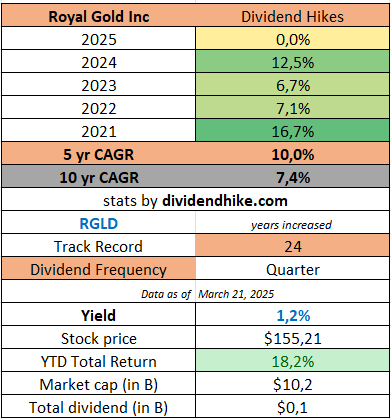

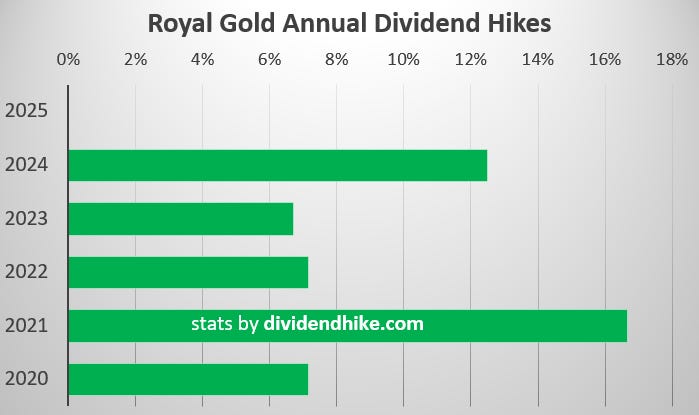

Paying a growing and sustainable dividend is a core strategic objective for Royal Gold. The company has paid a dividend on its common stock each and every year since the dividend was establised in July 2000.

Even better, Royal Gold has consistently increased its dividend, achieving a 15% compound annual growth rate (CAGR) from 2000 to 2025, demonstrating a steadfast commitment to sustainable and growing payouts. This dedication has earned Royal Gold a coveted place as the only precious metals company in the S&P High Yield Dividend Aristocrats Index. The funny thing is that RGLD does not have a high dividend yield; its a dividend growth stock known for its big dividend hikes, resulting in the stock trading at an all time high right now.

What makes this dividend growth possible? Royal Gold’s efficient streaming and royalty model generates high operating margins and substantial revenue per employee, providing resilience in various market conditions. The company's 2024 revenue came 76% from gold, primarily from high-quality, precious-metal-focused assets across 42 producing properties worldwide. With $1.2 billion in liquidity as of December 2024 and a $1 billion credit facility, Royal Gold is well-capitalized, funding growth through operational cash flow and strategic debt use while enhancing per-share performance.

Before you go—there’s even more to like about Royal Gold. We’ll break down its rock-solid fundamentals, soaring profit margins, and unmatched financial strength. Plus, we’ll dive into analyst ratings and price targets to see just how much upside remains. Spoiler: no other gold stock comes close.

Crucially, Royal Gold benefits from optionality to gold prices, production growth, and reserve expansion, meaning that as gold-producing partners expand their operations, Royal Gold gains increased exposure without incurring direct mining costs. With a highly experienced team and a proven growth strategy, Royal Gold remains a premier choice for dividend-focused investors seeking exposure to precious metals.

Royal Gold is a leading precious metals streaming and royalty company, specializing in the acquisition and management of precious metal streams, royalties, and similar production-based interests. This unique business model allows the company to partner with mine operators by providing upfront capital in exchange for rights to purchase a percentage of metal production at predetermined prices or to receive a portion of revenue from mining operations.

History

Established in 1981 as Royal Resources Corporation, the company initially focused on oil and gas exploration. Following a downturn in oil prices in 1986, Royal Resources shifted its focus to gold, acquiring Denver Mining Finance Corporation and rebranding as Royal Gold. After exploring various strategies, the company found success by acquiring minority interests in significant gold properties operated by major mining firms.

The acquisition of a cornerstone royalty on the Cortez Pipeline Mining Complex in Nevada marked a pivotal moment, solidifying Royal Gold's high-margin business model that continues today.

What Makes Royal Gold Unique

Royal Gold's business model offers several distinct advantages:

Upside Potential: The company's investments are structured to provide exposure to potential higher metal prices, future production expansion, and resource conversion.

Limited Downside: By not being directly involved in mining operations, Royal Gold's investments are less exposed to operational risks and cost inflation.

Diversification: With a portfolio spanning various stages of mining projects across multiple geographic regions, Royal Gold reduces its reliance on any single asset.

Scalability: The company's lean operational structure allows for efficient management and the ability to scale without significant increases in overhead.

Economic Moat

An economic moat refers to a company's ability to maintain a competitive advantage over its rivals, protecting its long-term profits and market share. Royal Gold's economic moat is characterized by its unique streaming and royalty business model, which provides stable cash flows with lower operational risks compared to traditional mining companies. This model creates high barriers to entry for potential competitors, as establishing similar agreements requires substantial capital, industry relationships, and expertise.

Competitors

Royal Gold operates in the precious metals streaming and royalty sector, with primary competitors including:

Franco-Nevada Corporation: A leading gold-focused royalty and streaming company with a diversified portfolio of assets.

Wheaton Precious Metals Corp.: Specializes in streaming agreements for silver and gold, offering upfront financing to mining companies in exchange for future production streams.

Sandstorm Gold Ltd.: Focuses on acquiring gold and other precious metal purchase agreements from companies that have advanced stage development projects or operating mines.

These companies, like Royal Gold, leverage the streaming and royalty model to provide investors with exposure to precious metals while mitigating many operational risks associated with mining.

Rock-Solid Fundamentals & Outstanding Dividend Stats

Royal Gold isn’t just a premier dividend stock—it’s backed by impressive financial strength and profitability. Here’s why its fundamentals make it stand out:

Forward P/E (2025): 24.9 at a stock price of $153, reflecting strong market confidence.

Market Cap: $10.2 billion, securing its position as a leading gold royalty company.

Dividend Yield: 1.2%, backed by decades of consistent increases.

EBIT Margin: A massive 59.8% in 2024, expected to soar to 64.5% in 2025, highlighting its ultra-efficient business model.

Return on Invested Capital (ROIC): 10.7% in 2024, projected to jump to 14.7% in 2025, a clear indicator of capital efficiency.

Revenue Growth: Up 18.8% in 2024 to $719.4 million, with a forecasted 13.5% increase in 2025 to $817 million.

Balance Sheet Strength: Debt-free with a net cash position of $195 million at the end of 2024, expected to explode to $680 million in 2025 and over $2 billion within two years.

These numbers confirm that no other gold stock offers this level of financial health, profitability, and dividend reliability.

Analysts See More Upside for Royal Gold

Wall Street analysts remain bullish on Royal Gold, recognizing its strong financials and unmatched dividend track record. Of the 11 analysts covering the stock:

1 rates it a Strong Buy

7 recommend a Buy

2 have a Hold rating

1 analyst rates it a Sell

The average price target (PT) is $172, implying a 12% upside from the current stock price of $153. With the stock already up 16.5% year-to-date and trading near its all-time high, Royal Gold continues to prove its resilience and attractiveness for long-term investors.

Moreover, record-high gold prices in 2024 have been a major tailwind for the entire sector, further supporting Royal Gold’s earnings potential and dividend sustainability. As gold prices remain elevated, Royal Gold stands to benefit even more from its high-margin, capital-light business model.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.