Six top dividend growth stocks from Europe

Twenty+ years of dividend increases with double digit annual growth

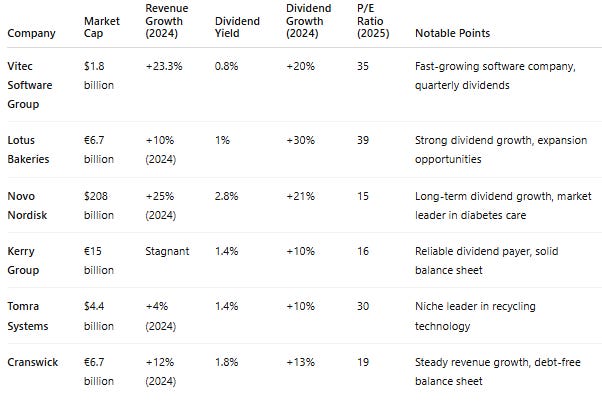

In this post, we highlight six premier European dividend stocks that have not only raised their dividends for at least 20 consecutive years but have done so with double-digit growth; specifically, we are targeting companies delivering a minimum increase of 10% this year. The best thing? Most of these six top dividend growth stocks from Europe are down by double digits in 2025 year-to-date!

Our 6 Picks come from Ireland, Denmark, the United Kingdom, Belgium, Sweden and Norway and 3 of them are European Dividend Heroes!

This results in an outstanding selection of stocks — the true "Parker Hannifins PH 0.00%↑ of Europe" — combining an exceptional dividend track record with robust, sustained dividend growth. Let dive into our 6 Top Dividend Growth stocks from Europe, starting with Vitec from Sweden.

1. Vitec Software Group

What they do: Vitec Software Group is a Swedish software company that provides software solutions for specific markets, such as real estate, finance, and healthcare. They offer both cloud-based and on-premise solutions. Vitec operates through six business areas offering software for property managers, media companies, energy and utility companies, banks and insurance companies. Subsidiaries include Futursoft OY, AutoData Norge AS, Tietomitta OY, Aloc A/S, Norwegian Fox Publish AS, Norwegian Insurance Computer Environment AS (Nice AS) and MV-Nordic A/S.

History: Founded in 1985, Vitec Software Group has grown through acquisitions of various software companies, expanding its reach in specialized markets.

Competitors: IFS AB, EPiServer, Visma.

Website: https://www.vitecsoftware.com/en/

Vitec is a fast-growing software company with a market cap of $1.8 billion. The company is set to achieve SEK 3.4 billion in revenue in 2024, reflecting a strong growth of 23.3%. With a forward P/E of 35, Vitec showcases both strong financial performance and impressive growth potential moving forward.

Vitec has increased its dividend for over 2 decades (see the table at the bottom of this article for the exact details and statistics on Vitec’s dividend and the other five stocks in this article). This year, the dividend is increased by 20%, amounting to SEK 3.60 per share.

What makes Vitec unique is that they pay dividends quarterly, which is quite rare in Europe, especially for a software company.

You will receive SEK 0.90 per share each quarter; the dividend yield is 0.8%. While this may seem low, keep in mind that the dividend has been increased by 20% or more annually for several years. The stock is down 17% year-to-date at a stock price of SEK 450.20. Would we considering buying Vitec at current levels?

Analysts are generally positive about Vitec, with 1 strong buy, 4 buys, 1 hold, but also a sell recommendation. The valuation remains high, and the dividend yield is relatively low, but there is no doubt that the dividend will continue to grow significantly in the coming years, in line with revenue and profits. The payout ratio is very low, with a free cash flow yield of nearly 4%. Additionally, the stable EBIT margin of over 20% provides confidence. However, the fact remains that Vitec operates in a highly competitive market and primarily grows through acquisitions, which brings its own risks. If the stock price drops a bit further, it’s definitely worth considering around the current 52-week lows. That said, we believe there may be better opportunities in Europe for strong dividend growers.

2. Lotus Bakeries (Belgium)

What they do: Lotus Bakeries is a Belgian company known worldwide for its biscuits, including the famous Lotus Speculoos. The company produces and sells a variety of baked goods, snacks, and cookies.

History: Lotus Bakeries was founded in 1932 and has positioned itself as a market leader in the production of speculaas biscuits and other sweet products.

Competitors: Mondelez International (Oreo), Bahlsen, Pepsico (Lays).

Website: https://www.lotusbakeries.be/

The second stock comes from Belgium and is known for its delicious cookies and, in addition, healthy sports bars. What’s impressive about Lotus is that the company is growing extremely quickly for its sector, with double-digit revenue growth. The dividend is truly remarkable, with an increase of nearly 30% this year and last year, and double-digit hikes since FY 2013. Lotus is undoubtedly on its way to becoming one of the next true Dividend Aristocrats in Europe. With a P/E ratio of 39 for 2025, the stock is expensive, but that’s typical for such a fast-growing company.

This year, revenue is expected to rise by over 10% to a record €1.35 billion. Lotus has a market cap of €6.7 billion and an almost debt-free balance sheet. After a 24% drop in the stock price this year, the dividend yield is nearly 1%. While this may seem low, keep in mind that the dividend has grown by 30% for two consecutive years, and Lotus achieves a relatively high EBIT margin of over 16%. The company still has huge international expansion potential, with nearly 85% of its revenue coming from Europe in 2024 and only 15% from the United States.

3. Novo Nordisk (Denmark)

What they do: Novo Nordisk is a Danish pharmaceutical company specializing in diabetes care, obesity treatment, and other chronic diseases. They are a market leader in insulin production and also offer other medications and treatment options.

History: Founded in 1923, Novo Nordisk has grown to become one of the largest pharmaceutical companies globally, with a focus on endocrine care.

Competitors: Sanofi, Eli Lilly, Bayer, Merck.

Website: https://www.novonordisk.com/

Novo Nordisk certainly needs no further introduction; it is a true Dividend Aristocrat, with nearly 30 consecutive years of dividend growth. This year, the dividend increased by 21%, and it has consistently risen by double digits over the past 10, 20, and 30 years—unprecedented. However, this stock is currently at a significant loss, primarily due to the race for the weight loss pill (after the injection), where Eli Lilly (included in our dividend portfolio) now seems to be leading. With a P/E ratio of just 15 and a 2.8% dividend yield, Novo is looking extremely attractive around its 52-week low. This year, the stock has dropped by a substantial 34%. Please note that analysts rate Novo with 4 strong buys, 14 buys, 8 ‘hold’ ratings and also 1 sell and 1 strong sell.

4. Kerry Group (Ireland)

What they do: Kerry Group is an Irish company operating in the food and beverage industry. They supply ingredients, flavors, and food products to the food industry, as well as ready-to-eat products for consumers.

History: Established in 1972, Kerry Group has expanded globally through acquisitions, becoming a significant player in the food ingredients and solutions sector.

Competitors: Nestlé, Unilever, Danone, Cargill.

Website: https://www.kerry.com/

Kerry has now increased its dividend for more than three decades; what’s impressive is that the dividend has been raised by around 10% each year in recent years. In terms of predictability, it is by far the best stock among our six ‘picks’.

Analysts are also very positive about Kerry, with 2 strong buys, 7 buys, and 3 holds. Kerry has a market cap of €15 billion and is trading at a reasonable P/E ratio of 16 for 2025. However, revenue has stagnated in recent years, which is the only downside. The dividend yield is now 1.4%, with a share price of €91.15. The stock is down just 2% YTD in 2025.

5. Tomra Systems (Norway)

What they do: Tomra Systems is a Norwegian company specializing in solutions for resource management, focusing on waste sorting and recycling. They provide technologies for reverse vending machines, sorting systems, and recycling equipment.

History: Founded in 1972, Tomra pioneered the development of reverse vending machines and has grown into a global leader in waste and recycling technologies.

Competitors: Veolia, Suez, Reverse Vending Corporation, Eco-Business.

Website: https://www.tomra.com/

Tomra is truly a niche specialist with its well-known machines in European supermarkets, where customers can return cans, bottles, and other waste for deposit refunds. The company is benefiting greatly from the growing trend; Tomra has a market cap of approximately $4.4 billion and is trading at a high P/E ratio of over 30 for 2025.

The stock is currently showing a solid gain of 8% this year. Tomra's revenue grew by over 4% in 2024, reaching NOK 1.34 billion. Analysts expect an acceleration of growth in the coming years. Tomra also boasts a strong balance sheet and cash flow, which allows for the annually increasing dividend: this year, the dividend will rise by over 10% to NOK 2.15 per share. Tomra also paid special dividends for FY 2018 and FY 2021. The dividend yield is now 1.4% at a share price of NOK 158.30. However, analysts are quite divided, with 1 strong buy, 4 buys, 5 holds, and even 2 strong sells—so caution is advised.

6. Cranswick (UK)

What they do: Cranswick is a UK-based company that produces and supplies high-quality food products, including fresh and prepared meats, snacks, and ready meals.

History: Established in 1970, Cranswick has grown to become one of the leading suppliers of food products in the UK, focusing on meat processing and food production.

Competitors: Pilgrim's Pride, Tyson Foods, 2 Sisters Food Group.

Website: https://cranswick.plc.uk/

One of the top dividend stocks in the United Kingdom is Cranswick, which has been a reliable dividend payer for years. The dividend for the latest fiscal year 2024 increased by over 13%, reaching a new record of 90 pence per share. Cranswick has been raising its dividend for decades now, and just like all UK stocks, dividends are paid semi-annually.

The dividend yield is currently 1.8% at a share price of 5140 pence. The next interim dividend will also see a significant increase, rising from 22.7 pence to 25 pence.

What makes Cranswick attractive is that its revenue continues to grow steadily each year; in 2024 (fiscal year ending in March), revenue grew by 12% to GBP 2.6 billion. For 2025 (ending March this year), analysts expect a growth of 4.4% to GBP 2.7 billion. A major plus for Cranswick is its nearly debt-free balance sheet. These excellent figures mean the stock is not far from its all-time high in London, trading at 5140 pence. With a P/E ratio of 19 for 2025, the valuation is quite high for such a stock, but this is for good reason. Analysts are also positive, with 2 strong buys, 4 buys, 3 holds, and no sell recommendations.

These companies operate in diverse sectors, ranging from food production and pharmaceuticals to software and recycling, each with strong competitors within their respective industries.

If you have any further questions on one of these stocks please leave us a message or comment on this post!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.