The #1 dividend hero for 2025

Unmatched dividend growth and buyback stats for this dividend growth beauty

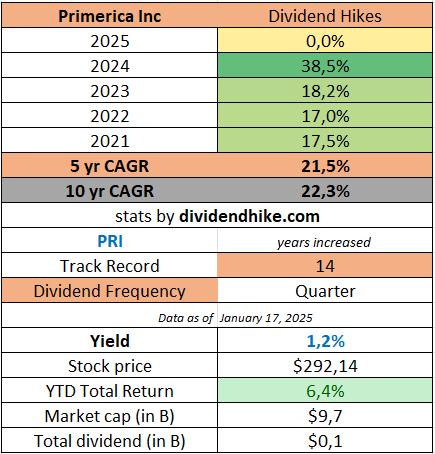

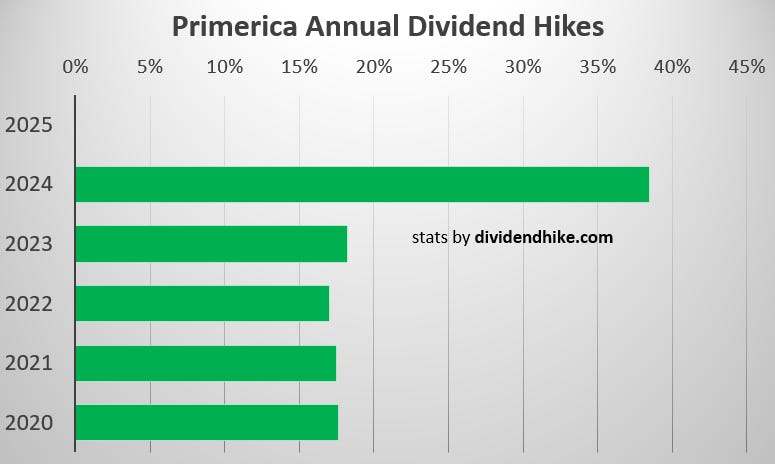

Our new Focus stock is a true buyback and dividend growth monster with unmatched double digit dividend hikes every year in the last 10 years. Actually the dividend was hiked two times in 2024 for a total increase of 38.5%. The average annual dividend increase is a whopping 22.7% in the last decade. That’s even a little bit better than our top ranked Dividend Aristocrat (and also one of the Dividend Heroes in 2025) Cintas Corporation (CTAS). On top of this this company also bought back almost 40% of its own shares since 2013.

We just finished our 2025 Dividend Heroes Selection and this stock ended up first with the highest points total ever, ranked as the #1 Dividend Hero (following a #7 position in 2024). The stock price gained 31.9% in 2024 after a 45.1% rise in 2023.

The company that we are talking about is Life Insurance company Primerica (PRI). The company hiked the dividend two times in 2024 for a total increase of 38.5% and has now raised its dividend 14 consecutive years.

Primerica, Inc. (NYSE: PRI) is a financial services company that operates primarily in the United States and Canada. Founded in 1977, the company focuses on the distribution of financial products and services aimed at middle-income households. Its offerings include term life insurance, mutual funds, annuities, and other investment and savings solutions.

What Does Primerica Do?

Primerica specializes in direct selling, leveraging a network of independent representatives to reach potential clients. These representatives offer term life insurance underwritten by Primerica Life Insurance Company, as well as investment and savings products distributed through third-party providers. The company’s mission is centered on helping families become financially independent by reducing debt, protecting income, and increasing savings.

A notable aspect of Primerica’s business model is its focus on education. Representatives aim to teach clients financial literacy, covering topics such as budgeting, retirement planning, and debt management. This educational component helps distinguish Primerica in a crowded financial services market.

A Brief History of Primerica

Primerica was established in 1977 by Arthur L. Williams Jr., a former high school football coach who sought to revolutionize the insurance industry. Dissatisfied with the high costs and complexities of whole life insurance, Williams advocated for term life insurance as a simpler, more affordable alternative.

In 1980, Primerica merged with Massachusetts Indemnity and Life Insurance Company (MILICO), laying the groundwork for its national expansion. Over the years, the company underwent several transformations, including a period under Citigroup’s ownership. In 2010, Primerica became a publicly traded entity through an initial public offering (IPO).

Today, Primerica’s headquarters are located in Duluth, Georgia, and the company continues to focus on providing financial solutions to middle-income families.

Primerica’s Competitive Edge (Moat)

Primerica’s primary competitive advantage lies in its extensive network of independent representatives. By utilizing a direct-selling approach, the company taps into communities and demographics often underserved by traditional financial institutions. This grassroots strategy enables Primerica to build strong client relationships and expand its customer base cost-effectively.

Additionally, the focus on term life insurance—as opposed to whole or universal life policies—sets Primerica apart. The company emphasizes affordability and simplicity, which resonates with its target market of middle-income families.

Another key element of Primerica’s moat is its brand recognition in the financial education space. Its representatives’ commitment to improving financial literacy enhances customer loyalty and trust.

Risks and Controversies

Despite its successes, Primerica faces several risks and controversies. The company’s multi-level marketing (MLM) structure has drawn scrutiny, with critics likening it to a pyramid scheme. While Primerica operates legally and within regulatory guidelines, some negative reviews allege that the emphasis on recruiting new representatives can overshadow the focus on providing high-quality financial products and services.

Regulatory risks also loom large. As a financial services provider, Primerica is subject to stringent oversight from multiple agencies. Any changes in regulations or compliance failures could impact its operations and reputation.

Finally, the company’s reliance on independent representatives introduces variability. High turnover rates, common in MLM-style businesses, could affect Primerica’s ability to maintain consistent growth and service quality.

Key Competitors

Primerica competes with a range of financial services providers, including:

MetLife: A global leader in insurance and employee benefits, offering a broader range of life insurance products.

New York Life: A mutual insurance company that provides both term and whole life insurance, with a strong focus on wealth management.

Aflac: Known for supplemental insurance products, Aflac also targets middle-income households. We all know that Aflac is a Dividend Aristocrat. The funny thing is that Aflac is #3 on the Dividend Heroes List for 2025, behind previous Focus stock American Financial Group (AFG) and Primerica.

Edward Jones: A financial advisory firm that, like Primerica, serves individuals and families but operates through a network of financial advisors instead of independent representatives.

These competitors often target similar customer segments, though Primerica’s direct-selling model and emphasis on term life insurance create some differentiation.

Fundamentals/Key financial metrics as of January 21, 2025

Forward P/E for 2025: 15

Return on Equity: Estimated at 30.8% for 2025

EBIT Margin: Estimated at 29.9% for 2025 (and 37.4% in 2024)

Revenue Growth: Expected growth of 4.1% for FY 2024 to $1.7 billion, with analysts estimating a 4% growth for 2025 and 2026.

EPS: $16.07 for 2023, $19.21 for 2024 (est) and $20.81 for 2025 (est)

Buybacks: 5.1% in 2023, 4.9% in 2024 (est) with shares outstanding dropping from 44 million at the end of 2018 to an estimated 34.2 million at the end of 2024. We calculated that PRI has repurchased almost 40% of shares outstanding since 2013.

Dividend: The dividend has been raised 14 consecutive years now with a total increase of 462.5% in the last 10 years in which PRI hiked by double digits every since year. Even better, the dividend was hiked two times in 2024 for a total increase of 38.5%. We expect dividend growth to continue by double digits in the next couple of years. PRI has a current dividend yield of 1.2% at a stock price of $293.

Analyst Coverage and Upcoming Earnings

Currently, according to our information, there are 8 analysts covering Primerica (PRI): 2 have issued a ‘buy’ rating, and 6 recommend holding the stock. There are no ‘sell’ ratings. Primerica is scheduled to report its quarterly earnings on February 11.

Conclusion

Primerica occupies a unique niche in the financial services industry, combining direct selling with a mission to educate and empower middle-income families. While its business model offers significant advantages, including a broad network of representatives and a focus on term life insurance, the company is not without its challenges. Regulatory scrutiny, reputational risks, and competition from traditional financial services firms are factors that could impact its performance. On the other hand, the company is a standout based on dividend growth and buybacks, earning the #1 spot on our Dividend Heroes list for 2025.

As always, investors and observers are encouraged to conduct thorough research and consider multiple perspectives when evaluating a company like Primerica. We strongly advise you to look at the company’s Investor Relations Page to learn more about Primerica.

We would also like you to share your thoughts on the company in the comments below. Thank you for that!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.