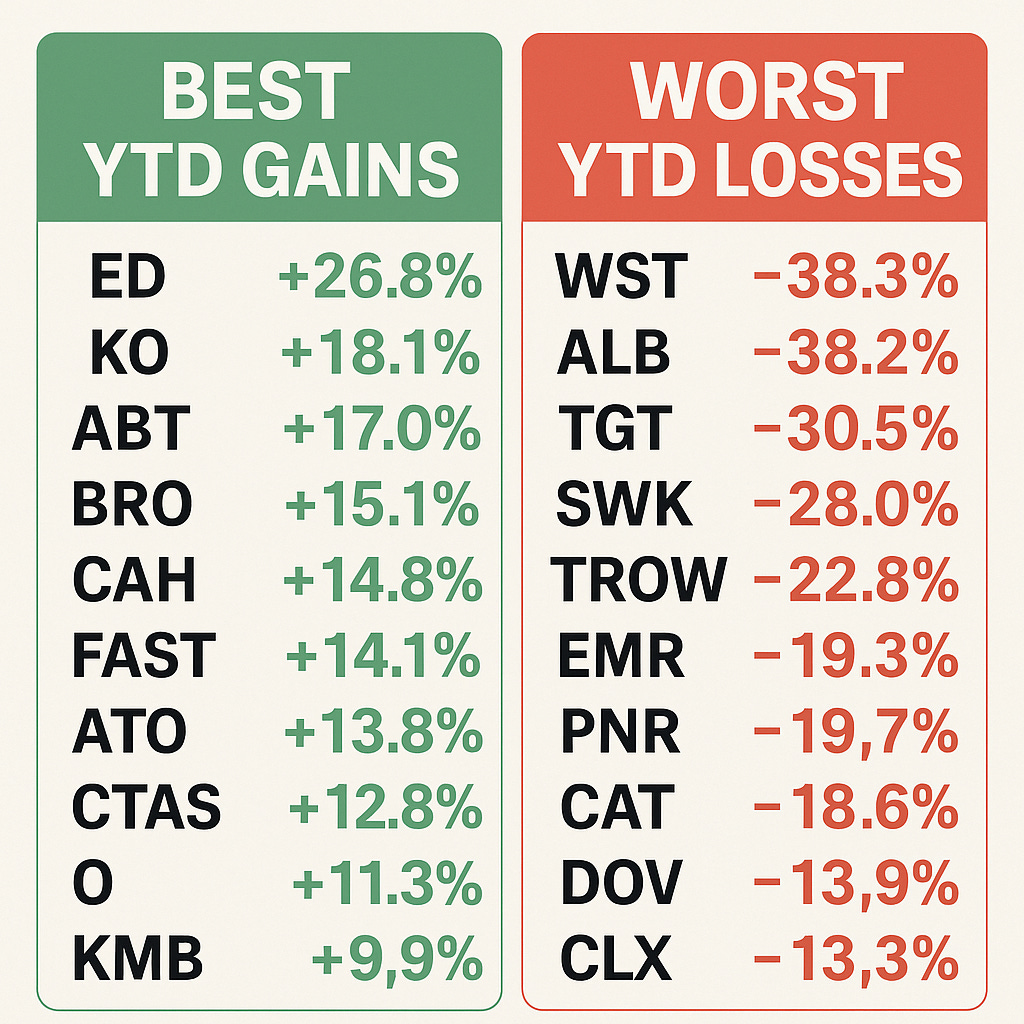

The 10 Best and Worst Dividend Aristocrats in 2025

The average year-to-date return for all Dividend Aristocrats combined is -2.9%

As of April 17, 2025, the Dividend Aristocrats, a group of companies with a track record of increasing their dividends for at least 25 consecutive years, continue to be a reliable source of income for investors.

The average return of the 68 Aristocrats in 2025 is -2.9%. The average yield is 2.7%. There are 9 double-digit gainers and 19 double-digit losers. The biggest risers this week were Realty Income and Fastenal with +7%, while the biggest decliners were Albemarle (-3%) and Stanley Black & Decker (-2%).

Below, we'll explore the top 10 best and worst performers among these Dividend Aristocrats based on their Year-to-Date (YTD) total return, dividend yield, and what these companies do.

Top 10 Best Dividend Aristocrats in 2025 (YTD Total Return)

Consolidated Edison Inc ED 0.00%↑

Stock Price: $112.10

YTD Total Return: 26.8%

Yield: 3.0%

Business: Consolidated Edison is a utility company providing electricity, gas, and steam in the New York City area.

Coca-Cola Co KO 0.00%↑

Stock Price: $73.00

YTD Total Return: 18.1%

Yield: 2.8%

Business: Coca-Cola is a global leader in the beverage industry, producing soft drinks, juices, teas, and other beverages.

Abbott Laboratories ABT 0.00%↑

Stock Price: $130.98

YTD Total Return: 17.0%

Yield: 1.8%

Business: Abbott is a healthcare company that develops medical devices, diagnostics, nutrition products, and branded generic medicines.

Brown & Brown Inc BRO 0.00%↑

Stock Price: $117.22

YTD Total Return: 15.1%

Yield: 0.5%

Business: Brown & Brown is an insurance brokerage firm, providing risk management and insurance products.

Cardinal Health Inc CAH 0.00%↑

Stock Price: $134.71

YTD Total Return: 14.8%

Yield: 1.5%

Business: Cardinal Health is a healthcare services and products company, including pharmaceuticals and medical supplies distribution.

Fastenal Co FAST 0.00%↑

Stock Price: $81.58

YTD Total Return: 14.1%

Yield: 2.2%

Business: Fastenal is a distributor of industrial and construction supplies, with products ranging from fasteners to safety equipment.

Atmos Energy Corp ATO 0.00%↑

Stock Price: $157.54

YTD Total Return: 13.8%

Yield: 2.2%

Business: Atmos Energy is a natural gas utility company serving communities across the U.S.

Cintas Corp CTAS 0.00%↑

Stock Price: $205.76

YTD Total Return: 12.8%

Yield: 0.8%

Business: Cintas provides corporate identity uniform programs, facility services, and fire protection services.

Realty Income Corp O 0.00%↑

Stock Price: $58.32

YTD Total Return: 11.3%

Yield: 5.5%

Business: Realty Income is a real estate investment trust (REIT) focused on commercial properties leased to businesses.

Kimberly-Clark Corp KMB 0.00%↑

Stock Price: $142.81

YTD Total Return: 9.9%

Yield: 3.5%

Business: Kimberly-Clark is a consumer goods company known for its paper-based products, including brands like Kleenex and Huggies.

Top 10 Worst Dividend Aristocrats in 2025 (YTD Total Return)

West Pharmaceutical Services Inc WST 0.00%↑

Stock Price: $201.90

YTD Total Return: -38.3%

Yield: 0.4%

Business: West Pharmaceutical provides packaging and delivery systems for injectable drugs.

Albemarle Corp ALB 0.00%↑

Stock Price: $52.91

YTD Total Return: -38.2%

Yield: 3.1%

Business: Albemarle is a global leader in specialty chemicals, including lithium production for electric vehicle batteries.

Target Corp TGT 0.00%↑

Stock Price: $93.11

YTD Total Return: -30.5%

Yield: 4.8%

Business: Target is a major retail corporation, offering a wide range of products including apparel, electronics, and groceries.

Stanley Black & Decker Inc SWK 0.00%↑

Stock Price: $57.21

YTD Total Return: -28.0%

Yield: 5.7%

Business: Stanley Black & Decker manufactures tools, security products, and industrial equipment.

T Rowe Price Group Inc TROW 0.00%↑

Stock Price: $86.11

YTD Total Return: -22.8%

Yield: 5.9%

Business: T Rowe Price is a global investment management firm, offering mutual funds and other financial products.

Emerson Electric Co EMR 0.00%↑

Stock Price: $99.57

YTD Total Return: -19.3%

Yield: 2.1%

Business: Emerson Electric provides automation solutions, climate technologies, and industrial equipment.

Pentair PLC PNR 0.00%↑

Stock Price: $80.36

YTD Total Return: -19.7%

Yield: 1.2%

Business: Pentair specializes in water treatment and filtration products for residential and commercial markets.

Caterpillar Inc CAT 0.00%↑

Stock Price: $294.25

YTD Total Return: -18.6%

Yield: 1.9%

Business: Caterpillar is a leader in the manufacturing of heavy construction equipment and mining machinery.

Dover Corp DOV 0.00%↑

Stock Price: $161.08

YTD Total Return: -13.9%

Yield: 1.3%

Business: Dover designs and manufactures industrial equipment, including pumps, compressors, and other mechanical components.

Clorox Co CLX 0.00%↑

Stock Price: $139.78

YTD Total Return: -13.3%

Yield: 3.5%

Business: Clorox is a manufacturer of cleaning products, disinfectants, and other consumer goods.

Highest Dividend Yields Among Dividend Aristocrats (from high to low)

Franklin Resources Inc (BEN) – Yield: 7.3%

T Rowe Price Group Inc (TROW) – Yield: 5.9%

Realty Income Corp (O) – Yield: 5.5%

Stanley Black & Decker Inc (SWK) – Yield: 5.7%

Amcor PLC (AMCR) – Yield: 5.4%

Target Corp (TGT) – Yield: 4.8%

Federal Realty Investment Trust (FRT) – Yield: 4.7%

Chevron Corp (CVX) – Yield: 5.0%

Archer-Daniels-Midland Co (ADM) – Yield: 4.3%

Eversource Energy (ES) – Yield: 5.2%

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.