The best dividend stock from Belgium

Dividend Hero with 20+ years of double digit dividend increases

In this new substack post we take a closer look at the best dividend stock from Belgium based on dividend growth, track record and stock market performance. This beauty trades near its all time high at the moment.

First of all some dividend stats for our new Focus Stock from Europe:

2024 dividend hike: +28.9%

2023 dividend hike: +12.5%

2022 dividend hike: +12.7%

2021 dividend hike: +10.9%

2020 dividend hike: +10.3%

2019 dividend hike: +48.7%

The five year CAGR is 14.9% for this food processing company from Belgium that just hit a fresh all time high last Friday after another set of impressive quarterly earnings. Year-to-date the stock price has now gained 30%. Even better, this gain comes on top of double digit gains in each of the previous five years for this company that has a family from Belgium as its biggest shareholder.

The company we are talking about happens to be one of the top ranked European Dividend Heroes for 2024 and operates worldwide as a manufacturer of biscuits and cakes (❤️ next part is availabe only to our paying subscribers, thanks to them for keeping this substack alive! ❤️).

Our new Focus stock is Lotus Bakeries NV, based in Belgium, a renowned producer of biscuits and cakes with a diverse product portfolio divided into six distinct lines.

Caramelized Biscuits: This line features caramelized biscuits, caramelized biscuit spread, and caramelized biscuit ice cream, all sold under the Lotus brand.

Waffles and Galettes: Includes a variety of products such as Liege waffles, soft waffles, filled waffles, galettes, and vanilla waffles, also marketed under the Lotus brand.

Cake Specialties: Comprises a range of cakes including frangipane, madeleines, carre confiture, Zebra cakes in Belgium, as well as Glaces, Enkhuizer cookies in the Netherlands, and Breton butter.

Gingerbread: Features gingerbread products sold under the Peijnenburg and Snelle Jelle brands.

Pepparkakor Biscuits: Offers traditional Swedish biscuits under the Annas Pepparkakor brand, available in Sweden, Finland, the United States, Canada, and other countries.

Dinosaurs Biscuits: Includes children’s biscuits sold under the Dinosaurs brand.

Lotus Bakeries has built a strong competitive edge through its unique recipes, high-quality ingredients, and effective branding. Its rich heritage in biscuit production and commitment to quality have fostered a loyal customer base and facilitated significant international expansion, cementing its reputation in the global confectionery market.

Lotus Bakeries was founded by the Boone family. The company began in 1932 in Lembeke, Belgium, with a traditional recipe for speculoos cookies. The Boone family was instrumental in its early growth and development. Today, while the company has grown significantly and is publicly traded, the Boone family remains involved and retains a significant influence in the business.

The shares of Lotus Bakeries, which was founded in 1932 in the village of Lembeke, are predominantly held by the Boone and Stevens families. The largest shareholder is currently the Stichting Administratiekantoor van Aandelen Lotus Bakeries, which holds 50% of the shares and represents the interests of these families.

DOUBLE DIGIT GROWTH

Lotus Bakeries continues to experience impressive growth. The company's revenue has been rising at double-digit rates for years, with a remarkable 21.1% increase in 2023, reaching €1.063 billion. Analysts forecast an average growth of 10.6% for the fiscal year 2024, projecting a new record revenue of €1.176 billion.

Shares in Lotus Bakeries surged nearly 7% last Friday to an all-time high of €10,720 in Brussels after the company reported better-than-expected results for the second quarter. For the first half of 2024, Lotus Bakeries reported a 20.9% rise in EBITDA, reaching €115.8 million, and a 19.6% increase in revenue to €599.2 million.

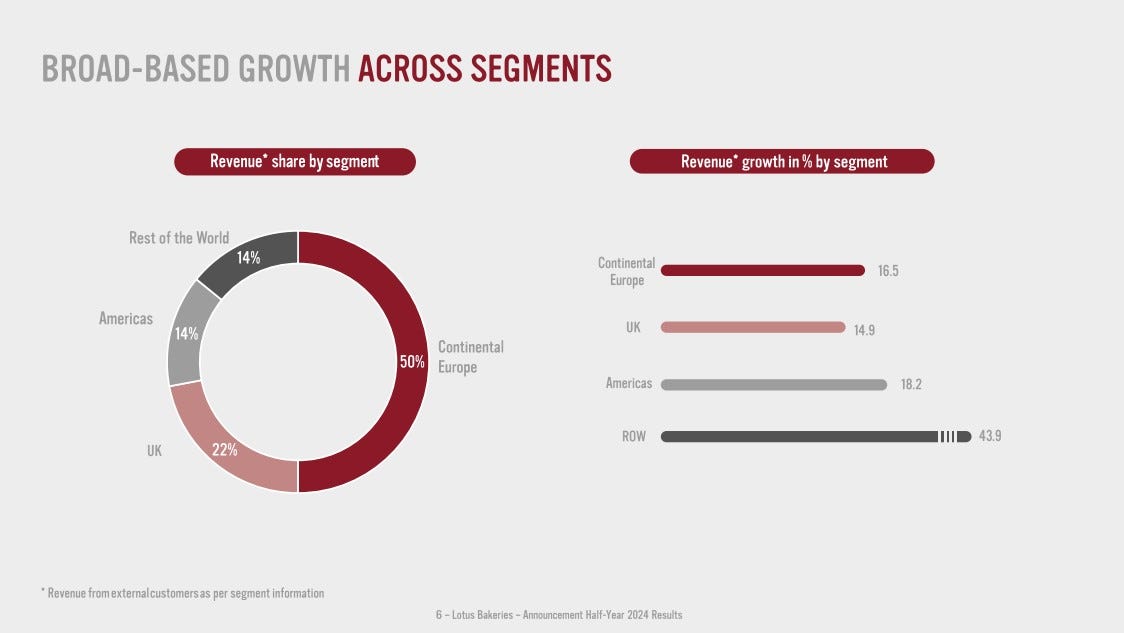

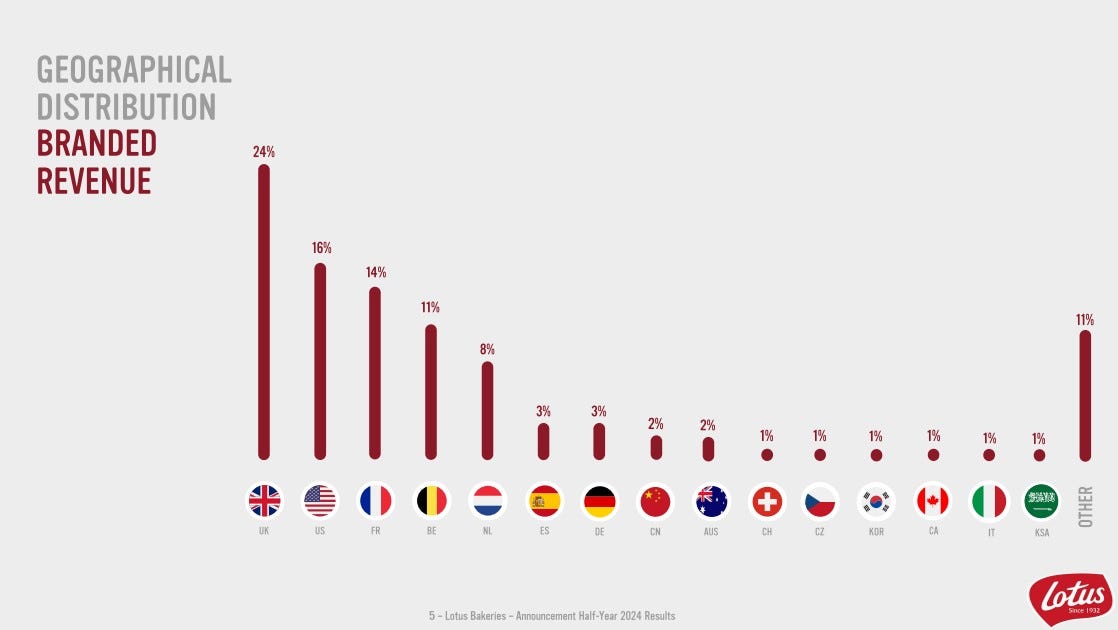

The sales increase has been driven by a robust and broad-based volume growth of over 16% across geographical segments and the three main product divisions. The largest division, Lotus Biscoff, saw volume growth exceeding 20% in the first half of the year, with this growth being geographically widespread.

This continued strong performance highlights Lotus Bakeries' effective growth strategy and its capacity to meet and exceed market expectations, reinforcing its leading position in the global snack food industry.

VALUATION AND DIVIDENDS

The story with Lotus Bakeries' stock has been largely the same for years: everyone considers it expensive and approaches it with caution, but every year the stock continues to rise on the exchange. We see a similar pattern in the United States with a Dividend Aristocrat like Cintas; high valuation, but excellent financial performance and impressive annual dividend growth.

Key Financial Metrics for Lotus Bakeries

Forward P/E for 2024: 53

Return on Invested Capital (ROIC): 16.3% in 2023, expected to jump to 21% in 2024

EBIT Margin: 16.3% (2023)

Revenue Growth: 21.1% in 2023 to €1.063 billion, expected to grow almost 11% in 2024 to nearly €1.2 billion, with double-digit growth anticipated for 2025 and 2026

(Almost) Debt-Free: Lotus Bakeries has a net debt position of €159.6 million at the end of 2023

Dividend growth: Lotus Bakeries is the #1 dividend growth stock in Belgium based on track record (20+ years of increases) and dividend growth with a double digit hike in the last 11 years.

Dividend yield: Because of the crazy stock run the yield is low with just 0.6%. Imagine the stock price unchanged in the last five years with give Lotus a yield of 2.4%. The dividend grows by double digits, but the stock price moves even faster resulting in the low dividend yield today.

And let's be honest: with a projected P/E ratio of around 53 for the current fiscal year 2024, the stock is expensive, especially for the consumer staples sector. However, Lotus Bakeries is a company that continues to positively surprise and has significant global expansion opportunities. The stock price speaks for itself: five years ago, it was at €2,500, and now it has surpassed €10,000. On the positive side, Lotus shows an impressive ROIC of between 16% and 18%. For 2024, analysts estimate this could exceed 20%, along with an EBIT margin of over 16%. Additionally, the company is expected to achieve double-digit annual growth in both profit and revenue, and, last but not least, it has a very strong balance sheet with net debt of only €159 million at the end of 2023. In the latest company press release we see a 0.7X net debt/ebitda for Lotus as of June 2024.

With the stock price trading above €10.000 a stock split would be very welcome. Many smaller investors don’t have access to Lotus Bakeries stock right now because of the high stock price. Last Friday the stock gained 6.8% with the market cap jumping to €6.8 billion.

Last but not least: Analysts are very cautious with Lotus Bakeries at the moment wilt only 1 Strong Buy, 3 Hold ratings and also 2 Sell ratings and 1 Strong sell rating. The current average target price is €8550, significantly below the last stock price.

We love the business and use the Lotus Bakeries products ourselves daily, but the high valuation and the strong run of the stock make us cautious, in line with the average analyst opinion.

The stock may be worth buying on dips, if they ever occur, of course. For now, we would be very cautious around the all-time highs. Lotus, one of the European Dividend Heroes, does earn a place on our Focus Stock List.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.