The Biggest dividend hikes in 2024

🔔 🚨 25 stocks with 50%+ dividend increases this year including Nvidia and GE

In 2024, a few companies have made remarkable dividend hikes, catching the attention of investors and market analysts alike.

👉 LET’S CHECK THE 5 BIGGEST DIVIDEND HIKES SO FAR YTD

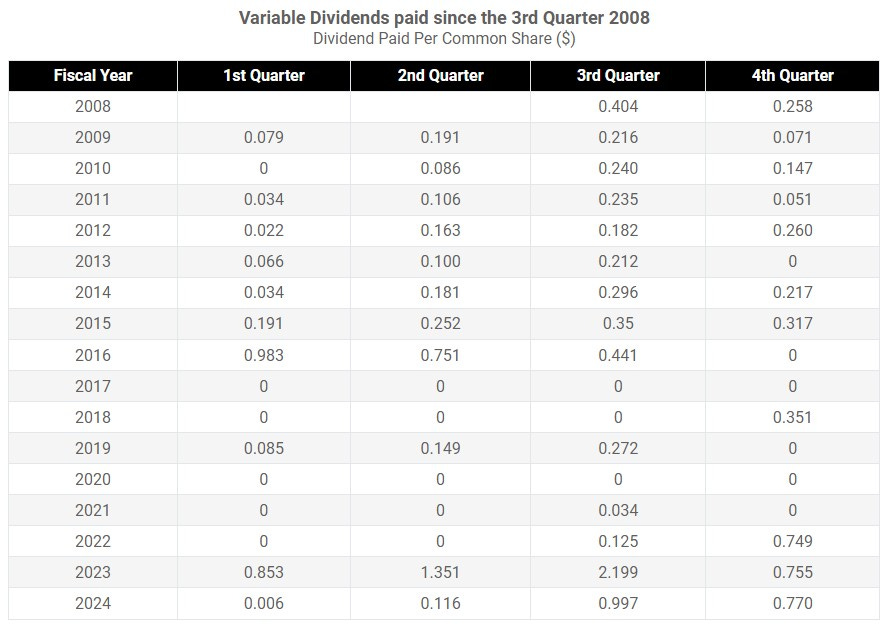

Leading the pack is Cal-Maine Foods Inc. (CALM), which has stunned the market with an astronomical 12,733.3% increase in its dividend, a testament to its robust growth in the egg production and distribution industry. It is important to know that Cal-Maine has a rare variable dividend policy with the quarterly dividend based on earnings (see table below).

No earnings is no dividend and a big earnings jump QoverQ means big dividend growth. The percentage is huge, but is calculated from a near zero dividend in Q4 of 2023, when CALM paid just $0.006. The stock is trading near its (all time) highs.

Coca-Cola Consolidated Inc. (COKE) is the real dividend hike champion in 2024 with an impressive 400% hike, underscoring its dominant role as the largest independent Coca-Cola bottler in the United States, benefiting from strong brand loyalty and operational efficiency.

Vertiv Holdings Co. (VRT), specializing in critical digital infrastructure and continuity solutions, marked a 300% dividend increase, highlighting its successful strategies in the rapidly growing tech industry and benefiting from the surge in AI-related infrastructure, datacenters and servers that need to be cooled. Vertiv makes power management products, switchgear and busbar products, thermal management products, integrated rack systems, modular solutions, and management systems for monitoring and controlling digital infrastructure with brands including include Vertiv, Liebert, NetSure, Geist, Energy Labs and others. In 2023 the VRT revenue growth was 10.6% to $6.8 billion.

General Electric Co. (GE), a longstanding conglomerate with diversified operations, raised its dividend by 250%, reflecting its ongoing transformation and renewed focus on core industrial sectors.

Lastly, Meritage Homes Corp. (MTH), a leader in the home construction industry, particularly in energy-efficient homes, increased its dividend by 177.8%, showcasing its strong financial performance amid a booming housing market.

This series of dividend hikes from such a diverse set of industries reflects a broader trend of companies capitalizing on their growth and profitability to reward shareholders in a year of economic recovery and expansion.

Other big names announcing massive dividend hikes so far this year are Nvidia (+150%), Amphenol (+50%) and Walt Disney (+50%). Of these three Amphenol (APH) has the best track record with 13 consecutive years of increased dividends.

Nvidia pays less than $1 billion in dividends annually with a projected FCF of more than $60 billion for this year.

As we all know, Nvidia ‘refused’ to hike its dividend for many years. The first hike since 2018 looks impressive but still leaves shareholders with a 0.03% dividend yield because of the small payment and high stock price. The 1 cent per share quarterly payment means that Nvidia pays less than $1 billion in dividends annually. This while the semiconductor company is expected to generate a free cash flow of more than $60 billion in FY 2025 (ending January).

Walt Disney did a 50% dividend hike this year but pays less than the peak dividend from 2018, with a dividend cut in 2019 and no dividends paid in 2021 and 2022.

So we like the Amphenol (APH) dividend hike the most; The manufacturer of electrical, electronic and fiber optic connectors and interconnect systems, antennas, sensors and sensor-based products, and coaxial and high-speed specialty cables has raised its dividend 13 consecutive years. Amphenol has paid a dividend every year since 2005 with a 5 year CAGR of 21.1%.

The company first raised its dividend in 2012 with a massive 600% increase, followed by 9 more double digit increases through 2024. It is no surprise that Amphenol is one of the big winners in 2024 with a 36.6% gain (see table above). The stock now trades near its all time high with an estimated p/e of 38, making APH one of many dividend growth stocks with a high p/e and with a current dividend yield of less than 1% (0.98% for APH).

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.