The Dividend Hike Portfolio Hits New High in 2025

YTD gain jumps to 8.6% in 2025 | we are buying one new stock

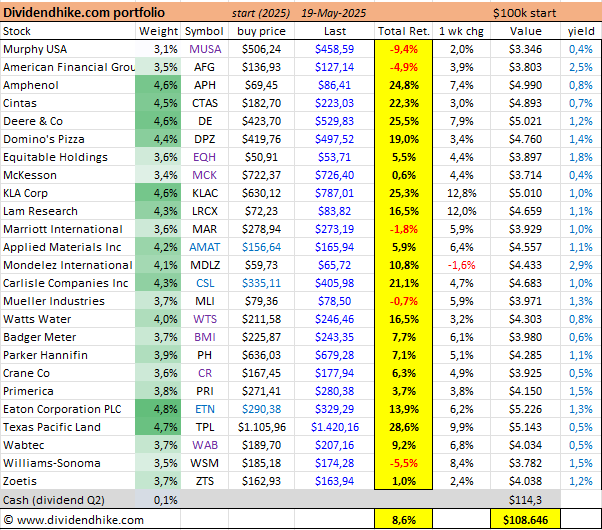

The Dividend Hike Portfolio has shown a very strong recovery in recent weeks and is now up 8.6% for 2025—marking a new record high since its inception earlier this year. The seven new additions from May 7 are already performing well, with Watts Water WTS 0.00%↑ standing out as the top performer, delivering a 16.5% gain since our purchase.

Murphy USA MUSA 0.00%↑ has fared less well, issuing a warning just a day after we added it to the portfolio. The stock is currently down 9.4%, but we remain confident in the long-term outlook.

Today, we're adding another new stock to the portfolio. It's a combined defense and aerospace company with a rock-solid balance sheet, a compelling business mix (including involvement in nuclear energy), and—most importantly—tremendous dividend potential. Just last week, the company increased its dividend by 14%, which gives us a strong reason to initiate a position in the Dividend Hike Portfolio now.

Portfolio Update – Outperforming the Indices

As of May 19, the Dividend Hike Portfolio—now consisting of 25 stocks—is up 8.6% for 2025. That’s a solid result, especially when compared to the major U.S. indices and the Dividend Aristocrats, both of which are underperforming significantly this year.

Even our own Dividend Heroes are trailing behind in 2025, with a year-to-date gain of 6.4% as of May 19—still respectable, but not quite on par with the Dividend Hike Portfolio.

Following the seven new purchases on May 7 (Badger Meter was already discussed in detail on May 13), we will be highlighting the remaining six new additions over the coming weeks as part of our ‘Focus Stock’ series, including Murphy USA MUSA 0.00%↑.

Today, we’re also adding another new stock to the portfolio: Curtiss-Wright Corporation CW 0.00%↑. Curtiss-Wright is a U.S.-based industrial technology company operating across three main sectors: defense, aerospace, and energy. The company provides specialized products and services such as motion control systems, electronic components, and high-performance valves and pumps. Curtiss-Wright plays a key role in defense (e.g., systems for submarines and combat vehicles), commercial aerospace, and nuclear energy, where it supplies critical components for nuclear power facilities. The company is known for its engineering expertise, strong profit margins, and consistent dividend growth.

We’re particularly enthusiastic about this stock due to its strong balance sheet, impressive revenue and earnings growth, and—perhaps most notably—the fact that the dividend was finally increased by double digits last week. We had actually considered adding this company at the start of the year, but with just 5% dividend growth at the time, we couldn’t justify the inclusion. Now, however, the dividend has been raised by 14%, making Curtiss-Wright (CW) a compelling addition—even at an all-time high.

We’ll feature the company later this week as a Focus Stock, where we’ll dive deeper into its dividend, business outlook, and the long, storied history behind this exceptional company.

The stock is being added to the portfolio today (we had planned to do this last week, but processing all the May 7 portfolio changes took considerable time). As a result, one existing position needs to be sold—a difficult decision, since all 25 current holdings are still performing well.

However, after careful consideration, we’re choosing to sell Mueller Industries MLI 0.00%↑ . The stock has underperformed its peers—both in recent weeks and since the start of 2025. While Mueller Industries remains a solid industrial company with a strong position in copper and HVAC-related products, we are choosing to exit the position at this time. We see better long-term opportunities in comparable companies that are less exposed to commodity prices and economic cycles—such as Parker-Hannifin PH 0.00%↑ —and which offer a more stable and predictable growth and dividend profile. As a result, we’re reallocating capital toward names with a more resilient business mix.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.