The Dutch Dividend Growth Machine

#1 Aristocrat in The Netherlands with 15% annual dividend hikes and €1 billion buyback (every year!)

In this post, we’ll dive into our new Focus Stock from The Netherlands, known for its impressive track record of increasing dividends every year. Also this company is known for its annual share buybacks. If you're curious about investing in stable dividend stocks, this is one you won't want to miss. We are convinced that even Warren Buffett would love to own this stock that has been one of the best performers in Europe in the last decade.

Warren Buffett could very well be interested in Wolters Kluwer, given its wide moat, strong ROIC, high EBIT margins, disciplined capital allocation through dividends and buybacks, and consistent cash flow generation. The company’s long-term focus, reliable earnings, and shareholder-friendly policies make it the kind of stock that could fit within Buffett’s investment philosophy.

Wolters Kluwer’s Dividend Policy

Wolters Kluwer is committed to a progressive dividend policy, aiming to raise its dividend per share in euros each year, regardless of currency fluctuations. Although the payout ratio may vary from year to year, the company carefully considers its financial performance, market conditions, and the need for financial flexibility when deciding on the annual dividend increases. This balanced approach takes into account future cash flow expectations, the company's need for organic investments in innovation and productivity, as well as potential acquisitions. Wolters Kluwer’s focus remains on maintaining a strong financial position, ensuring long-term stability.

Investors also have the option to automatically reinvest their dividends through Wolters Kluwer’s Dividend Reinvestment Plan (DRIP), a feature often seen in U.S. markets. Managed by ABN Amro, this DRIP allows shareholders to reinvest both interim and final dividends by purchasing additional Wolters Kluwer shares, helping investors compound their returns over time.

Wolters Kluwer’s History and Operations

Wolters Kluwer has a long and storied history that dates back to the 19th century. It was formed in 1987 through the merger of two Dutch publishing companies: Wolters-Samsom and Kluwer. Initially focused on legal and regulatory publications, the company quickly expanded its offerings into professional information and software services. Over time, Wolters Kluwer transformed itself from a traditional print publisher into a global leader in information services, focusing on digital and software solutions for highly specialized fields.

Throughout the years, the company has adapted to changing market needs, making strategic acquisitions and heavily investing in its digital transformation. This has allowed Wolters Kluwer to stay ahead of the curve in sectors that increasingly rely on technological solutions and data-driven insights. Today, the company serves millions of professionals worldwide, across more than 180 countries.

Wolters Kluwer NV has a long history of providing critical information, software, and services to professionals worldwide. Their operations span key sectors, including legal, business, tax, accounting, finance, audit, risk, compliance, and healthcare. The company is divided into four main operational segments: Health; Tax & Accounting; Governance, Risk & Compliance; and Legal & Regulatory. These divisions are tailored to serve specific customer needs.

Geographically, Wolters Kluwer operates in the Netherlands, broader Europe, North America, Asia, and other global markets. As a testament to its size and significance, the company is listed on the AEX index, which includes the top companies in the Netherlands.

Wolters Kluwer’s Moat and Competitive Advantage

What makes Wolters Kluwer stand out from the competition is its strong "moat," or competitive advantage, which is deeply rooted in its specialized products and services. The company provides essential, mission-critical tools to professionals in highly regulated industries like healthcare, legal, tax, finance, and compliance. This creates a high barrier to entry for competitors because these sectors require deep expertise, regulatory knowledge, and the trust of customers who rely on these tools for daily operations.

Moreover, Wolters Kluwer's ongoing focus on innovation—especially in software solutions and data analytics—has strengthened its moat, allowing it to continuously improve the efficiency and effectiveness of its products. This has fostered long-term relationships with clients who are reluctant to switch providers due to the integration of these specialized tools into their workflows. In industries where precision, compliance, and trust are paramount, Wolters Kluwer's reputation provides it with a significant edge.

Wolter Kluwer competitors include RELX Group, Thomson Reuters, Bloomberg and Intuit. Despite the presence of such heavyweights, Wolters Kluwer has maintained its strong position thanks to its deep integration into its customers' daily operations and its continued focus on expanding its digital offerings.

Wolters Kluwer has not only become a leader in its field but has also built a reputation for rewarding its shareholders with reliable and growing dividends year after year. Could this be the stable dividend stock your portfolio is missing? Watch on to learn more!

Unmatched dividend track record and growth PLUS buybacks

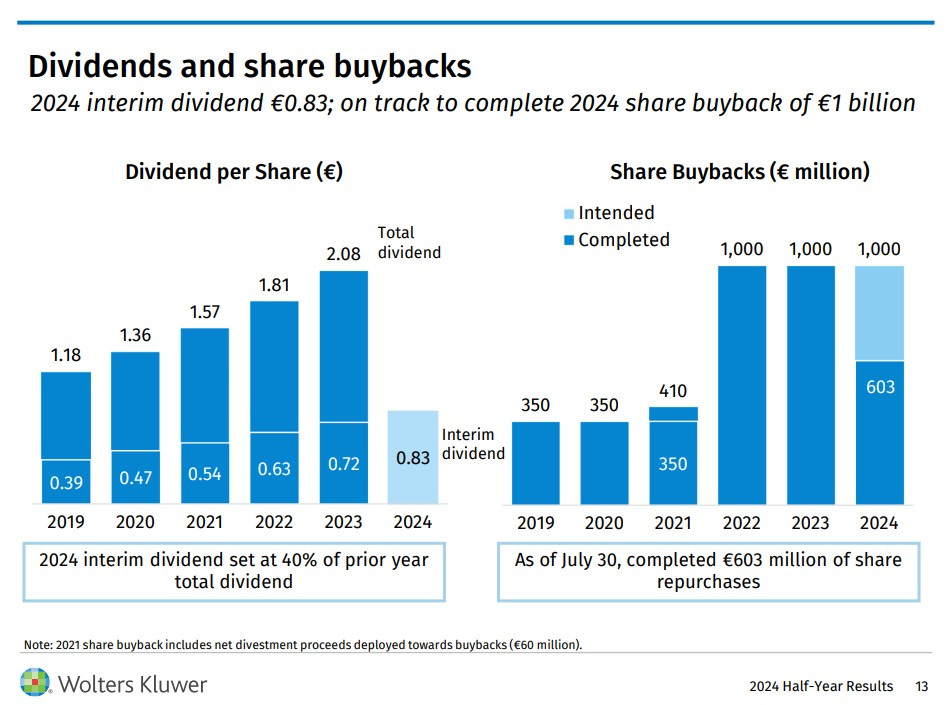

No other company in The Netherlands has a better dividend history than Wolters Kluwer with decades without a dividend cut and even better 18 consecutive years of increased dividends. Even better Wolters Kluwer hiked the dividend by at least 15% in each of the last six years with the annual dividend rising from 85 cents annually in 2017 to 2 euros and 8 cents in fiscal year 2023.

Wolters Kluwer, now paying an estimated €490 million in dividends annually, also raised its last interim dividend for 2024 by 15% to a new record high. On top of that the company is also known for its big annual buybacks with more than 20% of its outstanding shares retired in the last 10 years and annual buybacks of appromimately 2% annually in the last five years.

Wolters Kluwer did a 1 billion euros buyback in both 2022 and 2023 and is on track to complete another 1 billion euros buyback for 2024.

Key financial stats for Wolters Kluwer

Forward P/E for FY 2024 (current fiscal year): 31.4

Return on Invested Capital (ROIC): 24.8% for FY 2023

EBIT Margin: 24.2% in 2023

Revenue: The FY 2024 revenue is expected to grow by 6% to €5.9 billion.

Balance sheet: Wolters Kluwer had a net debt position of €2.6 billion at the end of 2023 with an interest expense of €83 million.

Free cash flow: The free cash flow was €1.2 billion in 2023 or €4.97 per share. This compares to a dividend of €2.08 per share for FY 2023.

A Buffett stock?

Warren Buffett is known for his simple, yet powerful investing philosophy: he looks for companies with strong, durable moats, consistent cash flows, and shareholder-friendly policies. If he were to come across Wolters Kluwer, there’s a good chance he’d find a lot to like.

While Warren Buffett may be cautious about companies exposed to rapid technological shifts, Wolters Kluwer’s core business—providing mission-critical services to industries that require precision and compliance—mitigates that risk. The company's moat, consistent profitability, high ROIC, and disciplined capital allocation through dividends and buybacks align closely with Buffett’s criteria for long-term investment.

So, could Wolters Kluwer catch Warren Buffett’s eye? Absolutely. It has all the hallmarks of a Buffett stock: a strong moat, impressive financial metrics, stable cash flow, and a management team committed to rewarding shareholders. If you’re looking for a dividend champion with a proven track record, Wolters Kluwer might just be the kind of stock Buffett would love.

However, with the stock price touching new highs recently, Buffett may want to wait for a better entry point, but the big question is if this will ever happen……..

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.