The Irish Dividend Aristocrat with Unmatched Growth

Our New Focus Stock: A 10% Annual Dividend Growth Champion

Our next Focus stock from Europe is an Irish nutrition giant that has consistently delivered an impressive 10% annual dividend growth, earning its place as a favorite among income investors.

With a market cap of €3.5 billion, this global company combines innovation with disciplined financial management, offering both stability and significant upside potential.

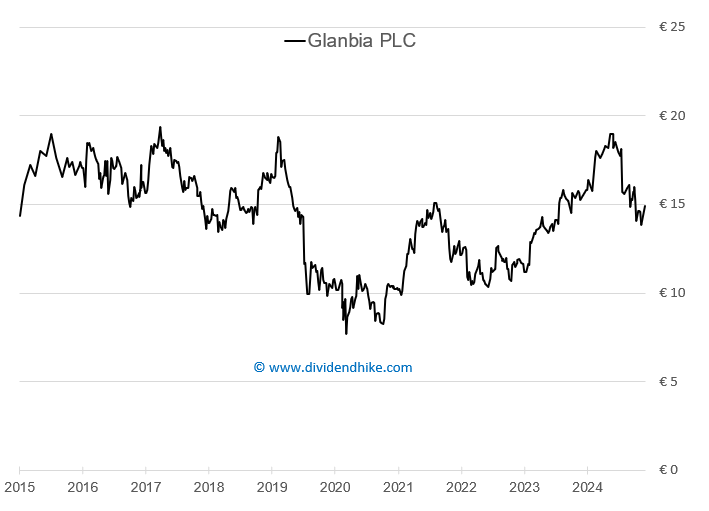

You will be surprised about the low valuation of this stock that trades near its 52 week low and continues spending millions on buybacks together with a growing dividend that currently yields 2.8%.

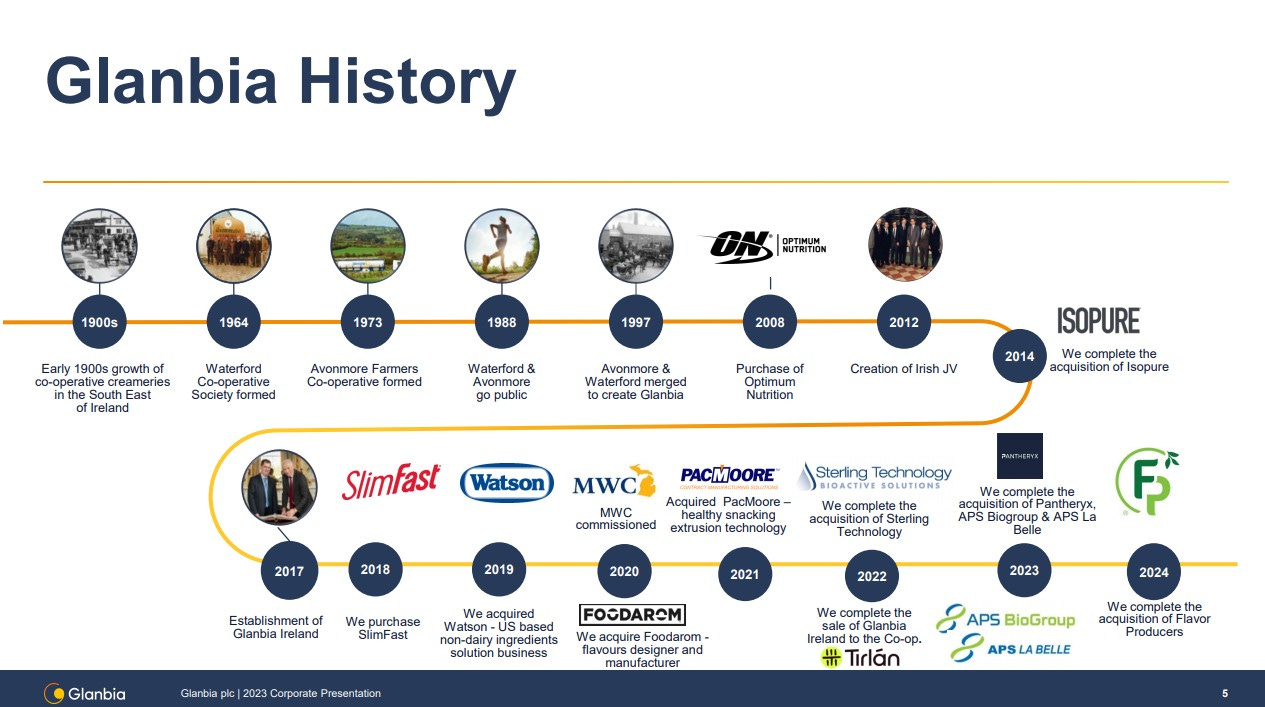

Glanbia’s Journey: From Local Dairy to Global Nutrition Leader

Glanbia’s rich history reflects a legacy of transformation and growth:

Early Beginnings (1900): Rooted in Ireland’s cooperative dairy sector, Glanbia supported local farmers with collaborative ventures.

Expansion (1964): Formation of Avonmore Creameries Federation in southeastern Ireland.

Evolution (1997): Merger of Avonmore and Waterford Co-op to form Glanbia, meaning “pure food” in Irish.

Global Diversification (2000-2020): Transition from traditional dairy to a focus on nutrition and performance markets.

Recent Milestones (2023): Sale of Glanbia Cheese joint ventures to focus on high-growth segments like sports nutrition and functional ingredients.

Operating in over 30 countries, Glanbia now employs 5,500 people and touches millions of lives daily through its innovative nutrition solutions.

A Robust Dividend Policy for Shareholder Value

Glanbia’s biannual dividend policy exemplifies its commitment to rewarding shareholders. We like to call Glanbia the 10% dividend hike company because of the exact 10% annual increases.

2024 Highlights:

A 10% dividend hike

Five 10% dividend hikes in the last six years

A 20 year CAGR of 10.3%

Capital Return: €100 million spent on share buybacks, supported by a cash conversion ratio of 90.4%.

Sustainability: Dividends supported by a free cash flow of €385 million, of which just €97 million was distributed, leaving ample room for reinvestment and debt management.

This disciplined approach underscores Glanbia’s ability to balance growth investments with attractive shareholder returns.

Financial Performance and Strategic Allocation

Glanbia combines financial strength with operational efficiency:

Return on Invested Capital (ROIC): Stable at 12-13% annually.

EBIT Margin: Projected to maintain around 10% in the coming years.

P/E Ratio: A highly compelling 10x for 2025 earnings.

Net Debt (2023): €827 million, comfortably managed through robust free cash flow.

Core Business Segments Driving Growth

Glanbia’s operations are anchored in two high-potential segments:

Glanbia Performance Nutrition (32.5% of revenue): A global leader in sports and lifestyle nutrition with household brands like Optimum Nutrition, SlimFast, and Isopure.

Glanbia Nutritionals (67% of revenue): A pioneer in functional ingredients, dairy alternatives, and customized nutritional solutions.

The United States accounts for nearly 80% of Glanbia’s revenue, while Ireland contributes just 0.3%. This geographic diversity ensures resilience and access to dynamic markets.

Leveraging Strategic Acquisitions

Glanbia’s growth strategy includes 2-5 acquisitions annually, enhancing its portfolio while reinforcing its market leadership in Better Nutrition. The company’s ability to innovate and adapt positions it strongly in a $96 billion market driven by trends in health and wellness.

Competitive Landscape: Leading Across Diverse Markets

Despite intense competition, Glanbia maintains a strategic edge:

Sports Nutrition Rivals: Competes with PepsiCo (Gatorade), Nestlé Health Science, and Herbalife.

Functional Ingredients: Challenges Kerry Group, DSM-Firmenich, and Arla Foods Ingredients.

Plant-Based Alternatives: Faces innovators like Beyond Meat, Oatly, and Huel.

Traditional Dairy: Competes with FrieslandCampina and Fonterra.

Glanbia’s world-class brand portfolio, R&D focus, and operational efficiency provide significant advantages in these competitive sectors.

Sustainability: A Core Pillar of Glanbia’s Strategy

Aligned with the UN Sustainable Development Goals, Glanbia integrates ESG into its operations:

Environmental Commitments: Reducing carbon emissions, waste, and water usage.

Sustainable Packaging: Developing eco-friendly solutions.

Science-Based Targets: Clear objectives to minimize environmental impact while enhancing business resilience.

A Reliable Investment for Income and Growth

Glanbia’s strengths make it a standout choice for investors:

Dividend Growth: Sustained annual increases of 10%, supported by strong cash flow.

Attractive Valuation: Low P/E ratio and high ROIC ensure significant upside potential.

Market Leadership: Dominance in sports nutrition and functional ingredients.

Sustainability Focus: Aligns with evolving consumer and regulatory demands.

Global Reach: Diversified revenue streams across continents.

Glanbia: Poised for a Bright Future

With a proven track record, disciplined strategy, and focus on innovation, Glanbia continues to deliver exceptional value to its shareholders. The company’s commitment to Better Nutrition, sustainable growth, and financial resilience positions it as a leader in the global nutrition landscape.

For those seeking a reliable blend of income and growth, Glanbia represents a unique and compelling opportunity.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.