🚨The Most Impressive Dividend Hikes of 2024

🔔 Explosive YOY dividend growth: top-3 and Dividend Aristocrats

In this post we look at the top-3 biggest YOY dividend changes in the United States and for our beloved Dividend Aristocrats. What we did is comparing the 2023 dividend hike with the 2024 hike (if announced yet of course). This results in a ranking of biggest changes. So it’s not the biggest hikes YTD, but the biggest change in increases: So if a company hiked by 10% in 2023 and 15% in 2024 we put down a 5% score.

So far we have registered 31 US companies with a 2024 increase that’s more than 50% bigger than in 2023. The top-3 is shown below, followed by some interesting names further down this article.

The 3 Most Impressive Dividend Hikes of 2024 (So Far): Cal-Maine, Coca-Cola Consolidated, & GE

Dividend investors are always on the lookout for companies making bold moves in their payouts to shareholders. While a steady dividend is great, it's the big hikes that really turn heads. As we move through 2024, some companies are making waves by delivering eye-popping increases compared to last year.

#1 Cal-Maine Foods (CALM)

2024 Dividend Hike: 16,883.3%

2023 Dividend Hike: -99.3%

Leading the charge is Cal-Maine Foods, the largest producer and distributor of shell eggs in the United States. Cal-Maine has been riding the wave of elevated egg prices and demand, translating that success into a stunning dividend increase for shareholders and following a strong increase in egg prices.

In 2023, Cal-Maine cut the dividend by 99.3% based on the last quarterly dividend of $0.006 per share paid in November 2023. But 2024 saw the company take it to another level entirely. The company delivered a jaw-dropping 16,883.3% dividend hike, reflecting a massive increase in profitability driven by higher egg prices and lower feed costs. For investors who stuck around during the volatility of egg prices, this hike is a monumental reward and positions Cal-Maine as one of the most shareholder-friendly companies of the year. Remember that Cal-Maine pays a variable quarterly dividend based on the earnings in each quarter.

This kind of explosive dividend growth is rare, especially from an agriculture-based company, making Cal-Maine Foods the clear leader in 2024’s dividend hike race. The stock is trading at an all time high with a 3.1% dividend yield based on the last quarterly payment.

#2 Coca-Cola Consolidated (COKE)

2024 Dividend Hike: 400%

2023 Dividend Hike: 0%

At number two is Coca-Cola Consolidated, the largest bottler of Coca-Cola products in the United States. While the Coca-Cola brand itself is known for modest, steady dividend growth, Coca-Cola Consolidated has stepped out of that shadow in 2024 with a huge dividend hike that left investors buzzing.

In 2023, the company did not hike the dividend, with a 100% increase in 2022. But in 2024, Coca-Cola Consolidated surprised the market with a 400% dividend hike to $2.50 quarterly per share. This massive hike of the dividend reflects strong sales momentum, higher margins, and smart cost management as the company capitalizes on continued demand for non-alcoholic beverages. In the first quarter of 2024 COKE also paid a special dividend of $16.00 per share.

This substantial increase signals management’s confidence in the company’s future growth, setting Coca-Cola Consolidated apart from its more conservative peers. The dividend yield for COKE is 0.8%.

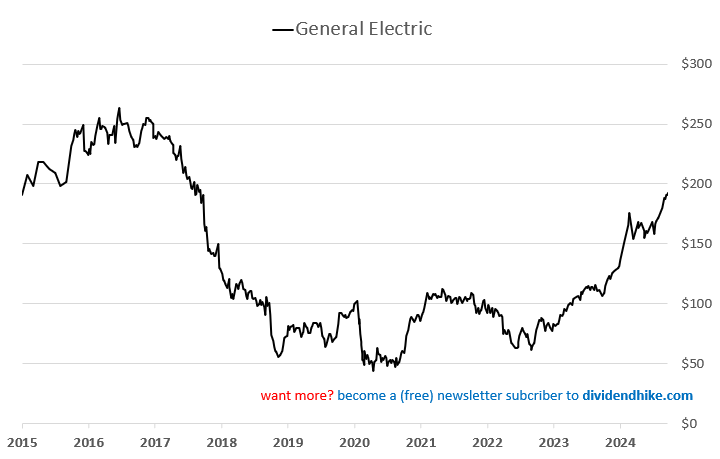

#3 General Electric (GE)

2024 Dividend Hike: 250%

2023 Dividend Hike: 0%

Rounding out the top three is General Electric (GE), a name that’s been synonymous with industrial might for over a century. GE has had a challenging few years, restructuring its business and working to rebuild investor confidence after slashing its dividend during turbulent times. In 2023, 2022, 2021 etc, GE did not announce any dividend hikes.

Fast forward to 2024, and GE absolutely crushed expectations with a 250% dividend increase. This drastic hike is a clear signal that the company’s transformation is taking hold. GE’s renewed focus on aviation, energy, and healthcare is paying off, and management is rewarding shareholders for their patience as the company re-establishes itself as a dividend powerhouse.

While GE’s dividend yield is still modest (with 0.6%) compared to its heyday, this enormous jump shows the company is serious about returning capital to shareholders as its turnaround story progresses.

Final Thoughts

Dividend hikes are a powerful signal of a company’s financial health and confidence in its future. In 2024, Cal-Maine Foods, Coca-Cola Consolidated, and General Electric have all delivered outsized increases, sending a clear message that they are committed to rewarding their investors. Cal-Maine Foods takes the top spot with a mind-blowing 16,000+% hike, followed by Coca-Cola Consolidated’s 400% increase, and General Electric’s impressive 250% rebound.

If you're a dividend investor looking for companies that aren't just paying dividends but dramatically increasing them, these three should definitely be on your radar. Stay tuned as 2024 unfolds to see if more companies join the ranks of aggressive dividend hikers!

What do you think? Will these companies keep the momentum going into next year? Share your thoughts in the comments below!

Dividend Aristocrats

Another categorie we checked are the Dividend Aristocrats (actually we have data for all listed US stocks!) or rather stocks with 25 consecutive years or more of annual dividend hikes.

We see some interesting names stepping up dividend growth YOY with one clear winner: Sherwin-Williams (SHW). The paint and coatings maker has raised its dividend for 46 consecutive years and announced a 18.2% increase in 2024. This is a whopping 17.4% rise from the 2023 hike, when Sherwin-Williams raised the dividend by just 0.8%.

But there are many more interesting names including a couple of steady dividend raisers that hike by double digits every year and are stepping up dividend growth big time in 2024. These are the most interesting companies, most of them are actually Dividend Heroes.

If you want the top-10 of these most impressive YOY hikes, please leave a comment below this post and we will email you all this data next Tuesday.

We want to boost dividendhike.com and you can help us with that by subscribing and joining the community with comments, likes and shares. We will reward you for helping us with these extra dividend sheets that we will send you by separate email. So leave a comment and we will do something back for you!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.