🇩🇪 The next Dividend Aristocrat from Germany

This $5.7 billion company hiked the dividend for the 24th consecutive year

A Hidden Champion in the Lubricants Industry?

It’s not a household name, but this company has quietly built a global empire in specialized lubricants. With nearly a century of innovation, strategic expansion, and a focus on sustainability, it has outpaced many industry giants.

This company from Mannheim has just raised the dividend for the 24th consecutive year. Even better, it was the biggest dividend hike in the last 8 years by our new Focus Stock from Germany. And no, it’s not SAP that we highlighted in 2024.

Want to know which company we’re talking about? Read on. 👇

Fuchs SE: A Deep Dive into the Global Lubricants Specialist

Fuchs SE, formerly known as Fuchs Petrolub, is a global leader in the lubricants industry. Headquartered in Mannheim, Germany, the company develops, produces, and markets a wide range of lubricants and related specialty products. These solutions serve diverse industries, including automotive, industrial manufacturing, mining, and food production.

A Legacy of Growth and Innovation

Founded in 1931 by Rudolf Fuchs, the company began as a small family business supplying high-quality lubricants. Over the decades, Fuchs expanded its operations beyond Germany, gradually transforming into a multinational corporation. Today, the company operates in over 50 countries, with a strong global distribution network and manufacturing facilities across Europe, Asia, and the Americas.

Fuchs' ability to innovate has been a key factor in its growth. The company invests heavily in research and development to create specialized lubricants that meet evolving industry standards and regulatory requirements. Sustainability has become an increasing focus, with Fuchs emphasizing biodegradable and energy-efficient lubricants in response to environmental concerns.

Competitive Landscape

Fuchs competes with major players in the global lubricants market, including multinational oil giants such as Shell, ExxonMobil, and BP, as well as specialty lubricant companies like TotalEnergies and Chevron. Unlike the integrated oil majors, which derive the majority of their revenue from crude oil and refined products, Fuchs is a pure-play lubricant manufacturer. This specialization allows the company to focus entirely on product innovation, customer-specific solutions, and long-term partnerships.

Despite competition from larger firms, Fuchs has maintained a strong position by leveraging its flexible production capabilities, technical expertise, and comprehensive product portfolio. Additionally, its independent status means it is not tied to a specific oil supplier, allowing greater agility in sourcing raw materials and responding to market changes.

Dividend and Financial Stability

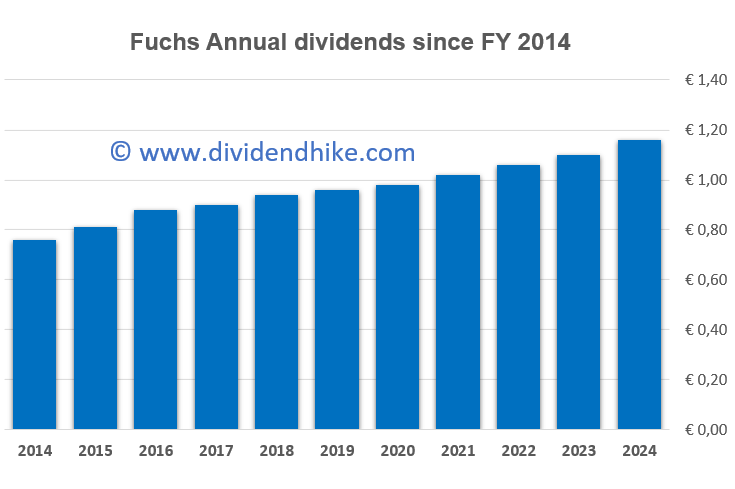

Here’s why Fuchs stock stands out: The dividend has been raised for 24 consecutive years with a 5.5% dividend hike just announced for FY 2024. This is the biggest dividend increase in the last 8 years by Fuchs.

The company has a 20 year CAGR of 13.5% for the dividend. However this number has dropped to 4.3% for the last 10 years (average annual dividend hike). The bigger increase this year is a big positive!

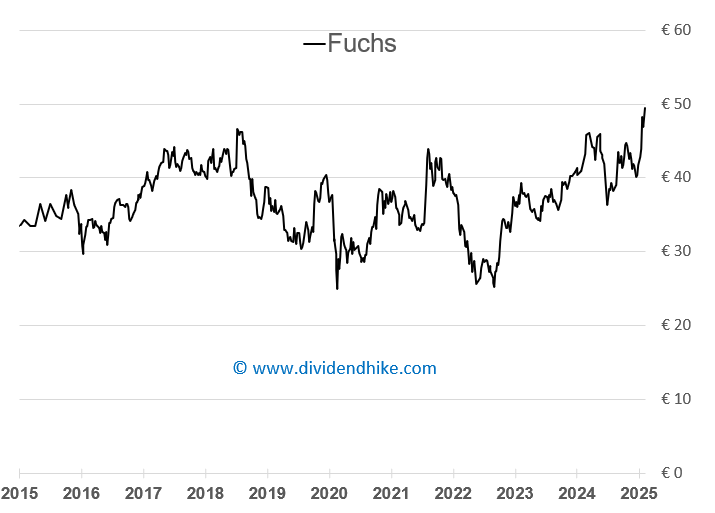

Below we have displayed some more fundamentals for Fuchs, based on the stock price on March 25, 2025.

Forward P/E (2025): 18.5 at a stock price of €47.68.

Dividend Yield: 2.5%, with a payout of €1.17 per share in 2025. Ex-dividend date is May 8, 2025.

EBIT Margin: 12-13% annually.

Return on Invested Capital (ROIC): 17-18% per year.

Revenue Growth: Expected 5.2% increase in 2025, reaching €3.7 billion.

Balance Sheet Strength: Debt-free, with an estimated net cash position exceeding €200 million by the end of 2025.

Free Cash Flow (FCF): Projected to exceed €300 million, with planned dividend payments of €146 million in 2025.

Analyst Consensus: 4 "Strong Buy" ratings, 6 "Buy" ratings, 2 "Hold" ratings, and 1 "Strong Sell" rating.

Two more stocks we like (both from the USA): Valvoline (VVV) and WD-40 (WDFC) are both in the broader lubricants and specialty chemicals space, but they are not direct competitors to Fuchs SE in the same way as companies like Shell or TotalEnergies. Here’s how they compare:

Valvoline primarily focuses on automotive lubricants, including motor oils and fluids for passenger and commercial vehicles. While Fuchs also serves the automotive sector, it has a much broader portfolio that includes industrial lubricants for manufacturing, mining, and specialty applications.

WD-40 is best known for its multi-use spray lubricants and maintenance products rather than industrial or automotive lubricants. Its business is more consumer-oriented, whereas Fuchs serves industrial, B2B, and specialized technical markets.

So while there is some overlap, Fuchs SE is much more diversified and specialized in high-performance industrial lubricants compared to Valvoline and WD-40.

Another company from Germany that we highlighted as a Focus Stock last year is SAP. The software giant became the biggest company based on market cap in Europe just this week, surpassing Novo Nordisk, LVMH and ASML!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.