Top-25 biggest dividend hikes as of March 27, 2025

Two dividend growth beauties with 15 consecutive years of increases and a 25% hike

So far in 2025, more than 350 U.S. stocks have rewarded investors with dividend increases, with 31 of them delivering hikes of at least 20%. While market volatility and economic uncertainty continue to dominate headlines, these companies have shown remarkable resilience and a strong commitment to shareholder returns. Among them, some have made particularly bold moves, significantly raising their dividends and signaling confidence in their future earnings. In this report, we highlight the most impressive increases—the biggest dividend hikes of the year so far.

But perhaps the real gems of 2025 are two stocks that have now raised their dividends for 15 consecutive years. These companies have just announced a 25% dividend hike—keeping their perfect streak alive. For long-term dividend growth investors, these are the stocks to watch. Which ones made the cut? Find out after the paywall for subscribers of DividendHike.com.

Leading the pack is DiamondRock Hospitality DRH 0.00%↑ , a real estate investment trust specializing in premium hotels and resorts. The company has stunned investors with a staggering 166.7% dividend increase, despite its stock being down 13.7% year-to-date. Hospitality has faced headwinds, but DiamondRock’s move suggests a belief in the sector’s long-term recovery.

Another standout is Sturm, Ruger & Company RGR 0.00%↑ , a major firearms manufacturer, which has raised its dividend by 118.2%. The company has benefited from stable demand and has seen a 13.6% increase in its stock price since the start of the year. Please note that RGR pays a mixed dividend based upon quarterly earnings, just like CALM (see below). Expect big changes QoverQ.

In the financial sector, US Century Bank USCB 0.00%↑ has doubled its dividend, reflecting strong fundamentals despite some stock price fluctuations. The Florida-based community bank has managed to grow steadily, rewarding its investors with a 100% dividend hike.

Yum China Holdings YUMC 0.00%↑ , the operator of KFC, Pizza Hut, and Taco Bell in China, has also made a bold move, increasing its dividend by 50%. The company continues to navigate a challenging consumer environment but remains committed to capital returns.

Similarly, PC Connection CNXN 0.00%↑ , a provider of IT solutions, has also lifted its dividend by 50%, demonstrating confidence in its ability to weather economic uncertainties in the tech sector.

In the food industry, Cal-Maine Foods CALM 0.00%↑ , the largest egg producer in the U.S., has boosted its dividend by 46.2%. Even with a 9.2% drop in its stock price this year, the company is maintaining solid profitability, supported by high egg prices.

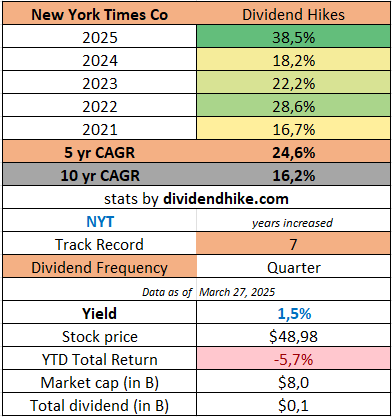

Meanwhile, The New York Times Company NYT 0.00%↑ , a leading media organization, has increased its dividend by 38.5%. Despite ongoing challenges in the publishing industry, the company’s digital transformation continues to drive revenue growth.

One of the more surprising names on the list is Royal Caribbean Cruises RCL 0.00%↑ , which has hiked its dividend by 36.4%. While the cruise industry has faced its fair share of volatility, Royal Caribbean’s strong booking trends and financial recovery have allowed it to return more capital to shareholders.

In the tech sector, InterDigital Wireless IDCC 0.00%↑ , a company that licenses wireless technologies, has raised its dividend by 33.3%. The stock has gained over 11% this year, reflecting investor optimism in its intellectual property portfolio.

Rounding out the list is Aris Water Solutions ARIS 0.00%↑ , a company specializing in water management for the energy sector. With sustainability becoming a key focus in the industry, Aris has rewarded its investors with a 33.3% dividend boost, capitalizing on the increasing demand for water recycling solutions.

But perhaps the real gems of 2025 are two stocks that have now raised their dividends for 15 consecutive years.

These companies have just announced a 25% dividend hike—keeping their perfect streak alive. For long-term dividend growth investors, these are the stocks to watch. Which ones made the cut? Find out after the paywall for subscribers of DividendHike.com.

Want the full breakdown? Check out our detailed stats for the top 25 dividend increases YTD. Don’t miss it!

In 2025, two companies stand out for their impressive performance and dividend growth: Oracle Corp ORCL 0.00%↑ and Lemaitre Vascular LMAT 0.00%↑ .

Oracle Corp ORCL 0.00%↑ is a global leader in cloud computing and database software, known for its robust enterprise solutions and consistent financial performance. The company has earned a spot in the Dividend Heroes Selection for 2024, with a history of strong, reliable dividends, although it raises its dividend once every other year. Oracle will also become a Dividend Hero again in 2026 because of this new big dividend hike.

The table below shows the top-25 biggest dividend hikes in the USA YTD. A total of seven companies hiked by 20%: IDT IDT 0.00%↑ , Fresh Del Monte Produce FDP 0.00%↑ , Garmin Ltd GRMN 0.00%↑ , Pitney Bowes PBI 0.00%↑ , Tradeweb Markets TW 0.00%↑ , United States Lime & Minerals USLM 0.00%↑ and OFG Bancorp OFG 0.00%↑ . We have only displayed IDT below.

Lemaitre Vascular, on the other hand, specializes in medical devices for the treatment of vascular diseases. The company is recognized for its consistent double-digit dividend hikes, a hallmark of its ongoing success and stability. In 2025, it again stands proudly among the Dividend Heroes, with a remarkable track record of annual double digit dividend increases.

However, LMAT LMAT 0.00%↑ is ranked #84 on our Dividend Heroes list and doesn't make this year's top 10. Given the stock's 8.7% decline year-to-date, we’re not too concerned about that :D.

We are working diligently to publish the full top-25 ranked Dividend Heroes selection for the USA on dividendheroes.com within a few days, exclusively for paying subscribers, thanks to the generous pledges we've received so far for the $80 annual subscription. Thank you for your support and trust!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.